Stock Market Medium-long Term Bullish Case From a Trend Following Perspective

Stock-Markets / Stock Markets 2019 Jul 31, 2019 - 09:54 AM GMTBy: Troy_Bombardia

The stock market is going nowhere as traders prepare for a rate cut. Today’s headlines:

The stock market is going nowhere as traders prepare for a rate cut. Today’s headlines:

- The stock market’s MACD

- S&P’s indecision is coming to an end

- Put/Call remains very low

- Finance stocks are finally going up

- Materials are no longer lagging the stock market.

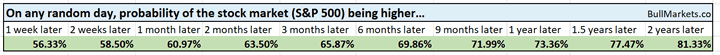

Go here to understand our long term outlook. For reference, here’s the random probability of the U.S. stock market going up on any given day.

Trend following: MACD

From a trend following perspective, traders should be long right now. If the stock market does make a short term pullback/correction, it will probably go up after that.

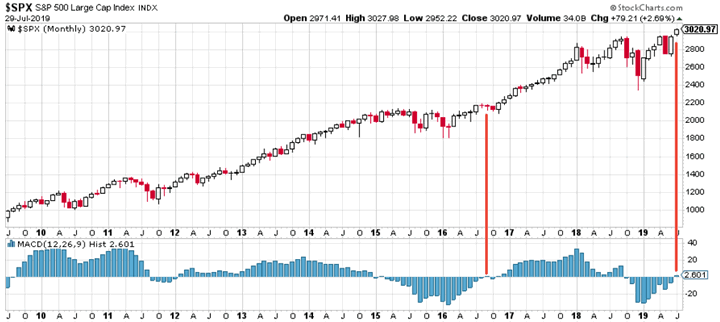

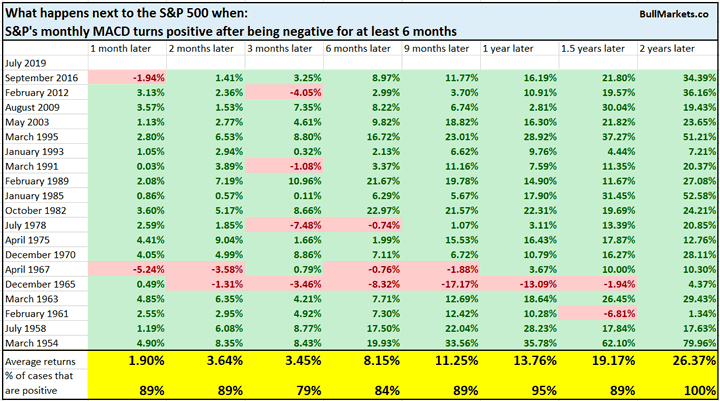

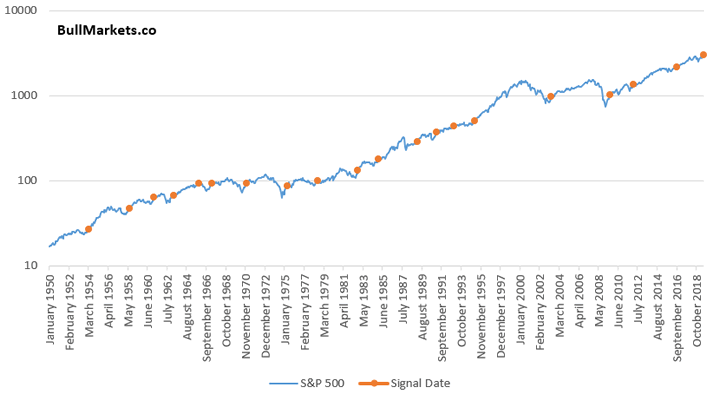

Here’s a monthly chart for the S&P 500. With 1 day left in July, the S&P’s MACD histogram is about to turn positive after being negative for more than half a year.

Historically, this was very bullish for the S&P over the next 1-2 years.

Final melt-up before this bull market ends? I don’t know. Instead trading based on predictions that are years into the future, I prefer to take things day-by-day.

