Gold 2020 - Financial Analysts and Major Financial Institutions Outlook

Commodities / Gold & Silver 2020 Jan 08, 2020 - 12:36 PM GMTSanta Claus rally in Gold and Silver Crowns a very good year

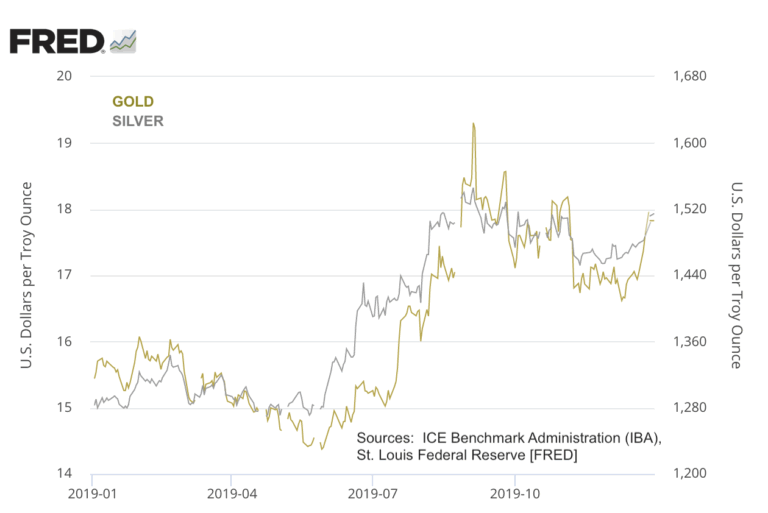

It was a very good year for precious metals. Gold posted a nearly 19% gain and silver rose over 17%. As you can see in the chart below, the move higher began in early summer defying the annual summer doldrums, hit an impasse during autumn, then ended the year with a surprise Santa Claus rally that took it over the $1520 mark. Silver pushed briefly over the $18 mark in late December then settled at $17.78. Bloomberg Intelligence’s Mike McGlone offers a hopeful tone for our favorite precious metal as 2020 begins:

“It’s a new year and decade and gold is poised to follow the dollar and equities to new highs, in our view. When, should be the primary question, particularly when the stock market and greenback succumb to some normal mean reversion. Absent a new higher dollar and stock-price plateau, gold is set to join the all-time-highs club. Gold prices are on a sound footing for further advancement in the coming year and decade, in our view. Gold prices are on a sound footing for further advancement in the coming year and decade, in our view.”

Gold and Silver Prices (2019)

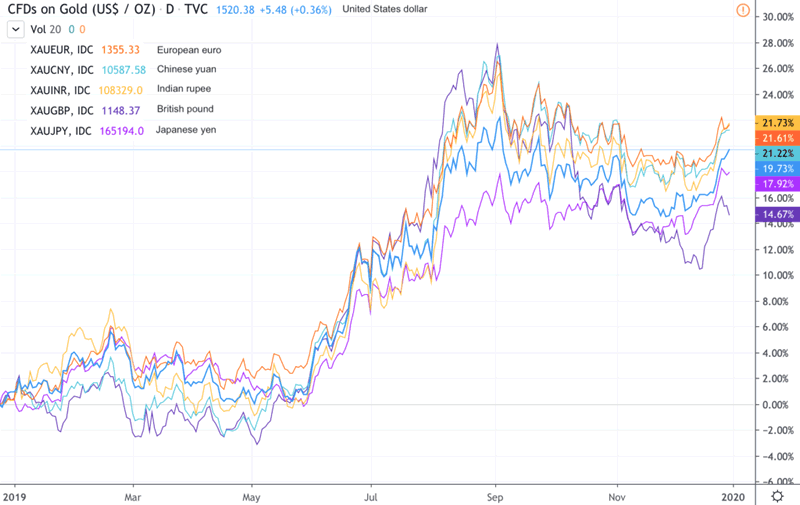

The importance of gold hitting record highs in most foreign currencies last year

In five of the top eight economies – the United Kingdom, Japan, Canada, Australia, and India – gold posted all-time highs in the local currency during the course of the year. In short, as currencies raced for the bottom, gold raced to the top. “The true hallmark of a bull market in gold,” says veteran technical analyst John Murphy, “is its ability to rise relative to other major currencies. And it’s doing just that.”

