Fed Keeps Federal Funds Rate Unchanged Again

Interest-Rates / US Interest Rates Jan 30, 2020 - 03:17 PM GMTBy: Arkadiusz_Sieron

The FOMC held its first meeting in both the new year and the decade, keeping interest rates unchanged. But why did the yellow metal move up regardless? Let’s examine the implications for the king of metals.

Yesterday, the FOMC published the monetary policy statement from its latest meeting that took place on January 28-29th. In line with expectations, the US central bank kept the federal funds rate unchanged at 1.50 to 1.75 percent:

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee decided to maintain the target range for the federal funds rate at 1 1/2 to 1-3/4 percent. The Committee judges that the current stance of monetary policy is appropriate to support sustained expansion of economic activity, strong labor market conditions, and inflation returning to the Committee's symmetric 2 percent objective.

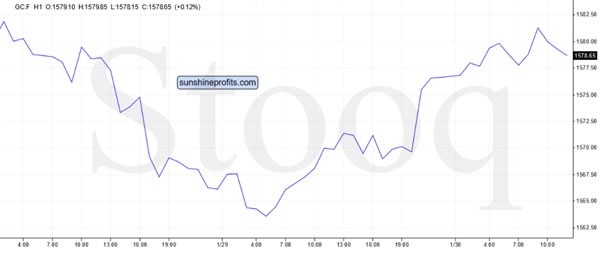

As in December, the decision was unanimous, which shows that there is no appetite for further cuts (or hikes) among the US central bankers, at least not now. However, the price of gold still increased yesterday, as the chart below shows. We will come back to this issue later.

Chart 1: The price of gold (February futures traded in Comex) from January 28 to January 30, 2020.

Although the Fed kept the federal funds rate steady, it hiked the interest rate paid on required and excess reserve balances from 1.55 to 1.60 percent, which was characterized by Powell as a “small technical adjustment” made necessary by all the liquidity flooding into the market.

Statement Is Little Changed…

The newest statement was practically unchanged from the December edition. There were only two modifications. First, the description of household spending was revised from “rising at a strong pace” to “rising at moderate pace”. It’s a dovish change, but it should not materially affect the gold market.

Second, inflation ceased to be “near” Committee’s symmetric 2 percent objective and became “returning” to the target. Although a returning object can also be near the destination point, the Fed’s intent behind the change is clear. The FOMC decided to acknowledge that inflationary pressure is weaker than it thought earlier. Although gold shines brighter in times of high inflation, the altered Fed’s inflationary expectations imply that the Committee is not likely to hike interest rates anytime soon in the future. Unless we see inflation again “near” or “close”, and later “at the target”, we will not see an interest rates hike. Which is good news for the gold bulls.

These Are the Shifts in Composition of the Committee

With the beginning of 2020, the composition of the FOMC also changed, as the regional Reserve Bank presidents serve one-year terms on a rotating basis (with the exception of the New York Fed President who serves permanently). So, we said goodbye to James Bullard, Charles Evans, Esther George and Eric Rosengren, while we welcomed Patrick Harker, Robert Kaplan, Neel Kashkari and Loretta Mester.

What does this replacement means for the gold market? Well, two hawks who opposed all the 2019 cuts – Esther George and Eric Rosengren – are out this year. On the other hand, James Bullard, an ultra dove, who loudly demanded the cuts last year (and voted for a 25-basis points cut in June) will also not vote in 2020. The same applies to Charles Evans, a moderate dove. Instead, Neel Kashkari, another ultra dove, joined the voting group. We will also see this year Robert Kaplan, a centrist, while Patrick Harker and Loretta Mester are definitely hawks.

So, on balance, little will change. Two hawks out, two hawks in. One ultra dove out, one ultra dove in. On the margin, a moderate dove is replaced by a centrist, so the FOMC could become slightly more hawkish, but remember that these terms are not rigid and clearly defined – they are only indicative. So, dear precious metals investors, do not expect any revolution in the FOMC stance.

Implications for Gold

The January FOMC statement is little changed and pretty much as expected. So, it should not materially affect the gold market. However, the statement confirms that the Fed will remain on the sidelines in the first half of the year with rather dovish perspectives later on the way, which should be generally supportive for the gold prices.

Indeed, the US central bank is going to err on the side of the doves rather than the hawks, if pressed. This is why the futures market expects that the Fed will cut interest rates as early as in July. The odds of such a move increased from 26.2 percent on December 30, 2019 to 45 percent one week ago and to 62.8 percent currently. From the fundamental perspective, the more dovish expectations should support gold prices.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.