Bollinger Bands

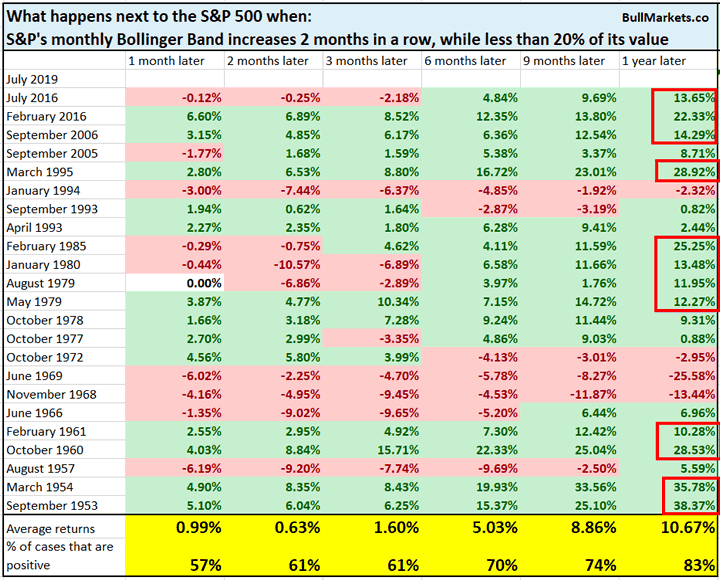

Chris Ciovacco posted an interesting tweet, which demonstrates that the stock market’s long term range is starting to expand again:

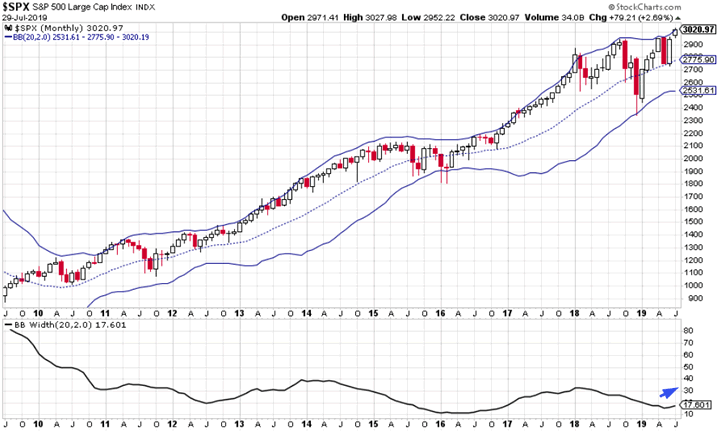

Here’s a more detailed chart, with Bollinger Bands overlapped onto the S&P 500.

In the past, such a range expansion was typically followed by a big move over the next year. Forward returns were not consistently bullish or bearish, but they were extreme. Either extremely bullish or extremely bearish. This is what one would expect when the market breaks out from an 18 month range.

