UK Surprise Decision to Thwart a No-Deal Brexit Changes Market Dynamics

Stock-Markets / Financial Markets 2019 Sep 05, 2019 - 02:57 PM GMTBy: Chris_Vermeulen

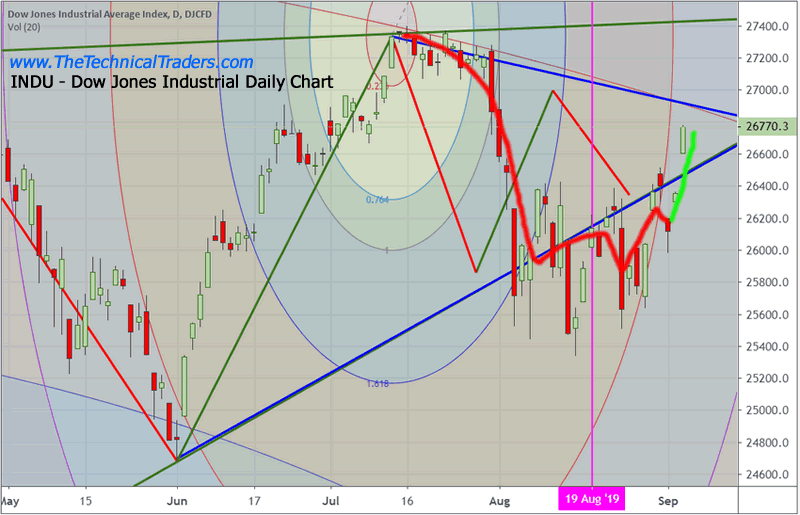

Our August 19th prediction of a market breakdown, as well as our continued research suggesting a breakdown in price was the most likely outcome, is a combination of technical analysis, predictive modeling and our understanding of the market dynamics at play throughout the world. But, when news like this hits (global economic news, surprise news announcements or any type of positive or negative massive news event) the dynamics of the global markets can shift quite suddenly which we want to explain here. Before we get into the details, be sure to opt-in to my Free Market Forecast and Trade Ideas Newsletter so stay on top of these market moves.

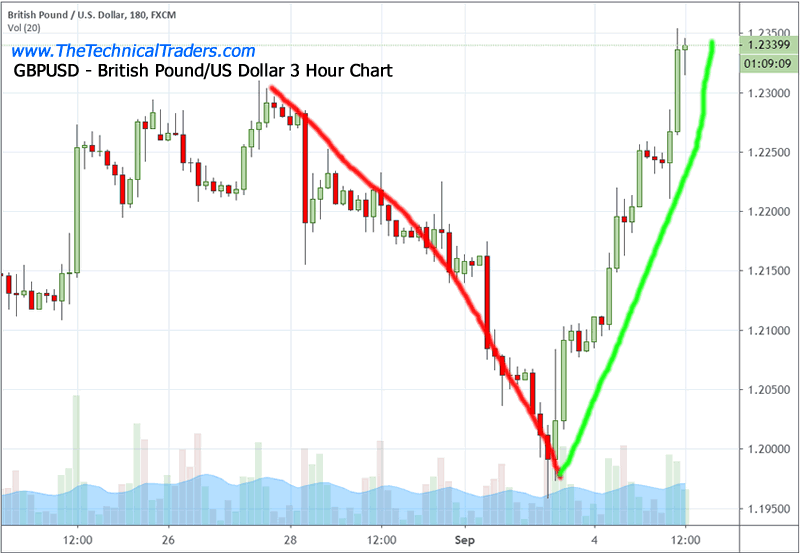

Just a few days ago, it appeared that the US/China trade deal was still 30+ days away from any type of continued discussion and the UK Brexit was likely to take place this week and next. With US earnings season setting up in September, headed into the holiday season throughout the globe, we believed the downside price move probability was far greater than the upside. Then, out of almost nowhere, the No-Deal Brexit deal is sidetracked and the British Pound rallies dramatically on the news.

This Three-Hour British Pound Chart highlights the dramatic price reversal that took place late yesterday (after markets) and resulted in a news-driven price move that was unexpected. The way these types of new events can come out of nowhere to dramatically alter price direction and trend is something that all traders have to deal with. For a technical trader, these events, thankfully, don’t happen all that often. But when they do happen, we have to readjust our understanding of the markets and dynamics that are taking place throughout the global financial environment and follow the money and potentially new trends against our current analysis.