“Historically,” adds Atlas Pulse’s Charlie Morris in a recent in-depth report on gold’s prospects for 2020, “it has proved to be important that gold rises in all currencies, and not just in US dollars. This simple test ensures we don’t mistake dollar bear markets for gold bull markets. Since 2000, the world’s best currencies have been the Swiss Franc and the Thai Baht, and gold recently broke higher in both. That implies that gold is rising everywhere.”

Mark Mobius (Mobius Capital Partners) explains in a NewsMax interview why he thinks investors should allocate at least 10% of their portfolios to gold:

“The reason is that gold maintains its status as a currency – a currency that has stood the test of time. There is a growing realization that the supply of fiat money is growing at a rapid pace not only because of central bank activities to drive down interest rates by printing more money but also because of the rapid and inexorable rise of cryptocurrencies. . .They are beginning to realize that fiat currencies like the U.S. dollar and euro really do not have anything behind them except the faith of the public.”

And that, to sum it up, explains why gold has performed so admirably over the past year against the world’s top currencies.

Gold in various world currencies (2019)

|

Chart courtesy of TradingView.com

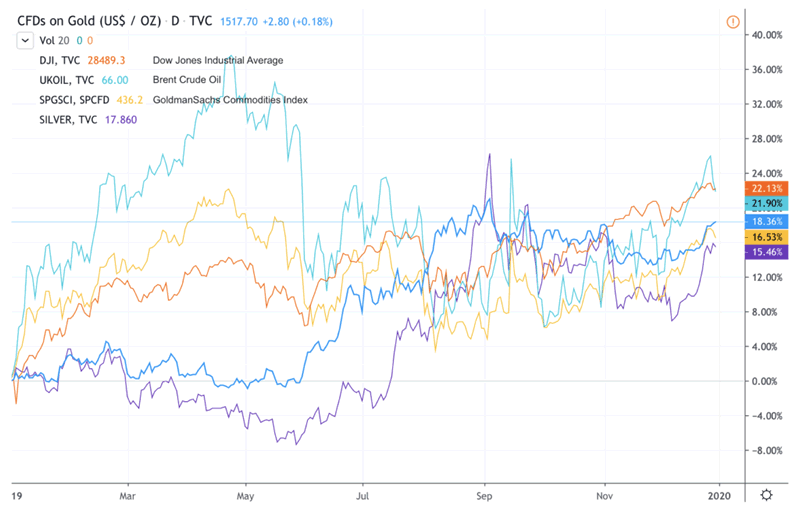

The DJIA outperforms gold in 2019, but just barely

Gold has produced positive returns in 16 of the last 19 years. Its average annual return compounded since 2001 is 9.38%. Gold’s appreciation in 2019 was nearly 19% while the Dow Jones Industrial Average was up 22.13%. In short, the DJIA did not do remarkably better than gold in 2019, though you would not know it given the comparative amount of publicity received by each. At the same time, the gains in stocks over the past two years have been shallow. So much so that Hussman Funds John Hussman was moved to offer the following observation:

“Yet for all the bullish exuberance, speculative enthusiasm, and fear-of-missing-out (FOMO) we’ve observed among investors in recent weeks, and indeed, in the past two years, the fact is that a pullback of just 11% in the S&P 500 would place the total return of the S&P 500 Index behind the return on Treasury bills since the January 26, 2018 market high. Given current overextended extremes, the entire gain of the S&P 500 since early-2018 could be given up in a handful of trading sessions.”

“Men, it has been well said,” says Charles Mackay in Extraordinary Popular Delusions and the Madness of Crowds, “think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one.” At present we are experiencing a modern-day version of that process at USAGOLD. We do not have a rush to buy gold and silver at the moment. Instead, we are experiencing a steady stream of new and old clientele purchasing to hedge the extremes to which John Hussman alludes above. They are returning to gold one by one, not as a herd. Much of the repeat business is coming from clients who bought early in gold’s secular bull market during the early 2000s.

