Whatever Happened to Philippines Debt Slavery?

Interest-Rates / Phillippines Oct 09, 2019 - 08:40 AM GMTBy: Dan_Steinbock

In early 2017, a Forbes contributor claimed President Duterte will bankrupt the Philippines economy in five years. Half of the period is gone. Will the country default in 2022?

In early 2017, a Forbes contributor claimed President Duterte will bankrupt the Philippines economy in five years. Half of the period is gone. Will the country default in 2022?

In May 2017, Forbes released a column, which claimed that “New Philippine Debt of $167 Billion Could Balloon To $452 Billion: China Will Benefit.” It was written by Anders Corr, who was portrayed as an independent geopolitical risk analyst. He predicted that the Philippines would be in debt slavery at the end of the Duterte era.

Now that half of that prediction period has passed, let’s see whether Corr was right.

The projections

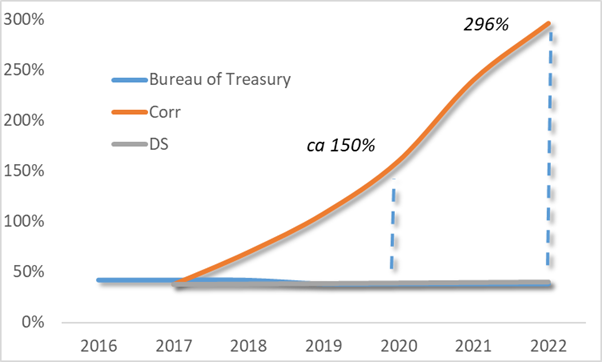

According to Corr, the Philippine government debt of $123 billion would soar to $290 billion because China would impose high interest rates on the debt: “Over 10 years, that could balloon Philippines’ debt-to-GDP ratio as high as 296%, the highest in the world.”

Based on flawed data and mistaken assumptions, the prediction sounded idiotic. Yet, Forbes's brand reputation and Corr's background felt credible to international media. Most of his clients are linked with Pentagon, its allies and defense contractors. He has been an associate for Booz Allen Hamilton in Hawaii (as was Edward Snowden when he worked for CIA) and served half a decade in US military intelligence. He has conducted "research" for US Army in Afghanistan, at US Pacific Command and US Special Operations Command Pacific. And he seems to specialize in efforts to destabilize critical areas in Asia.

In his projection, Corr assumed absence of transparency on the interest rate, heavy conditionality and repayment terms of $167 billion of new debt for the Philippines. Due to accrued interest (which he grossly over-estimated), “Dutertenomics, fueled by expensive loans from China, will put the Philippines into virtual debt bondage if allowed to proceed.” (In reality, the government’s borrowing sought to rely mainly on domestic sources, to alleviate foreign exchange risks).

Corr offered no evidence to substantiate the assertions. Yet, the commentary was quickly recycled across the Western media. The tacit assumption seems to have been that since Forbes represents world-class quality, so do its contributors (even those that have been subsequently fired, such as Corr).

So what’s the truth about the alleged “debt bondage”?

The realities

Let’s compare Corr's forecasts with projections. Between 2017 and 2022, most Philippine authorities estimated the debt would mildly decline. My estimate was slightly more conservative because I expected trade wars to begin to bite by 2018-20. In contrast, the implication of Corr’s claim was that Philippine debt-to-GDP ratio would soar to some 150% in year-end 2019 and to 296% by 2022 (Figure).

Figure Philippines Government Debt, 2016-22E (% of GDP)

In retrospect, Philippine authorities may have been 0.5-1% too optimistic, while I may have been too pessimistic by 0.5-1%. What is certain, however, is that Corr has already proven wrong by almost 110 percentage points (!).

Corr’s 2017 “predictions” have nothing to do with economic realities. It is also quite likely that, in another three years when Duterte will leave his job, both Philippine authorities and I will prove right by an error range of 1% to 2%, whereas Corr will prove wrong by some 250 percentage points (!).

When investment analysts commit such failures in markets, they are fired, banned or imprisoned. That's not the case with Corr. Despite disastrous projections, he has been used as an “expert” by major international media, such as Bloomberg, Fox, CNBC, New York Times, Nikkei Review, Al Jazeera, and UPI.

More recently, Corr predicted worldwide “financial carnage” if China intervenes in Hong Kong (Institutional Investor, Sep 23, 2019); claimed that millions of Uighurs linger in “Chinese concentration camps” (Washington Free Beacon, Jul 15, 2019); blasted the “Trump-Xi’s G20 trade truce” (Observer, Jul 1, 2019); and predicted that the division of the Philippine island Palawan into three provinces was a part of “China’s territorial expansion move” (Rappler Apr 13, 2019).

In the Philippines, even the Defense Forces Forum shared Corr’s “news” (Facebook, April 29, 2018) that the country had been invaded by 45,000 Chinese covert military operatives (he mistook online gaming operations, which China wants Philippines to eliminate, with covert military cells).

Economic hit men

Corr’s political links are most intimate with neoconservative and intervention-minded US senators, such as Marco Rubio, and vulture capitalists, including Paul Singer (who funds the above-mentioned Washington Free Beacon) that have recently supported destabilization in Hong Kong, Philippines and elsewhere in Asia.

He also cooperates with the radical conservative Japan Forward, which once recommended apartheid-policies to manage immigrants in Japan, the French Catholic daily La Croix International and the Union of Catholic Asian (UCA) News, which has since 1979 operated in the same Asian countries as Voice of America and the National Endowment for Democracy (NED). These catholic outlets work closely with the anti-Duterte leaders of Philippines Catholic church and the Liberal Party which suffered a meltdown in the 2016 election.

Since Corr’s predictions have no predictive power, the definition of an "economic hitman" may be more applicable in his case.

The real question is, why are such economic hitmen still used as “independent analysts” by some of the world’s most powerful international media?

Dr. Dan Steinbock is the founder of Difference Group and has served at the India, China and America Institute (US), Shanghai Institute for International Studies (China) and the EU Center (Singapore). For more, see http://www.differencegroup.net/

© 2019 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dan Steinbock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.