If you Want to Get Really Rich, Invest like Google Not Warren Buffett

Companies / Investing 2019 Sep 30, 2019 - 01:23 PM GMTBy: Stephen_McBride

Justin Spittler writes: "Follow the smart money."

Justin Spittler writes: "Follow the smart money."

We’ve all heard this saying.

It means if you want to make big money in the markets, do the following:

- Identify the smartest professional investors...

- buy the stocks they buy...

- and you’ll get rich too.

Just who are these genius investors who you can piggyback to riches?

Some folks might mimic super “value” investor Warren Buffett. Others might follow a master trader like Paul Tudor Jones.

When it comes to early stage disruptive stocks and IPOs, one investor beats all others, hands down.

I watch his every move like a hawk.

I guarantee you know this investor’s name. But I can almost guarantee you don’t think of him as a great investor.

Because the World’s Greatest Investor Isn’t a Person

It’s Google (GOOG), the $835 billion tech company.

I realize that might seem like a typo.

After all, when most folks think Google, they think “search engine.”

Google dominates in search. Every day, its website handles 3.8 billion searches. To put that into perspective, roughly 7.5 billion people live on this planet.

But Google is so much more than a search engine.

It also runs one of the world’s most popular email services—Gmail.

It owns YouTube—the world’s #1 video platform and the second most-visited website (after google.com).

And it owns Android—the #1 smartphone operating system.

And as regular RiskHedge readers know, it owns the world’s leading self-driving car company, Waymo.

If you’d bought Google stock when it went public in 2004, you’d be up more than 2,000%.

But I’m not recommending you buy Google stock. Instead, I want to share a far more lucrative idea...

On August 12, 2015, Google Changed Forever

That day, Google’s founders Larry Page and Sergey Brin announced the creation of “Alphabet.”

Alphabet is a holding company, which means it owns other companies. Berkshire Hathaway (BRK-B)—Warren Buffet’s company—is the world’s best-known holding company.

Alphabet is the parent company of Google. Technically, there’s no such thing as “Google stock” anymore. Its proper name is Alphabet stock, although no one calls it that.

Here’s why this matters to you...

Alphabet owns 14 companies. A few of these are “venture capital” investment shops that invest in small, private, disruptive businesses.

GV, formerly called “Google Ventures,” invests in early-stage private projects.

Capital G invests in later-stage private companies.

Alphabet also owns Gradient Ventures—an investment fund focused on artificial intelligence (AI).

And it has a secret research and development lab called “X” that specializes in “moonshots” or bets that can deliver astronomical returns.

Through its different entities, Alphabet has become an investing powerhouse.

In 2017 alone, it invested in 103 deals, making it by far the most prolific “corporate” investor.

Alphabet’s portfolio includes everything from robotic startups to companies trying to “cure death.”

The World’s Greatest Technology “ETF” of Private Companies

By buying Alphabet stock, you can own a tiny sliver of these disruptive businesses...

This is why some analysts call Alphabet the “world’s greatest technology ETF.”

But that’s an understatement. ETFs, as you might know, typically let you buy a basket of publicly traded stocks.

Remember, Alphabet invests in early-stage projects and moonshots. These companies are private. Everyday investors can’t buy them yet.

These are the companies I watch like a hawk. Many will go public—or IPO—eventually. And Google-backed IPOs often hand investors huge gains.

Here’s a couple of some Google-backed companies that’ve gone public recently:

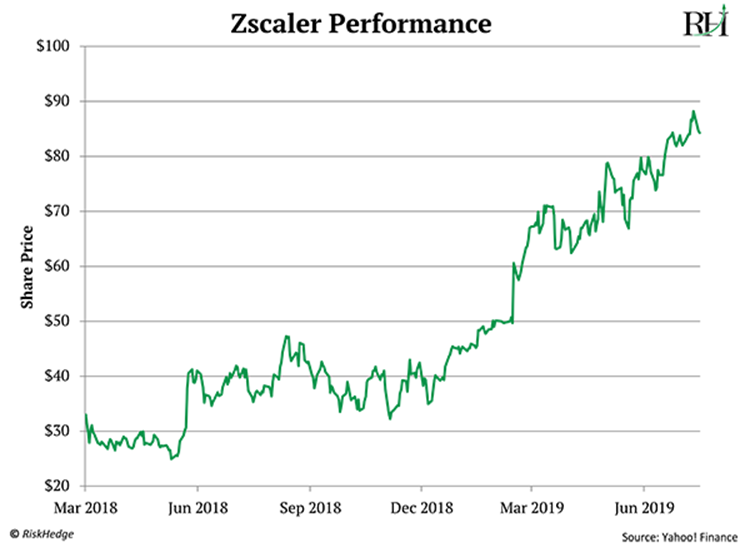

Zscaler (ZS)—a cloud-computing company that Google Capital invested in back in 2015—went public in March 2018.