With the news that the BREXIT is on hold right now and is being blocked by a certain segment in the UK Parliament, how will that result in new dynamics and opportunities for us to take advantage of and profit from? Obviously, currencies will continue to move until price levels settle near proper expectations – same thing with the global stock markets. It is very likely that the US Indexes (ES, NQ, YM, and others) may attempt to move back towards recent highs if the fear and uncertainty of the BREXIT deal warranted that much pricing pressures in the markets?

Overall, when events like this happen, it is often the best decision not to try to chase them right away. These are reactionary price moves related to news events – almost like a shock-wave which I explain this breakout on the chart is this video analysis. They are here now, they move the market and they appear dramatic, but they are typically over as fast as they started.

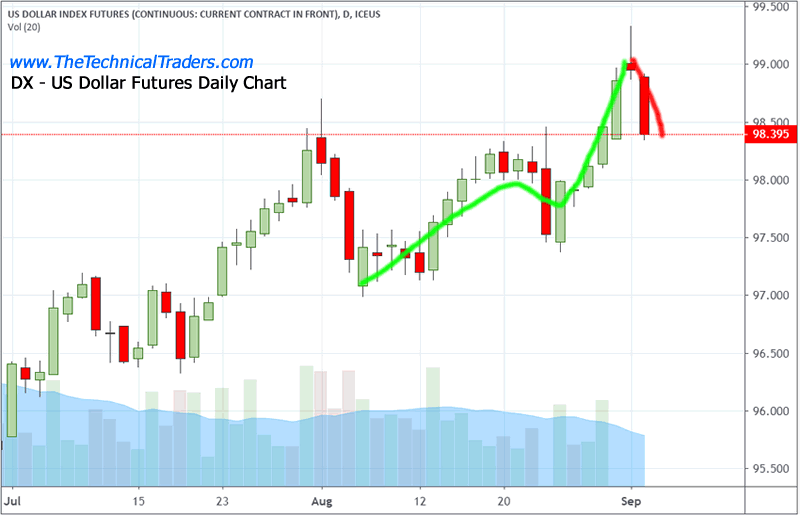

This US Dollar chart highlights the downward price rotation that was likely prompted by the BREXIT news last night and may continue as the markets revalue “fear and uncertainty” over the next few days. It is very likely that true price levels will be established over the next 7 to 10 days as the continued repositioning of assets results because of the change in BREXIT expectations from within the UK.

We need to stay dynamic in how we address these types of market moves and the risks that are persistent. We can’t know what is going to happen in the governments and governing bodies of the world. As technical traders, our job is to use our tools and resources to find the best opportunities and to take advantage of them when risks are manageable. We flip directions as the markets flip directions. All we want the markets to move up or down because this provides opportunities for us to profit.

This Dow Jones Industrial Daily Chart highlights just how dramatic the upside move is today and how price is still below the recent highs set near 27,400. Our August 19th Breakdown prediction is currently invalid based on this upside price move. We did see a big move lower in early August, but we never saw the continued downside move that we expected. The cycles were predicting this move would happen, but the global market dynamics (news and other items) have altered the current market perspective. Must like QE events and other major global events, just because technical analysis or cycles suggest one thing will happen, if there is enough pressure from outside forces to move the markets one direction, then markets will typically relent to that pressure and move into the “path of least resistance”. Right now, that path is upward.

CONCLUDING THOUGHTS:

We took a series of great profitable trades over the past 4+ weeks while the stock market traded sideways. This week we closed out three winning trades 3%, 6.5%, and 9.88% while most others lost money. As technical traders, our only objective is to protect our assets, find great trades, generate profits and avoid unwanted risks. We are doing exactly that by managing our position sizes, executing smart trades, creating profits for our members and continuing to seek out the best opportunities in the future.

Let this news event play out over the next few days. Let the markets figure out where price wants to go after all the dust settles. There will be lots of opportunities for more great trades in the future.

We believe our super-cycle research and other proprietary modeling systems are suggesting that price weakness will dominate the markets for the next few months. Ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis and recession.

In short, you should be starting to get a feel of where commodities and asset class is headed for the next 8+ months. The next step is knowing when and what to buy and sell as these turning points take place, and this is the hard part. If you want someone to guide you through the next 12-24 months complete with detailed market analysis and trade alerts (entry, targets and exit price levels) join my ETF Trading Newsletter.

FREE GOLD OR SILVER WITH SUBSCRIPTION!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.