Put/Call

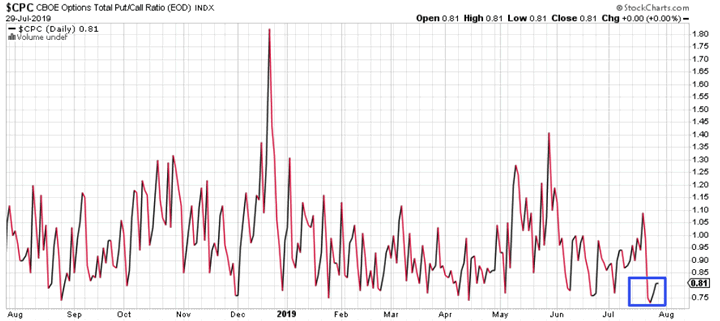

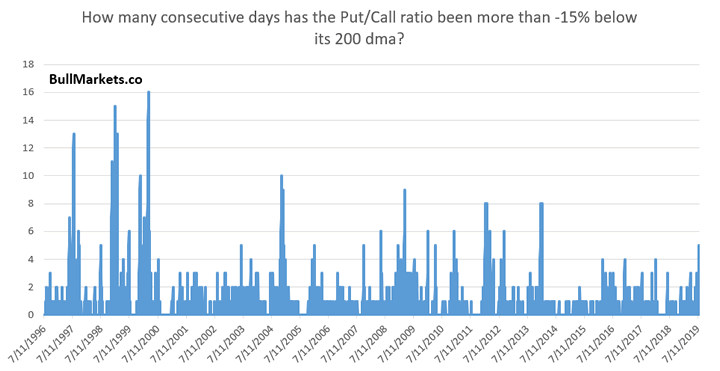

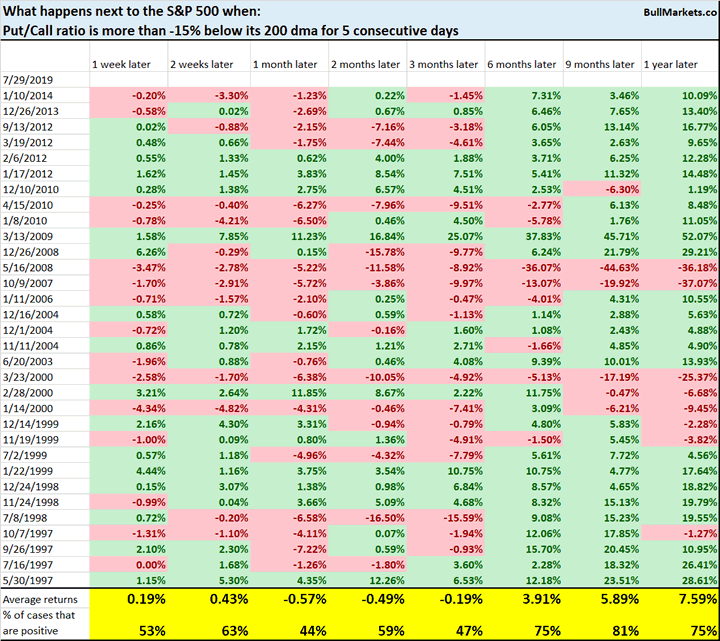

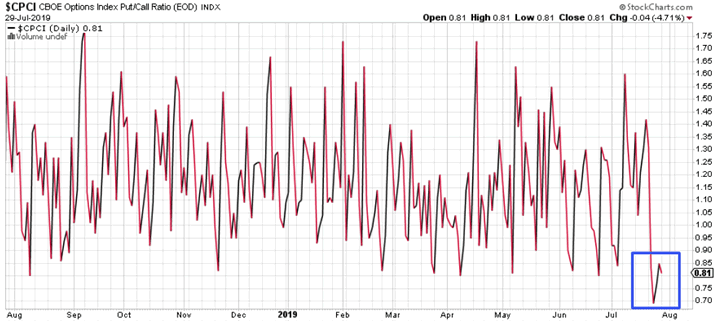

As I mentioned last weekend, the Put/Call ratio is consistently low. The Put/Call ratio has been more than -15% below its 200 dma for 5 days in a row.

This is quite a long streak, with the last one being more than 5 years ago. Historically, such a consistently low Put/Call ratio was more bearish than random for stocks over the next 1-3 months.

