The Narrative About Gold is Changing Again

Commodities / Gold & Silver 2019 Dec 02, 2019 - 07:29 PM GMTBy: Arkadiusz_Sieron

Teaser: Let’s face it, we live in a world of radical uncertainty. Yet we’re supposed to make perfectly rational decisions – so, how do we cope with the unknown? We tell narratives, and form our decisions around them! Let’s explore the narratives in the financial markets for it reveals their importance to the gold market.

Let’s face it, we live in a world of radical uncertainty. There are not only many known unknowns in the world, but the same can’t be said of unknown unknowns. We simply do not known what we don’t know. In other words, the problem is not risk. The notion of risk implies that we can compute probability. This is what the mainstream economists assume: we know the odds, so there is a single optimizing solution to each problem. But the real issue is that we do not know the probabilities, because we even do not know how the world works. You see, the probability applies in a casino but not in a real world. You are certainly aware of substantial difference between roulette or weather forecasting, and the scope of new inventions or the prospect of war, elections or the asset prices. As Keynes wrote (at least once we agree with him), “About these matters there is no scientific basis on which to form any calculable probability whatever. We simply do not know.”

So how do we cope with the unknown? Mervyn King, former governor of the Bank of England, provides an answer in his interesting book The End of Alchemy. According to him, a coping strategy comprises three elements – a categorization of problems, a set of rules of thumb, or heuristics, to cope with the latter class of problems; and a narrative. The latter is key – so we focus on it.

What is narrative? King defines it as “a story that integrates the most important pieces of information in order to provide a basis for choosing the heuristic and the motive for a decision.” When we cannot write down a mathematical model with known probabilities, we can nevertheless follow some narratives.

Some examples? Sure, King provides two of them. The first is the barely known financial crisis of 1914, when the narrative that war was inconceivable was replaced by the narrative that it was here. Second, more contemporary and better known, is the economic crisis of 2008, when the narrative that trends in the household spending and in the housing market were sustainable, was replaced by the narrative that they were not. As a consequence, the housing bubble burst and the Great Recession broke out. Yes, changes in narratives can be painful. People who went through divorce, know something about it.

Great, but how does it rela7te to investment? The narratives are of great importance in the financial markets. As King points out, “under radical uncertainty, market prices are determined not by objective fundamentals but by narratives about fundamentals.” Wow, that’s a strong statement! However, we are not convinced whether it is really the case in the long run, but it sounds cogently as a description of the short or medium term.

If stories about fundamentals, or stories that market consensus at any one moment judges true, are the powerful driver of asset prices, they are even more forceful in the gold market. Why? The fundamental value of equities are unknowable (as we do not know what will be the cash flows generated by the given company in 50 years), but we can at least estimate that somewhat. But what is the fundamental value of gold – an asset which does not generate any yield? It’s truly unknown.

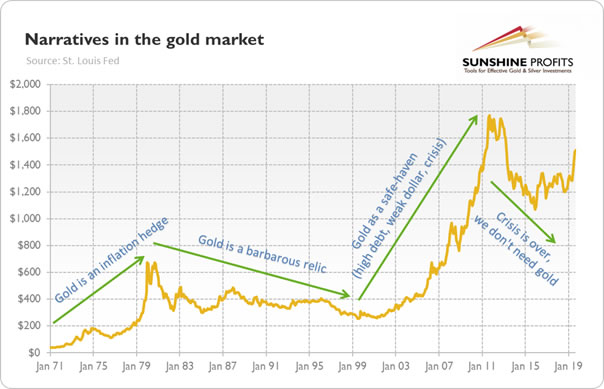

It does not mean that there are no fundamental factors in the precious metals – there are, and we provided many times evidence for the importance of the U.S. dollar or the real interest rates. But they affect the gold market through the narratives, or market sentiment (this is also why our trading alerts are so relevant). The chart below presents the history of the gold market shaped by four such powerful narratives.

Chart 1: Gold prices (London P.M. Fix, in $) and four narratives in the gold market from 1971 to 2019.

Have you ever wondered why gold – although it is generally negatively correlated with the greenback and real rates – sometimes moves in tandem with the dollar and yields? Or, why some rounds of quantitative easing were positive, while other were harmful for the gold prices? The answer lies in narratives.

When the U.S. dollar strengthens because of the increased demand for safe havens, as it seems to be the case today, it fits the narrative of elevated uncertainty, which is positive for the yellow metal. The first two rounds of QE were positive for the yellow metal, because the dominant narrative was that the economy was in the toilet and at best, QE would not change it, or at worst, it would generate high inflation. But in time of QE3 the narrative changed, people stopped worrying about inflation and started believing in the economic recovery and that the Fed regained control over the economy. Hence, the gold prices started to decline.

Now, it seems that the narrative about the economy, the central banking and gold is changing again. The economy is slowing down and people worry about recession. The global bond market is awash in negative yields. The Fed abandoned its tightening cycle. The price of gold jumped above $1,400 and it is flirting with $1,500. In such an environment, there are substantial odds that narratives will change in favor of gold, especially if investors start to worry about the sustainability of high public debt and the true strength of the U.S. dollar. If that happens, gold could start a new bull market for good.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.