Will Gold Continue to Outperform Silver?

Commodities / Gold & Silver 2019 Aug 12, 2019 - 01:38 PM GMTBy: Submissions

Gold Strength Dominates the Markets

Gold Strength Dominates the Markets

The recent rally in Gold has been hard to ignore. The yellow metal is certainly showing a lot of strength. But unlike prior rallies, the current one stands out in several ways.

For starters, Gold is trading at record levels against four of the seven major currencies. Looking at just spot Gold against the dollar does not represent just how strong Gold is at the moment. But not only that, Gold is rallying without the common correlations that we have seen in the past. Specifically, equities are not really under a whole lot of pressure at the moment. Neither is the dollar. In fact, the greenback just broke to a fresh high in the past few weeks.

Perhaps the best correlation to look at is that with bonds. The strong downwards momentum in global bond yields is possibly the best indicator and driver for the surge in Gold prices. Nevertheless, dominating appears to be the correct term here as none of the other commonly looked assets have had fluctuations that look anything like the rally in Gold.

Silver is Lagging Notably

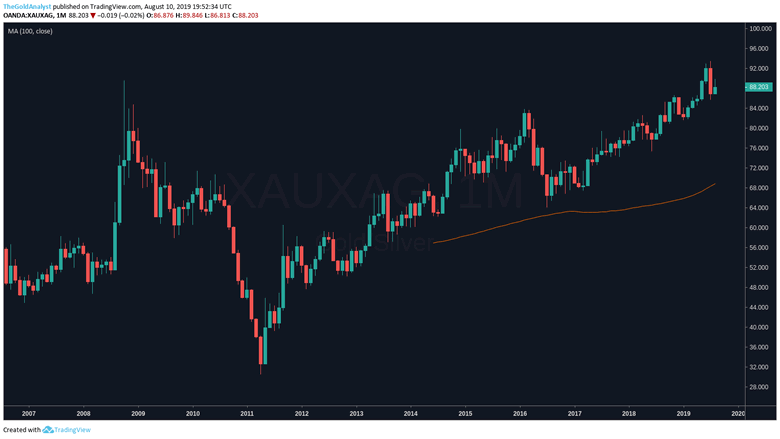

So that brings us to Silver. Saying that Silver is lagging is a bit of an understatement. While Gold prices trade at a 6-year high, Silver prices are still pretty much near decade lows. This highlights a huge divergence among precious metals. The Gold/Silver ratio is often referenced to gauge performance between the two metals. Take a look at the chart below which is a monthly chart of gold over silver.

First off, it is quite clear that Silver has been underperforming from a broader perspective. This has been going on since 2011. However, there are a few things that stand out from the above chart.

For starters, the ratio certainly looks extended. The indicator in the chart reflects the 100-month moving average and the price is currently several standard deviations away from it. As well, the ratio is also trading at a record high. But just because it is a bit extended here doesn't mean it's going to turn. There is however an interesting pattern in the chart. Note that the candle for July took the form of a bearish engulfing candle. This is a commonly known reversal candle and might just be hinting that the ratio is trying to top out.

There is Value in Silver

But even if the ratio is not topping, there is certainly a much better risk to reward in holding Silver in present conditions than it is compared to Gold. This is especially true for investors that are in countries where the yellow metal is at a record high in their base currency.

As Gold continues to gain traction, it makes sense that other precious metals stand to gain. After all, newer investors are more likely to get into an investment that they perceive to be cheap rather than investing at a multi-year high.

By Jignesh Davda

The Gold Analyst

Quality Analysis of the Price of Gold

© 2019 Jignesh Davda - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.