Gold At 6 Year High In Euros At €1,288 as ECB Says Outlook Is “Worse and Worse”

Commodities / Gold & Silver 2019 Jul 27, 2019 - 12:21 PM GMTBy: GoldCore

Gold rose to a six and a half year high in euros at €1,288/oz yesterday prior to giving up the gains as it succumbed to profit taking in volatile trading during and after the ECB meeting.

Gold in Euros – 10 Years – GoldCore.com

Gold spiked to its highest level since 2013 in response to the more dovish ECB policy statement. It then quickly changed course following the release of upbeat US durable goods orders data for June which saw it give up gains in all currencies. Stock markets rose before giving up gains as did gold.

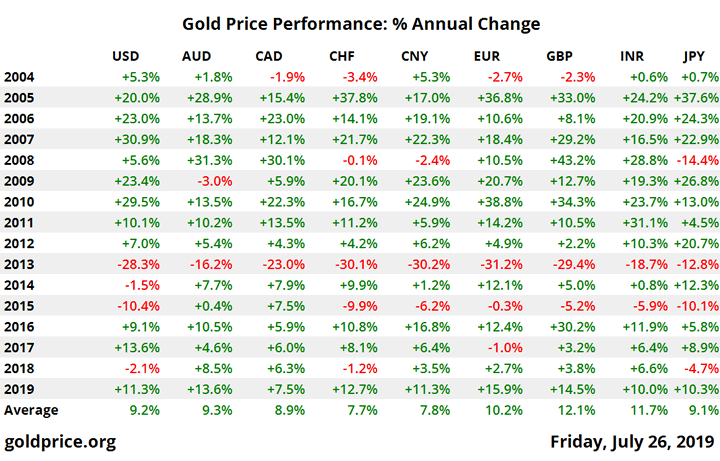

Today, gold prices have edged higher and recovered a part of yesterday’s intra-day sell off. Gold is currently set for a small weekly gains in most currencies including euros and pounds with stronger gains for the week seen in the embattled Australian dollar.

The euro hits two-year lows against the dollar and six year lows against gold after the ECB signaled ‘stimulus’ which will involve interest rate cuts and the likely return to digital euro creation in order to support Eurozone bond markets and economies.

Mario Draghi’s ECB announcement was in line with the consensus as he signaled interest rate cuts in the near future as the economic outlook is “getting worse and worse”.

Silver soared to a more than one-year high on increasing expectations that the ECB, the US Federal Reserve and other major central banks will have to adopt a ultra loose monetary policies again to prevent a global recession.

Uncertainty in the Middle East and tensions between the Iran and the UK and the U.S. should support gold and may lead to increased safe haven demand.

Britain has sent a warship to accompany all British-flagged vessels through the Strait of Hormuz, a change in policy announced by new PM Johnson’s government yesterday. The UK government had previously said that it did not have the resources to do so.

U.S. Secretary of State Mike Pompeo said in a television interview yesterday that he would go to Iran and talk to the Iranian people, amid rising tensions between Tehran and Washington.

Gold Prices via LBMA (AM/ PM Fix – USD, GBP & EUR)

25-Jul-19 1426.35 1416.10, 1143.08 1132.88 & 1281.86 1265.85

24-Jul-19 1425.55 1426.95, 1142.29 1142.70 & 1279.86 1279.69

23-Jul-19 1417.55 1425.55, 1140.42 1145.29 & 1268.14 1277.01

22-Jul-19 1424.45 1427.75, 1142.69 1143.63 & 1270.04 1272.13

19-Jul-19 1437.05 1439.70, 1148.06 1148.88 & 1278.11 1281.48

18-Jul-19 1420.90 1417.45, 1139.70 1135.94 & 1264.74 1263.51

17-Jul-19 1400.80 1410.35, 1129.61 1135.61 & 1249.09 1256.90

16-Jul-19 1416.10 1409.85, 1136.85 1134.79 & 1260.05 1256.88

15-Jul-19 1416.25 1412.40, 1127.76 1127.24 & 1255.93 1253.79

Receive our free Daily or Weekly Updates by signing up here and click here to subscribe to GoldCore’s You Tube Channel

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.