The Repo Liquidity Crunch Reveals Market Stress. Will Gold Shine?

Commodities / Gold & Silver 2019 Sep 24, 2019 - 06:32 PM GMTBy: Arkadiusz_Sieron

Last week, the Fed had to inject liquidity into the repo market for the first time since the Great Recession. Not once, but several times – and also commit to do more. Will such a crack in the proverbial dam let gold’s allure shine?

Last week, the Fed had to inject liquidity into the repo market for the first time since the Great Recession. Not once, but several times – and also commit to do more. Will such a crack in the proverbial dam let gold’s allure shine?

Scramble for Liquidity Pushes Rates Up

The focus last week was on the FOMC decision to cut interest rates. But a real drama was unfolding in the background. The Fed injected $278 billion into the securities repurchase, or “repo,” market over four days, to stabilize short-term interest rates and to calm the repo market scrambling for liquidity. More precisely, the U.S. central bank injected $53 billion in overnight repurchase agreement on Tuesday, followed by $75 billion re-open on Wednesday, then on Thursday and on Friday as well.

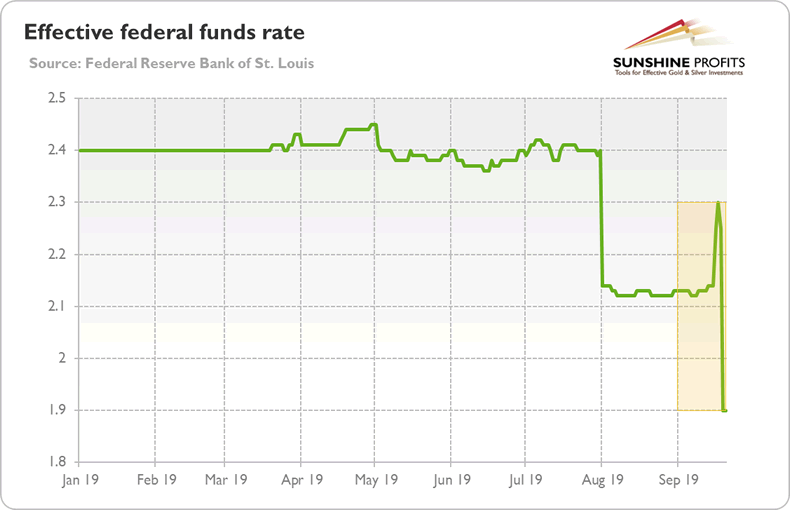

What happened? The liquidity dried up, which pushed the interest rates up. In particular, the effective federal funds rate jumped to 2.3 percent, as the chart below shows. It should have been in the target range of 2.00-2.25 percent before the Wednesday’s cut however. The Fed thus had to step in and inject some reserves to regain control over its main policy rate.

Chart 1: Effective federal funds rate in 2019

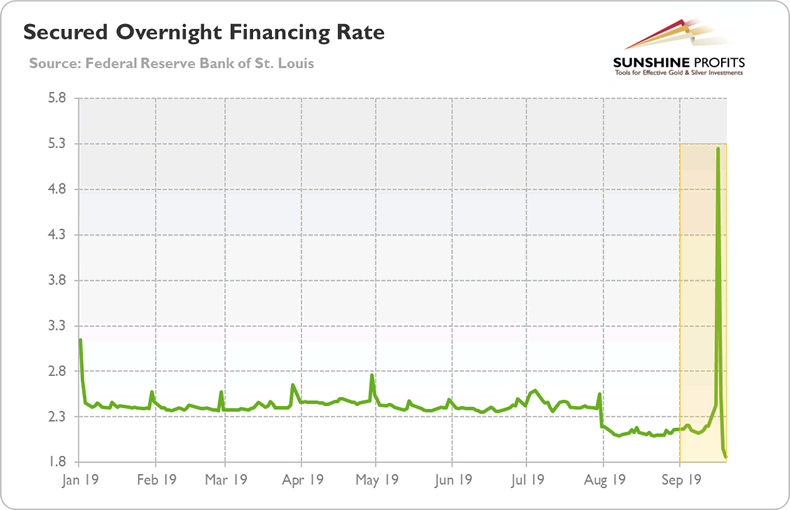

If you don’t feel impressed, please note that the U.S. overnight repo rate shot up from slightly above 2 percent to as high as 10 percent on Tuesday, while the Secured Overnight Financing Rate, the Fed’s measure of the cost of overnight borrowing collateralized by Treasuries, soared from 2.20 percent to 5.25 percent last week, as one can see in the chart below.

Chart 2: Secured Overnight Financing Rate in 2019

OK, we know that interest rates spiked, but the question is why did they skyrocket? The official narrative is that the spike was driven by two temporary factors, namely quarterly tax payments and the $78 billion Treasury auction to fund its large fiscal deficit. Both of them withdrew liquidity from the market and both of them occurred last week, what a bad luck! So, read my lips, it was not a liquidity crisis, just a liquidity shortfall that will quickly wane.

But there is one problem with that explanation. It does not make sense. Even John Williams, the President of the New York Fed, which was responsible for the interventions, admitted that although the corporate tax payments and Treasury actions were expected to reduce liquidity somewhat, the reaction in the repo market was “outside of recent experience.” And, what is even more important, the New York Fed announced that it will conduct $75 billion overnight repo operation every weekday until October 10, plus three 14-day repo operations on September 24, 26 and 27. So, although everything is fine and the liquidity shortfall will quickly go away, the announcement clearly indicates that the New York Fed is worried that the dollar funding shortage may continue.

Implications for Gold

What does it all mean for the gold market? Well, in the short-term, not much. The panic has been contained, while the interest rates came back to their more normal levels. But there are important long-term implications. First, the turmoil could strengthen the dovish camp within the FOMC and prompt the U.S. central bank to restart the growth in its balance sheet, perhaps through quantitative easing. More dovish Fed should be supportive for the gold prices.

Second, the episode reveals that the U.S. financial market is less liquid than previously thought. Thus, there is a risk that similar sudden cash shortages will repeat, for example when the New York Fed’s repo operations will end, leading to broader financial market turmoil. Gold should shine, then. We are not saying that the next financial crisis is imminent, but such episodes should, especially when many people fear the upcoming recession, strengthen the safe-haven demand for the yellow metal.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.