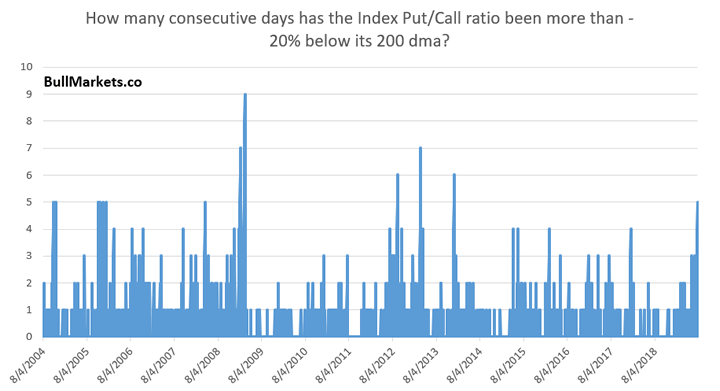

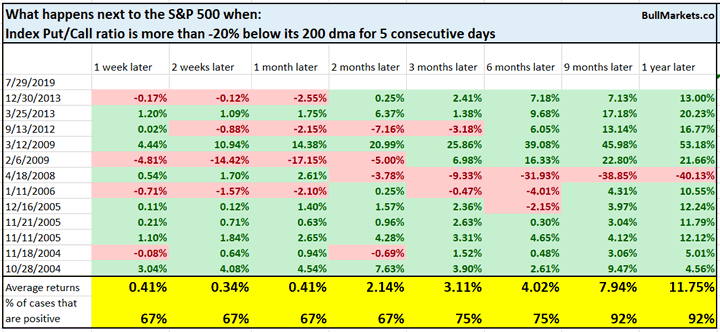

Similar to the Put/Call ratio, the Index Put/Call ratio is also consistently low.

Finance stocks & banks

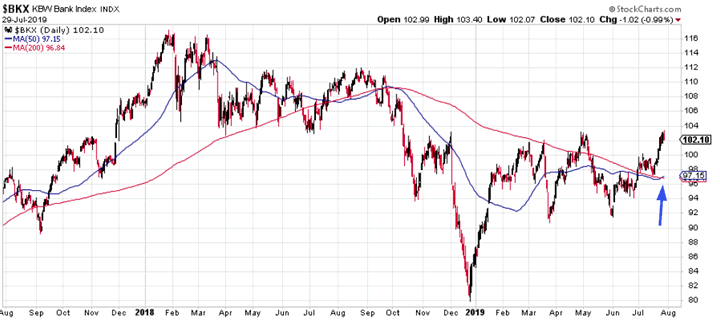

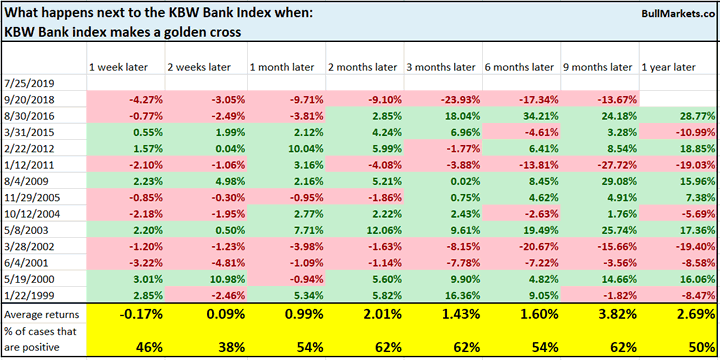

Finance stocks consistently underperformed the stock market throughout 2018, and are finally starting to catch up. As a result, the KBW Bank Index has now registered a golden cross (50 dma crosses above 200 dma).

In the past, golden crosses were not too good for bank stocks over the next 2 weeks.

… but this was not bearish for the S&P over the next 9-12 months.

