Self Driving Cars - Google’s World Domination Has Just Begun

Companies / Self Driving Cars Jul 24, 2019 - 01:32 PM GMTBy: Stephen_McBride

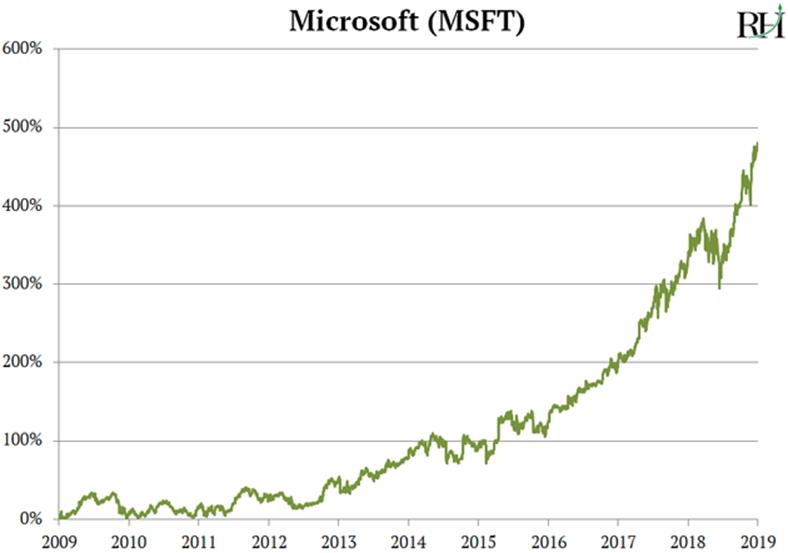

At a $1.04-trillion valuation, Microsoft (MSFT) is the biggest public company in the world

Its stock has shot up 480% in the past decade...

And an incredible 138,000% since it IPO’d in 1986!

Microsoft achieved this by creating one of the best-selling products ever: Microsoft Windows.

This will probably shock most Mac fans out there, but roughly 19 in every 20 computers sold in the past three decades run on Windows.

Windows is the operating system that made computers useful to the average person.

The Race to Build an “Operating System” for Cars Is Heating Up

Every carmaker on earth is ploughing billions into self-driving cars.

For example, General Motors (GM) has raised over $4 billion to fund its driverless car development. And German powerhouse Volkswagen (VOW) invested almost $2 billion in Ford’s (F) self-driving division earlier this year.

But when it comes to driverless cars, traditional carmakers are way out of their depth.

Think about it, General Motors and Ford know how to do one thing really well: mass produce cars.

Developing self-driving cars is all about teaching a computer to drive better than a human. It’s a totally different challenge that carmakers are just not very good at.

Self-driving cars must reliably detect and interpret everything around them.

They’re already great at recognizing obvious things like stop signs, pedestrian crossings, and red lights. When it comes to “invisible” hazards like black ice, the tech has ways to go.

The breakthrough making driverless cars possible is a centralized computer “brain” that learns from every mile driven. It then talks to the engine, brakes, headlights, and windshield wipers and tells them what to do.

Just like Microsoft Windows tells your mouse and keyboard what to do.

Nissan, Mitsubishi, and Renault Admitted They’ve Failed at Self-Driving Cars

These are three of the world’s biggest carmakers. They’ve spent billions of dollars trying to develop their own driverless systems.

Yet a couple weeks back they signed a licensing deal with self-driving leader Waymo to use its technology in their cars.

Waymo is Google’s (GOOG) self-driving car subsidiary. And it’s absolutely dominating the race to develop self-driving car technology.

