Will Labour's Insane Manifesto Spending Plans Bankrupt Britain?

ElectionOracle / General Election 2019 Dec 01, 2019 - 12:34 PM GMTBy: Nadeem_Walayat

Labour under Jeremy Corbyn is literally promising voters everything under the sun! Scrapping Universal Credit, Giving all public sector workers a 5% Labour pay hike bribe, Free personal care fore the elderly, scrapping of tutition fees, £30billion Increase in annual NHS spending!

All of which translates into an increase in government day to day spending of about £80 billion, or 10% per year!

AND additional 'investment' spending of £55 billion a year. For a total annual increase in spending of £135 billion, more than 2.5X the tax bribes of 2017! And that's EXCLUDING Labours plan for mass nationalisation. a bill for which runs into the hundreds of billions!

How does Labour propose to pay for this £1 trillion+ extra spending binge over the next 5 years?

TAX the rich! Corporations and the top 5% who already pay over 50% of the tax base are going to pay a whopping £83billion extra in tax per year!

What's going to happen if many of these corporations and individuals decide to migrate themselves and operations abroad. Which is much easier to do in the digital age!

Which means you can take Labour plans for raising an extra £83 billion per year with a giant mountain of salt. At best Labour will be able to reap a £30 billion increase which is set against a spending increase of £135 billion, resulting the budget deficit soaring by as much as £105 billion!

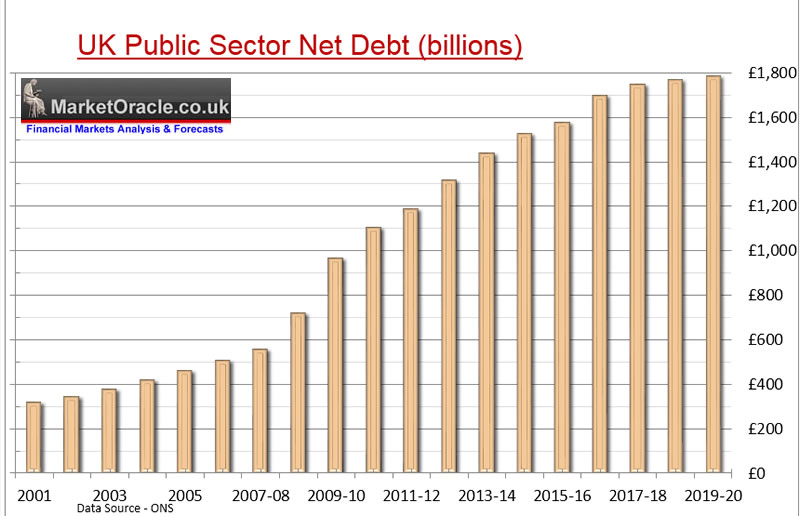

Looking at total government debt that partially includes Bank of England cooking the books (QE) projects to an estimated £1791bn for the year to April 2020 (ONS Data).

The debt graph on face value implies that the Tories over the past couple of years have managed to get a grip to some degree on what was a rampant build up in debt the consequence of which at the very least are stagflation. That should in theory allow the government some room to borrow for election bribes.

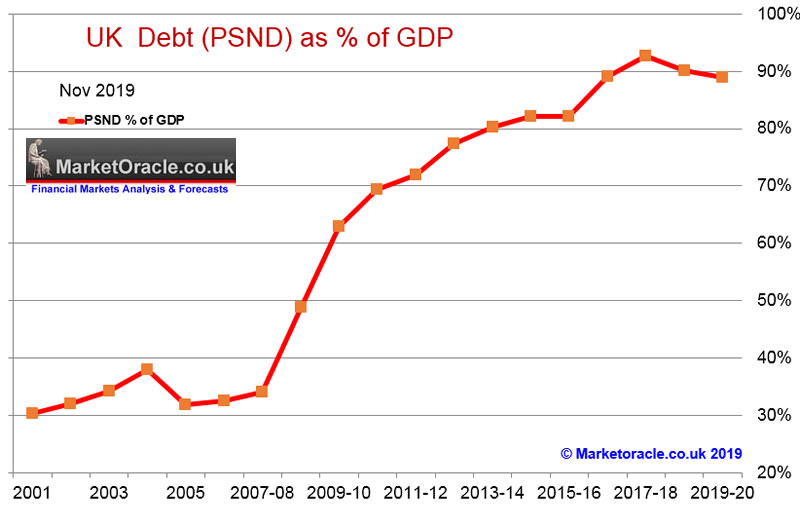

However, real debt to GDP paints a picture of an highly indebted economy that has NO ROOM TO BORROW! Let alone to go on a £135 billion Labour spending spree!

The graph explains why Theresa May in 2017 had a net neutral election manifesto as the Government had literally no room to manoeuvre with Debt to GDP standing at 93% that looks set to fall to 89% by the end of the current financial year.