Materials

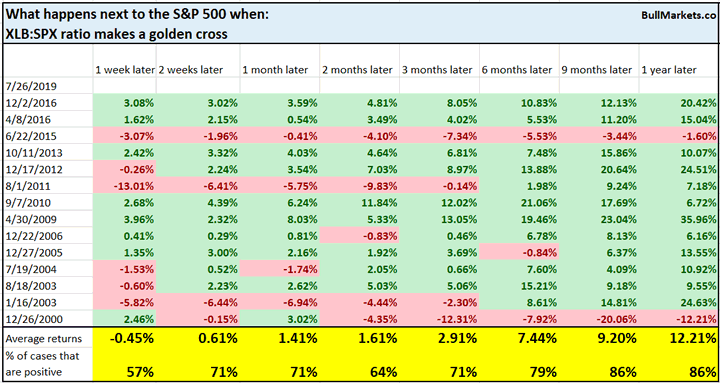

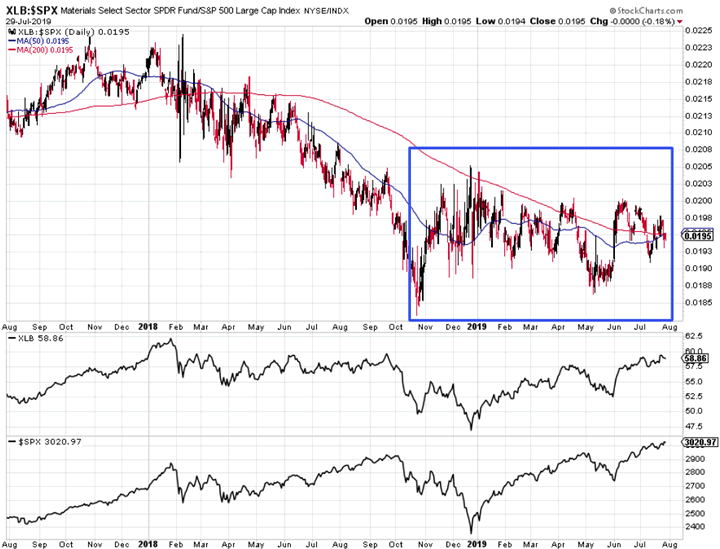

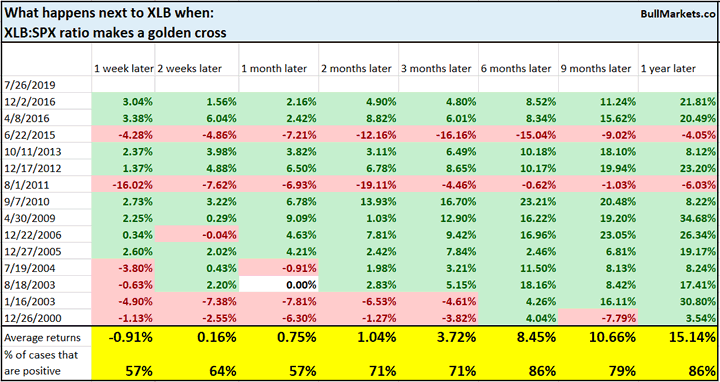

Material stocks performed very poorly throughout 2018 as commodity prices languished. Now that commodity prices are stabilizing, material stocks are no longer underperforming the broad stock market. Here’s the XLB:S&P ratio, which has made a golden cross.

*XLB = materials stock ETF

In the past, this was mostly positive for material stocks over the next 6-12 months.

We don’t use our discretionary outlook for trading. We use our quantitative trading models because they are end-to-end systems that tell you how to trade ALL THE TIME, even when our discretionary outlook is mixed. Members can see our model’s latest trades here updated in real-time.

Conclusion

Here is our discretionary market outlook:

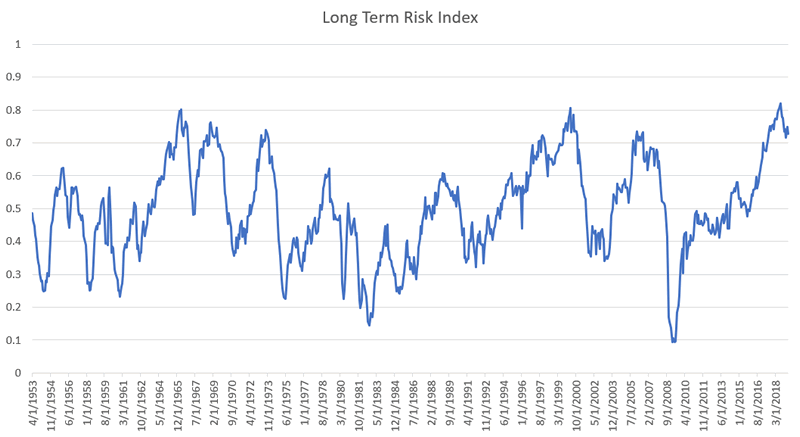

- Long term: risk:reward is not bullish. In a most optimistic scenario, the bull market probably has 1 year left.

- Medium term (next 6-9 months): most market studies are slightly bullish.

- Short term (next 1-3 months) market studies lean bearish.

- We focus on the medium-long term.

Goldman Sachs’ Bull/Bear Indicator demonstrates that risk:reward does favor long term bears.

Click here for more market analysis

Here’s what happens next to the S&P when lumber rallies above its 50 week moving

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2019 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Troy Bombardia Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.