British Pound GBP Trend Forecast Review

Currencies / British Pound Jan 13, 2020 - 07:05 AM GMTBy: Nadeem_Walayat

Get Brexit DONE just as Take Back Control before it won the day for the LEAVE camp (Tory party) after they finally managed to pry Remainer Theresa May's fingers from the doors of No 10, planting LEAVER Boris Johnson in her place.

Right from the outset Boris Johnson was perceived by all as being a tough sell to the public and just maybe the Corbyn socialist hard left brigade could pull off another surprise performance just as they had in 2017 that caught everyone by surprise.

And so the consistent Tory 9 point polls lead since the election campaign began was viewed by all with skepticism. Though many perked up and took note of YouGov's 23rd November magic mushrooms opinion poll that supposedly accurately called the 2017 general election result, despite the fact that is not what they were forecasting at the time, as it looks like several years on everyone has forgotten that Yougov actually expected the Tories in 2017 to increase their majority.

So could 2019 be the first election in over 10 years that the pollsters finally got right? 1 in 4 odds are good for finally getting an election right, given that a coin toss gets it right half the time!

However unlike 2017, neither the Tory Party nor Boris Johnson sat on their loral's, desperately trying to avoid a last minute gaff, whilst a remainer establishment media were desperately trying to engineer a gaff, so in comes an ITV news reporter who shoves a smart phone in Boris Johnson's hands featuring a picture of a sick child on the floor of an NHS hospital (apparently placed there by this parents for propaganda purposes). That Boris Johnson in his panic made things 10 times worse by pocketing!

We all wondered was that be the straw that broke the camels back?

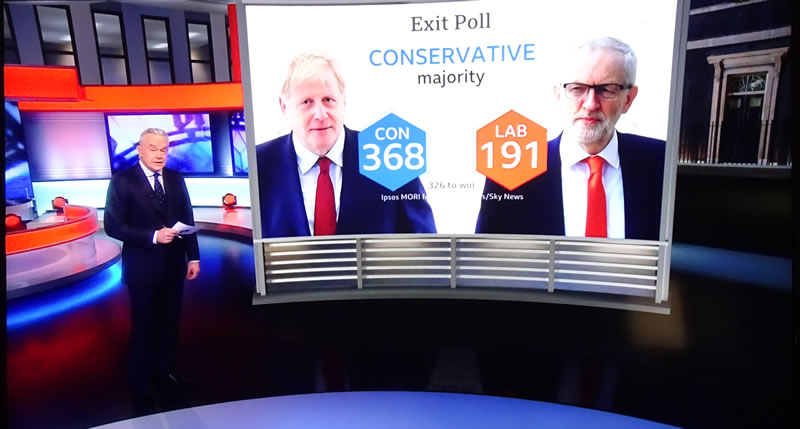

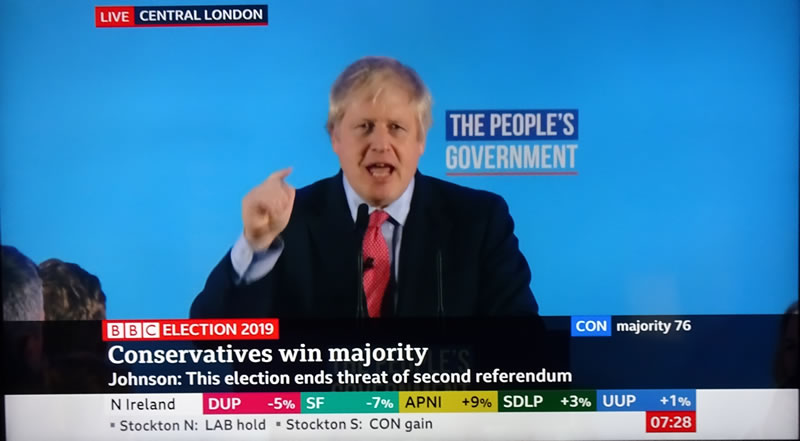

Then came voting day and the 10pm BBC EXIT POLL!

No one saw that coming for even Yougov in all their wisdom had revised their central forecast lower to 339 seats. Whilst I in recognition of the lack of consistency in of accuracy in opinion polls veered off in the other direction, to under forecast a Tory win by a long margin on 326 against 365 actual. Visa versa, this time house prices and the oscillation around them called the election wrong. Though ironically this increases the probability of house prices being right next time and polls wrong! So something to remember for 2024.

So Boris Johnson with his Get Brexit Done message swept the board, turning many Labour RED heartland seats BLUE for the VERY FIRST TIME! Even taking Tony Bliar's old constituency.

Sterling's immediate reaction was to rocket higher through 1.35 resistance on the surprise win. Though it soon dawned on the markets that they don't really want someone as fickle as Boris Johnson to have so much power, who is now likely to be in office for the next 10 years! Especially as history has demonstrated Prime Ministers with large majorities tend to go insane, as had Margaret Thatcher and Tony Blair had before. Still it's early days so we may manage to make it to 2024 before we start to witness the emergence of an more insane version of Boris Johnson.

And so sterling gave up ALL of it's election surge over the next 3 days, parking it where it roughly stands today.

My last GBP in-depth analysis of early September concluded in expectations for a trend to resistance at £/$1.3350 by the time of the Next General Election. Which further suggested that sterling would target £/$ 1.40 following a successful election outcome i.e. on an increase in the Tory majority.

British Pound Trend Forecast vs "Dead in a Ditch" BrExit Civil War General Election Chaos

Therefore my forecast conclusion is for sterling to target a trend to at least £/$ 1.32 by late November 2019.

(Charts courtesy of stockcharts.com)

Here's the updated chart of what subsequently transpired, which in forecasting terms is about as good as it can be expected to get.

British Pound GBP Trend Forecast 2020

The rest of this analysis has first been made available to Patrons who support my work: British Pound GBP Trend Forecast 2020

- Political Implications

- Fundamentals

- US Dollar Index

- GBP Long-term analysis

- GBP Trend Analysis

- Elliott Wave Theory

- GBP 2020 Forecast Conclusion

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Recent analysis includes:

Scheduled Analysis Includes:

- Gold / Silver Updates

- UK Housing market series

- Stock Market Trend Forecast 2020

- Machine Intelligence Investing stocks sub sector analysis

- US Dollar Index

Your Analyst

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.