Google made a killing on it, but so did smart individual investors.

You could have made 244% by simply buying Zscaler the day it started trading.

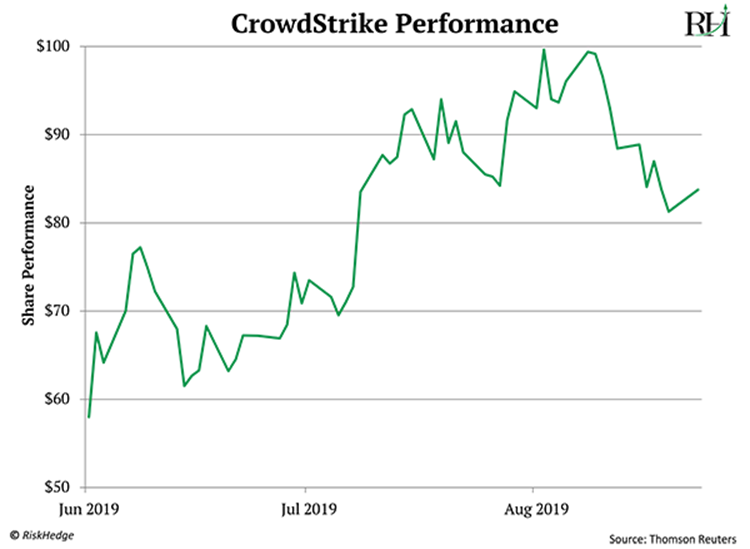

CrowdStrike (CRWD)—a security software company—also pulled off an incredible IPO. CRWD went public this June. Its share price skyrocketed 82% within two months after its IPO:

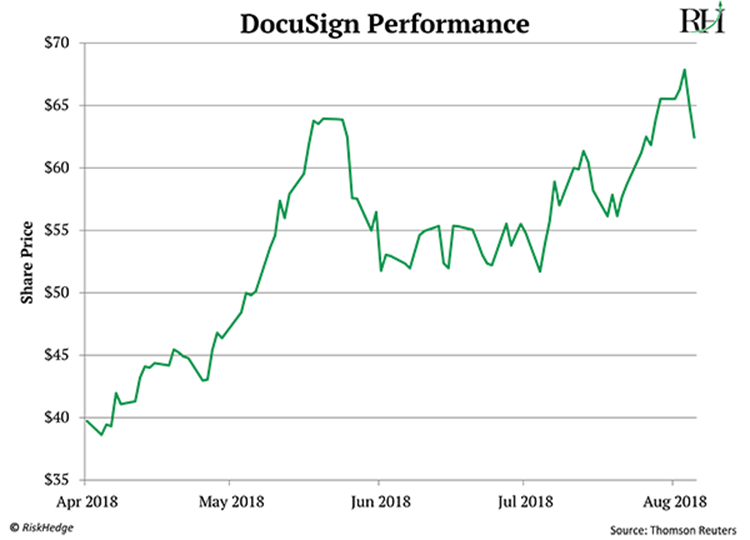

DocuSign (DOCU)—another Google-backed software company—also had a great IPO. Its shares skyrocketed 83% within four months after the company’s IPO.

Keep in mind, Alphabet’s shares have climbed 51% over the last three years. That’s a solid return. But you could’ve made far more money in far less time by buying certain Alphabet-backed IPOs.

Most Investors Missed Out On These Big Profits

That’s because these weren’t well-known IPOs.

Before these companies went public, less than 1 in 1,000 investors knew about them. Even now, maybe only 1 in 100 investors has heard of them.

If you’ve been reading my work, you know small, lesser-known IPOs are most likely to hand you big, quick profits.

You could have seen these opportunities coming from a mile away by simply studying Alphabet’s portfolio.

This is why I stalk Alphabet’s every move.

Alphabet is arguably the world’s most forward-thinking company. I’d put its “crystal ball” up against any other investor or company on the planet, including Warren Buffett.

If Alphabet invests in a company, it’s a powerful “stamp of approval.” And a hell of an endorsement.

In fact, Google’s backing is a key reason why I like Cloudflare (NET). I told my readers about this cloud-computing IPO last week.

On its September 13 IPO, it blasted to a 20% one-day gain. And it’s been climbing ever since. Cloudflare has now gained another 16% since its IPO.

I see it continuing to head higher from here.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Justin Spittler

© 2019 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.