All of which brings us back to a recent quote from billionaire investor Thomas Kaplan we have posted previously in this newsletter. It sums up with great clarity gold’s role in the private investment portfolio and offers his view of its future. His target price “measured in years” recalls prices in the late 1990s-early 2000s and the multiple returns that came years later as the bull market gained maturity, strength and participants.

“For twelve consecutive years, gold was up every single year whether there were inflation fears, deflation fears; strong dollar, weak dollar; political stability, political instability. It didn’t matter – strong oil, weak oil. . . Gold went up for twelve years. . . When gold embarks upon its next move, I believe that you will see that long wave take gold relatively quickly, but it will be measured in years, up to a $3000 to $5000 target that I believe is fundamentally justified based on the facts we have today. (Bloomberg’s Peer to Peer Conversations with David Rubinstein)

Comparative Investments (2019)

|

Chart courtesy of TradingView.com

If you think you could benefit from a concise review of the latest news, analysis and opinion on the gold market from a variety of expert sources, then News & Views is the newsletter for you. Since the early 1990s, we have offered it free-of-charge as a monthly service to our regular clientele and as an incentive to prospective clients. By subscribing, you will automatically receive future editions and occasional in-depth Special Reports by e-mail.

GOLD: Where-to in 2020? The experts weigh-in year one of a new decade

The year 2019 ended with a surprise gold market rally that extended into the first days of the new year amidst heightened tension in the Middle East following the drone attack on Iranian general Qassem Soleimani. What, though, might we expect for the rest of 2020? By and large, the experts profess an unusually strong and unified bias toward higher prices with opinions ranging from $1600 per ounce on the low side to one decidedly bullish analyst predicting a $3000 price on the high side. It was difficult to find forecasters calling for a sub-$1500 price.

Major financial institutions:

We were surprised at the unusually bullish perspective on gold for 2020 at Wall Street’s big financial institutions even though their price predictions remained typically conservative. At the same time, big institutions are known for routinely adjusting their forecasts as the year progresses.

Goldman Sachs is calling for $1600 gold in 2o2o citing political uncertainty in an election year and slow growth as inducements to own the metal. UBS also sees $1600 as in the cards in early 2020 based on US-China trade-related newsflows and persistently low real interest rates.

Australia’s ANZ Bank predicts a $1700 price in the first six months of 2020 based on its algorithmic modeling.

Deutsche Bank sees opportunities in gold based on the U.S. government’s rising budget deficit, but says gold will finish the year at $1550.

Standard Chartered is recommending that any weakness in the gold price represents a buying opportunity.

ABN Amro also sees gold at $1600 by year-end.

Professional investors and hedge fund managers:

Big-name hedge funds and hedge fund managers are among the most bullish on gold for the new year.

Blackstone’s Byron Wien says simply: “Watch gold in 2020. It has a chance to be an interesting investment.”

Atlas Pulse’s Charlie Morris says gold is already in a bull market and that “this bull market has legs.” He sees gold reaching $7166 per ounce by 2030 with inflation being the main driving force.

Electrum Group’s billionaire asset manager, Thomas Kaplan says, “I’m no insect. Gold is just a great way to make money” He sticks with his forecast made earlier in the year (and featured above) that gold will reach $3000 to $5000 over the next decade.

Similarly, Mark Mobius of Mobius Capital Partners says gold will double over the next decade adding that “people should have at least 10 percent of their portfolio in physical gold.”

Heritage Capital’s Paul Schatz predicts gold will reach $2500 to $3000 in 2020 “because the landscape for gold is so hugely constructive.”

A prescient Ross Koesternick of BlackRock given the events of early 2020 says, “In this environment, any shocks to equities are likely to come from concerns over growth and, or geopolitics. In both scenarios, gold is likely to prove an effective hedge.”

Crescat Capital’s Kevin Smith and Tavi Costa take Koesternich’s views to the next level saying that “precious metals are poised to benefit from what we consider to be the best macro set up we’ve seen in our careers. The stars are all aligning.”

In early December, Bloomberg posted a report on a $1.75 million trade placed in the COMEX gold options market “betting the precious metal could almost triple in more than a year, surpassing the record. Around noon in New York, 5,000 lots for a gold option giving the holder the right to buy the precious metal at $4,000 an ounce in June 2021 changed hands.”