Current Debt to GDP of about 90% also answers the question why the likes of the IFS are warning that the Conservatives are likely to spend MORE than that which has been costed in their Manifesto because unlike Corbyn's Labour party the Tories in government understand that there really is NO room to borrow more unless forced to do so due to commitments, instead the debt to GDP chart is flashing a RED WARNING LIGHT for future tax hikes and spending cuts!

So it is s no wonder the Tory manifesto is weak and vague on spending, barely touching on the big elephant in the room, one of financing the growing burden of an ageing population which will likely result in higher spending and deficits than the Government is budgeting for.

Will a Corbyn Laour Government Bankrupt Britain?

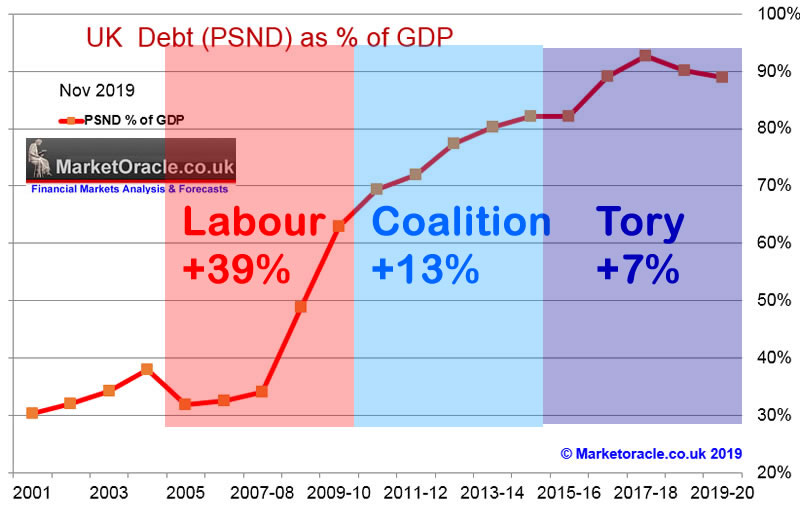

We'll barring an economic crisis, a Corbyn Government aims to ramp up deficit spending to the tune of about 5% per year which will send Debt to GDP soaring to above 100% which would bring the Corbyn government to a shuddering halt, much as happened to the last Labour government who faced with a bankrupt banking crime syndicate, decided to bail them out at huge cost to Britain, a bailout price that the people of Britian are still paying for today!

The spectacular economic collapse of the last Labour government sent debt soaring into the stratosphere, that would take a decade for subsquent governments to bring under control. However at 90% of GDP there is NO ROOM to go on another debt fuelled spending binge.

Of course it's not going to happen, Labour 's £135 billion annual spending spree resulting in a net increase of £105 billion of borrowing per year is just NOT GOING TO HAPPEN! As a trend trajectory to and beyond 100% of GDP would be accompanied by a severe sterling bear market prompting interest rate hikes and Inflation taking off even on the highly manipulated fake CPI inflation measure that tends to under report REAL inflation that people actually experience by half! I.e. Current real inflation is about 3% not 1.5%! whilst RPI a more accurate measure of UK inflation stands at 2.4%. Unfortunately the Government has plans to bastardise the RPI measure further by making changes to RPI to manipulate the rate lower towards that of CPI so as to complete the job of hiding Britain's real inflation from the general public which typically is twice the CPI rate i.e. currently 3%.

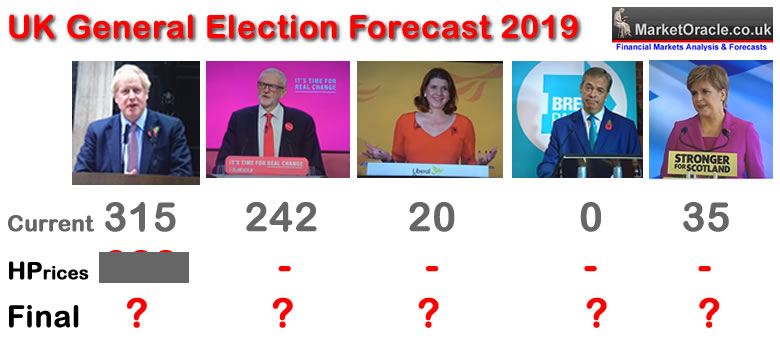

My next article in this series of lessons learned from 2017 in forecasting the outcome of UK general elections will look at the impact of the current state of the economy on the prospects of the 2019 election, are average earnings rising at enough of a pace to boost Tory electoral prospects or not?

- UK House Prices Momentum General Election Forecast

- Labour vs Tory Manifesto Voter Bribes Impact on UK General Election Forecast

- UK Economy Election Impact

- Marginal Seats, Social Mood and Momentum Election Impact

- Opinion Polls and Betting Markets

- UK General Election Forecast Conclusion and Market Opportunities.

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.