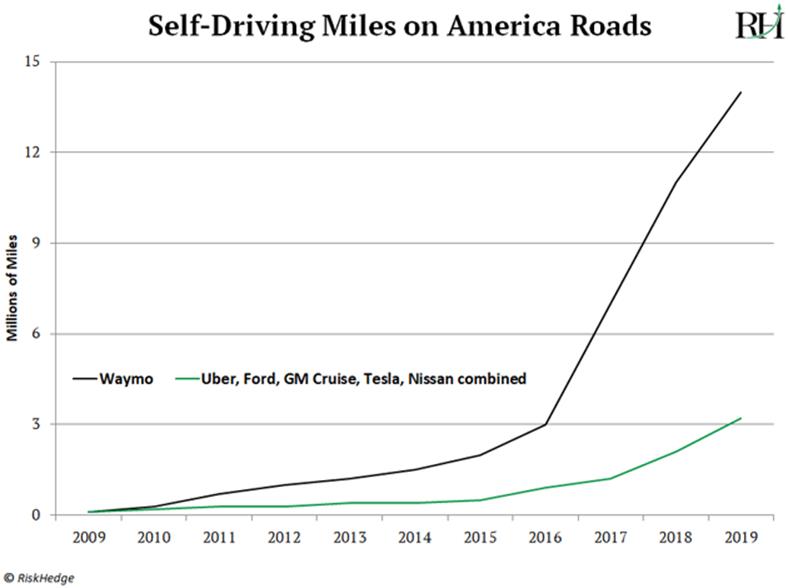

Waymo cars have clocked over 12 million miles on the roads of Arizona and California.

That’s more than all other companies combined.

The thing is, Waymo hasn’t built an actual driverless car. And it probably never will.

Instead it orders vehicles from Fiat Chrysler (FCA), then fits them with its self-driving hardware and operating system.

Soon Every Carmaker Will Be Begging Waymo for Help

As I said, auto companies are great at building cars. But to crack the driverless code, you need a whole different set of skills.

It’s similar to the problems faced by computer makers like IBM (IBM).

IBM built great computers. In 1993, it was the largest company on earth. Had you bought its stock in late 1993 and held on through today, you’d be sitting on a 880% gain.

Making 8X your money is a solid profit. But if you’d owned Microsoft, you would’ve 50X’ed your money as it soared 5,420%.

Waymo is a true disruptor company developing the “Microsoft Windows” of cars. Whether you buy a Ford, a Chevy, or a Nissan, they’ll all be running on its operating system.

This is a genius move by Waymo.

As you may know, making cars is a terrible business. Carmakers are lucky to eke out a couple pennies of profit for every dollar in sales. For example, for every $30,000 car Ford sells, it costs $29,000 to make, sell, and market the car.

Waymo Can License Out Its “Operating System” for Huge Profits

I estimate it can license out its technology to automakers for, say, $2,500/car. There are 275 million cars in America alone.

Do you see how huge Waymo’s money-making opportunity is?

And it goes far beyond cars. Waymo is also developing technology to operate driverless trucks. I expect it’ll eventually license that tech to the likes of UPS (UPS) and FedEx (FDX), which each own hundreds of thousands of delivery trucks.

This Just Might Be the Most Important Chart in All of Disruption Investing

As you’ll see below, Waymo cars have driven more driverless miles than all competitors combined:

As you can see, Uber (UBER), Tesla (TSLA), GM, and others are also working to build self-driving cars.

But they lag at least 2–3 years behind Waymo.

Take GM’s self-driving unit, Cruise, for example. Recent data shows its operating system failed every 3,000 miles or so. “Failure” means a human driver had to take control of the steering wheel.

Waymo beat this milestone more than three years ago.

Waymo’s nearly perfect safety record is why it’s the only company to be granted permission to operate fully driverless cars in California.

And Waymo is the ONLY company on the planet with a fully-functional self-driving taxi service. it’s fully driverless robo-cars are taxiing folks around Phoenix, Arizona every day.

How Much Is a Computer That Can Drive Better Than Any Human Worth?

$50 billion, $100 billion, $500 billion, a trillion?

Investment Bank UBS estimated the self-driving car market will be worth $1.2 trillion by 2030. Consulting firm McKinsey says revenues from driverless taxis could reach $1.6 trillion/year in 2030.

Whatever you think it’s worth, know this...

The Stock Market Is Completely Ignoring This Opportunity

If Waymo were a standalone company, it would be the hottest stock on Wall Street.

It’d easily be worth $125 billion—which is more than Starbucks (SBUX), Nike (NKE), and American Express (AXP) are each worth.

But because Waymo is tucked away inside Google—the world’s 4th-biggest public company—investors ignore it.

Within a couple years, Waymo will be raking in billions of dollars from licensing its technology to carmakers.

Not to mention its huge opportunity as it expands its robocar ride-sharing service. Within three years, that should rake in roughly another $10 billion a year.

I recommended buying Google at $1,070/share a couple of months back. Today it’s selling for $1,147/share. I see it hitting $2,000 in the next couple of years.

Get my report "The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money". These stocks will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2019 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.