Last, no review of gold’s prospects would be complete without mentioning the views of probably the most widely respected hedge fund manager of them all – Bridgewater Associate’s Ray Dalio. In Paradigm Shifts, an essay released earlier this year, he predicts radical changes in the economy and financial markets. The assets that “will most likely do best,” he says, “will be those that do well when the value of money is being depreciated and domestic and international conflicts are significant, such as gold.”

Analysts and newsletter publishers

Analysts and newsletter publishers – the gold market’s pundits – have some interesting views on where gold might be headed in 2020 and why.

Dennis Gartman, who says he is retiring from the newsletter writing business, does not offer a price prediction for 2020 but he does recommend a 30% portfolio holding in gold as inflation pressures will “finally return.”

Incrementum’s Ronald Stoferlebelieves that in 2020 “gold will get closer to its all-time highs because the gold party has only just begun.”

The World Gold Council’s Juan Carlos Artigas offers an interesting backdrop for gold as we enter 2020. “Gold,” he says, “has historically performed well in the year following Fed policy shifts from tightening to ‘on-hold’ or ‘easing,’” says Artigas – “the environment in which we currently find ourselves. In addition, when real rates have been negative, gold has historically returned twice as much annually as the long-term average, or 15.3%.” [Emphasis added]

U.S. Global Investors’ Frank Holmes says negative interest rates are what’s behind the strong performance for gold in 2019. He also says there is a possibility we will see $1800 to $1900 in 2020.

In light of gold’s year-end, early 2020 advance, Mike Shedlockasks How high in 2020? And answers: “The next technical resistance area is the $1700 to $1800 area so any move above $1566 is likely to be a fast, strong one, perhaps with a retest of the $1566 area from above that.”

Elliot Wave theorist Avi Gilburt says that the dollar has “begun a major decline” and that the precious metals are currently “setting up for a multi-year rally.”

UK- based Dr. Martin Murenbeeld says he is very bullish on gold for 2020 and that it will trade in the $1600s during the course of the year.

Wolfe Research analysts John Roque and Rob Ginsburg are more specific than many on the timing for gold in 2020 saying it will reach $1700 by March.

We end with a quote from super-bull Chris Vermuellen at Technical Traders, Ltd: “Gold broke down from a bull market in 2012/2013 – nearly 7 years ago. Now, Gold has broken resistance near $1375 and is technically in a full-fledged Bull Market. The importance of this is the 7-year cycle and how the rotation in gold, between the high near $1923 and the low near $1045 represent an $878 price range. The upside (expansion) rally in gold may very well move in expanding Fibonacci price structures – just like it did in 2005 through 2012. If this is the case, then we may expect to see an ultimate peak price in gold well above $3500.”

Note: We post this year’s predictions survey with our usual caveat that what you have just read is opinion along with a reminder that USAGOLD advocates owning gold and silver for long-term asset preservation purposes, i.e., as portfolio insurance, rather than for speculative gain.

An important insight for 2020 from Goldman Sachs

Given the rising level of uncertainty on several fronts, we think it worth passing along a recent observation from Goldman Sachs. It serves as both a timely reflection on changing circumstances in the gold market and some subtle guidance on how to go about owning gold and silver for defensive purposes. In short, it might not be enough to simply own gold. It has become increasingly important to own it in the right way.

Featured as a Yahoo Morning Brief under the headline (The world’s super-rich are hoarding gold), the advisory notes that “since the end of 2016 the implied build in non-transparent gold investment has been much larger than the build-in visible gold ETFs. This [data] is consistent with reports that vault demand globally is surging. . . [T]his build can also reflect hedges by global high net worth individuals against tail economic and political risk scenarios in which they do not want to have any financial entity intermediating their gold positions due to the counter-party credit risk involved.” [Emphasis added.]

In other words, smart money is hedging with actual coins and bullion, not the paper gold ETFs. Ownership of a gold ETF is simply a price bet – a speculation on the price of gold. If your interest is ultimate protection against economic and financial market uncertainties, gold coins and bullion are the way to go – assets that are not simultaneously someone else’s liability.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.