Gold and Silver - The Two Horsemen

Commodities / Gold & Silver 2019 Nov 11, 2019 - 10:02 PM GMTBy: Gary_Tanashian

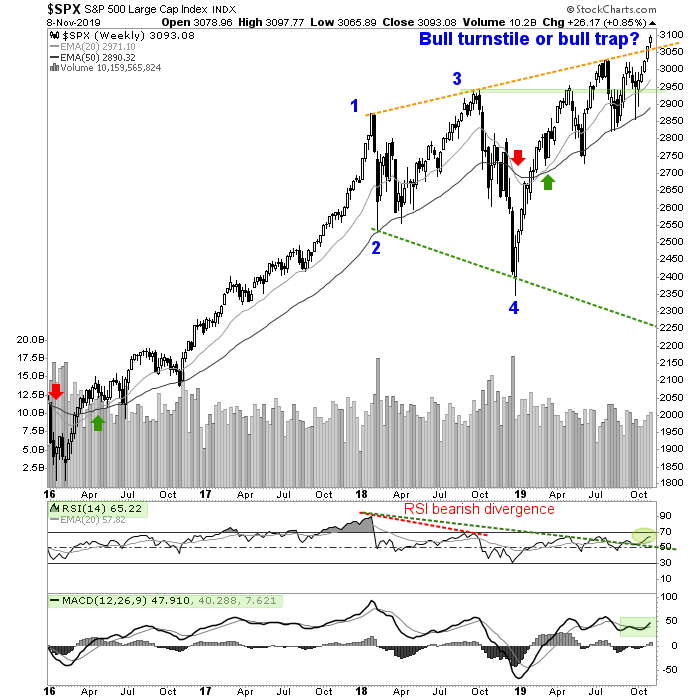

Global central banks have been pumping the liquidity spigots 24/7 and the US Fed is starting to go that way as well. This during a time of supposed economic splendor and fruitfulness (it is these contradictions that are the windows into a ginned up, leveraged economy dependent on monetary policy) while the S&P 500 breaks through the bull turnstile to blue sky.

Global central banks have been pumping the liquidity spigots 24/7 and the US Fed is starting to go that way as well. This during a time of supposed economic splendor and fruitfulness (it is these contradictions that are the windows into a ginned up, leveraged economy dependent on monetary policy) while the S&P 500 breaks through the bull turnstile to blue sky.

A real economy and real stock markets would not need constant juicing but then, even conventional mainstream investors know the deal in their heart of hearts; this massive bull market in equities has been aggressively managed since the 2008 liquidation (e.g. 7 years of ZIRP, QE as needed and global NIRP) and most maniacally since 2011 when silver blew out, gold topped and the macro-manipulative Operation Twist was set upon the bond market in order to twist its inflation signals, which had at the time been on the verge of getting out of hand.

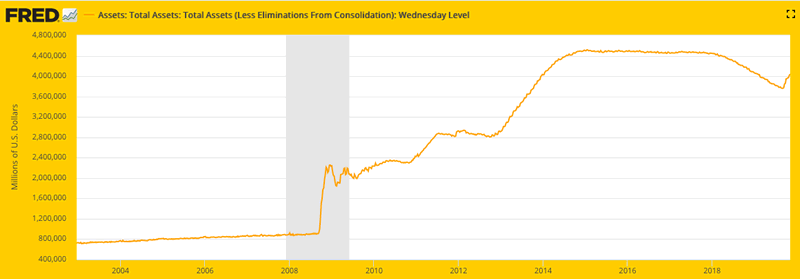

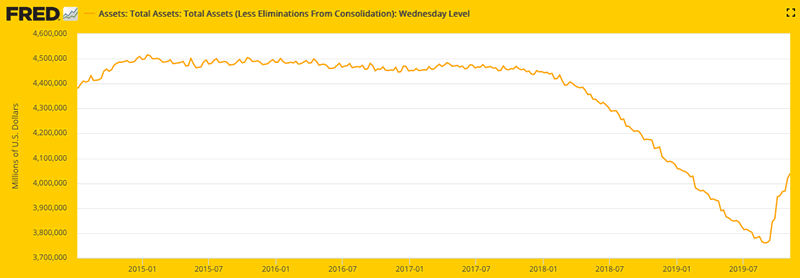

Here is a view of the Fed’s balance sheet, which had not expanded since 2014 after the Herculean efforts of 2008-2014.

But just recently, as the efficacy of Trump’s fiscal policies have worn down we see our heroes sneaking back into action. We’ve heard recently about Fed Repo maneuvers to keep market liquidity normal, but this general view shows the Fed stepping in again after stepping aside and letting the administration’s corporate welfare and other pro-business measures do their thing.

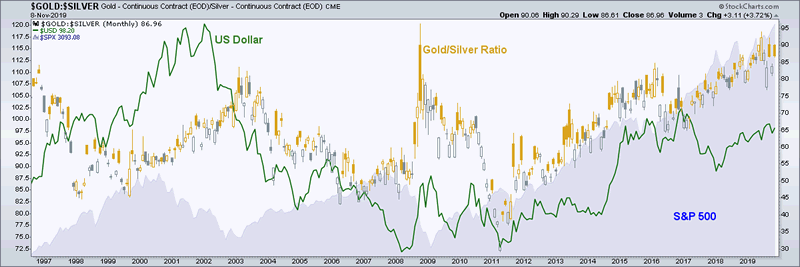

Anyway, it is the Fed’s (and global central banks’) will and ability to inflate vs. the market’s drive to liquidate. Last week we noted that the Silver/Gold ratio had started to fail and while not yet conclusive, this indicator of coming inflation (silver having more cyclical, commodity-like inflationary characteristics than gold) started to roll over on its daily chart after not having changed its downtrend on long-term charts.

Which brings us to an old theme that could be readying for reintroduction. If the Silver/Gold ratio fails it would then be flipped over to reveal one of the riders of market liquidity destruction; the other being the US dollar, which not coincidentally was firm last week. It is time to at least be aware of…

The 2 Horsemen (excerpted from this week’s edition of Notes From the Rabbit Hole)

Okay folks, you know I like a good metaphor/mental image/shtick with which to make my points. An old one that newer subscribers will not have seen is the 2 Horsemen, which was my way of illustrating how the reserve currency (USD) had tended to go in line with the Gold/Silver ratio (GSR) as the two riders of market liquidity destruction.

As with so many indicators in the post-2011 (and not coincidentally the post-Op/Twist) environment the relationship was rendered dysfunctional much of the time with respect to its ability to bring pain to the US stock market at least. But it did bring the pain to the various global inflation/reflation trades (while mostly visiting Goldilocks upon the US).

Last week the flip side of the GSR (SGR) faded as USD bounced again. As such, I think it is worthwhile to keep the Horsemen on watch together in gauging the probabilities of a positive or failing global macro trade and whether it could extend beyond the current vigorous bounce. It is an open question as to whether the Teflon Don – AKA the US stock market – would be greatly and adversely affected.

As you can see during the last two SPX bear markets GSR & USD rose together, but during the post-2011 period they have mostly risen together along with SPX. Now that’s indicator dysfunction!

Ah, but the ‘inflation trades’ of many global markets, commodities and resources suffered, as would be expected. Given that the Trump administration is considered ‘reflationary’ and anti-USD, we can entertain the prospect that the US stock market might not avoid a similar fate to the global macro if the 2 riders ride again. For now we are in evaluation mode. But ain’t it interesting, in a grim way?

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2019 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.