Gold Report from the Two Besieged Cities

Commodities / Gold & Silver 2020 Jan 24, 2020 - 05:57 PM GMTBy: Arkadiusz_Sieron

Two cities are besieged. One by officials, activists and business leaders, while the second by bloodthirsty politicians. Will anyone escape? No one knows, but the gold coin has always helped bribe the guards to look the other way…

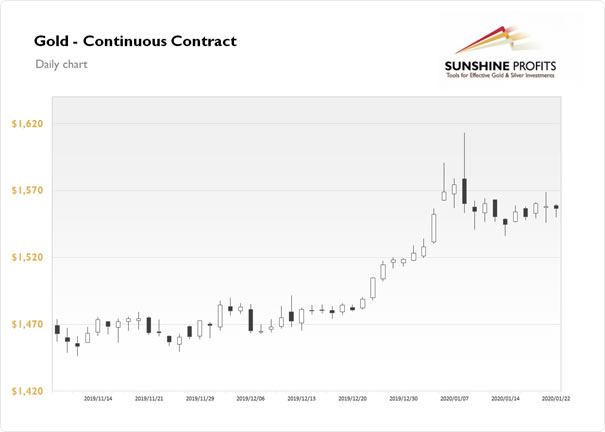

Just take a look at how it held value recently:

Gold Report from Davos

The 2020 World Economic Forum in Davos, Switzerland, has begun. What has happened there so far?

• Treasury Secretary Steven Mnuchin threatened retaliatory tariffs on automobile imports if the issue of digital tax wasn’t resolved. The threat was effective as President Emmanuel Macron agreed to suspend a French tax on American technology giants in exchange for a postponement of threatened retaliatory tariffs on French goods by the Trump administration. Another conflict resolved, while big U.S. companies’ profits saved – it’s bad news for gold.

• President Trump again criticized the Fed for its monetary policy and called for negative interest rates. The White House’s pressure on the U.S. central bank can prompt the Fed to be more dovish than hawkish, which is good for the yellow metal. The negative interest rates, if introduced, should be also be positive for gold, which likes the environment of low real interest rates.

• The IMF lowered its forecast of global economic growth for 2020 from 3.4 percent (which was forecasted in October 2019) to 3.3 percent and lowered its forecast for the following year from 3.6 to 3.4 percent. But these figures are still higher than 2.9 percent of the growth achieved in 2019, when the pace of global GDP growth was the lowest since the last financial crisis. What is important here is that the acceleration in the global growth is expected to be driven by the emerging markets. It means that we could see downward pressure on the U.S. dollar, which should be positive for the price of gold.

• The interesting discrepancy regarding the climate change emerged between the world of business and the world of leaders and the so-called experts. For the latter, climate change is the most eminent long-term risk the world faces. And for the first time, the Global Risks Report published by the World Economic Forum was dominated by the environment. Meanwhile, the survey by PwC showed that “climate change and environmental damage” were not even included by the CEOs in the first ten biggest threats to their companies’ growth prospects. Their number one worry was overregulation, not environment. In short, the markets do not believe in climate catastrophe. Given that the pseudoecologists often exaggerate and the bleak warnings about the future have been historically so wide off the mark (it didn’t start with Al Gore - remember the overpopulation hysteria or the acid rains scare?), it should not be surprising that the markets are skeptical. But if they are wrong – and sometimes the markets are wrong, and economic crises follow – we could see some painful adjustments in the future, which should be positive for the gold as the ultimate safe-haven asset.

Gold Report from Washington, D.C.

Meanwhile in Washington, D.C., the Trump impeachment process has begun. However, it hasn’t brought anything special so far. Lead House impeachment manager Adam Schiff started the proceedings, talking two hours in the Senate. Then, Trump’s defense team and the Democrats debated for more than 12 hours over the rules of the trial. The debate was intense, so Chief Justice John Roberts warned both teams about using rhetoric inappropriate for an impeachment trial. But let’s be honest, the whole trial is a theatre. The Republicans seem to be united and the Senate is not going to convict Trump. According to the PredictIt, the odds for conviction are merely 9 percent. The markets do not forecast that Trump will resign before the end of his first term. So, unless the Republicans lose all their political instincts and convict the president they support, which is very unlikely, the impeachment trial should not materially affect the gold prices.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.