China Coronavirus Infections Soar by 1/3rd to 60,000, Deaths Jump to 1,367

Politics / Pandemic Feb 13, 2020 - 09:44 AM GMTBy: Nadeem_Walayat

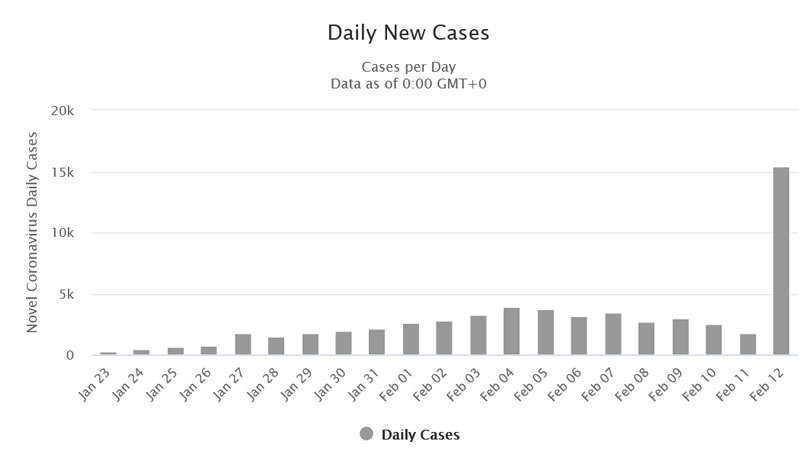

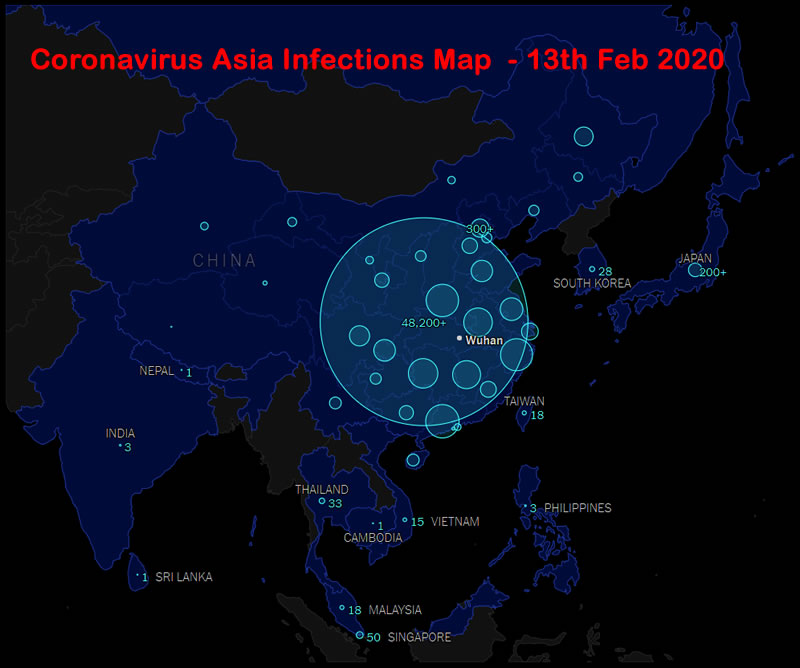

The Chinese communist regime's propaganda of the past week of having brought the Coronavirus outbreak under control by referring to daily falling infection rates from a peak of about 4,500 to 2000 has now been completely blown away following the declaration of a huge 33% jump in the number of infections (15,000) totalling 60,000 today! Also the number of deaths has jumped sharply higher to 1369 from 1115.

This illustrates what I have been stating for several weeks that China's coronavirus statistics just cannot be trusted where the true number of infections and deaths could easily be triple the official data. So today's jump should not be so surprising given that China is hitting capacity constraints in it's ability to diagnose cases and cause of deaths. As the primary objective is to halt the pandemic rather than count numbers. So even those suspected of being infected are being isolated by force or told to go home and self quarantine, far away from the over flowing hospitals and medical centres, thus greatly masking the true number of infections.

Though the same would likely be true for most nations once they start to pass a certain number of infections that swamp the capacity of healthcare the systems. The only difference being that China refused to acknowledge the outbreak for the first month, even going so far as to silence doctors who were warning of the new virus.

China is a totalitarian state where the primary objective of every citizen and lowly officials is follow the rules which means to demonstrate what a good citizen they are by towing the community party line, and to behave in a manner that pleases the communist party. Which in this respect meant not to be the harbinger of bad news. So clearly as I've often voiced in my videos and articles of the past 3 weeks is that officials are reluctant to pass bad news on up the command chain, which is primary factor in today's jump of 1/3rd, as suspected infections were tended to be ignored so as to fulfill the communist parties objectives for public statements that the virus was coming under control.

So expect to see further such revisions over the coming days as the number is likely to jump over 100,000 cases. Especially as I doubt that the temperature sensors are of much use in detecting infections, as a study of cases reveals that the high temperatures only tend to come about a week AFTER infection when the patient is clearly ill. So widespread use of the temperature checks is mostly useless in identifying infected persons.

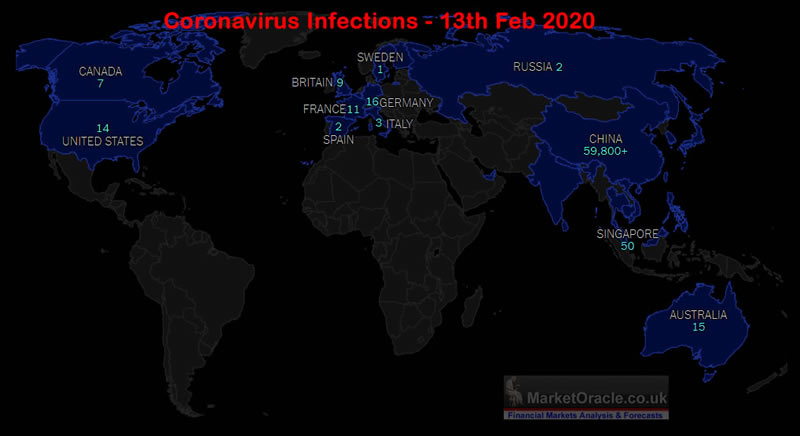

Coronavirus Spread Day 67 - 13th Feb 2020 Update

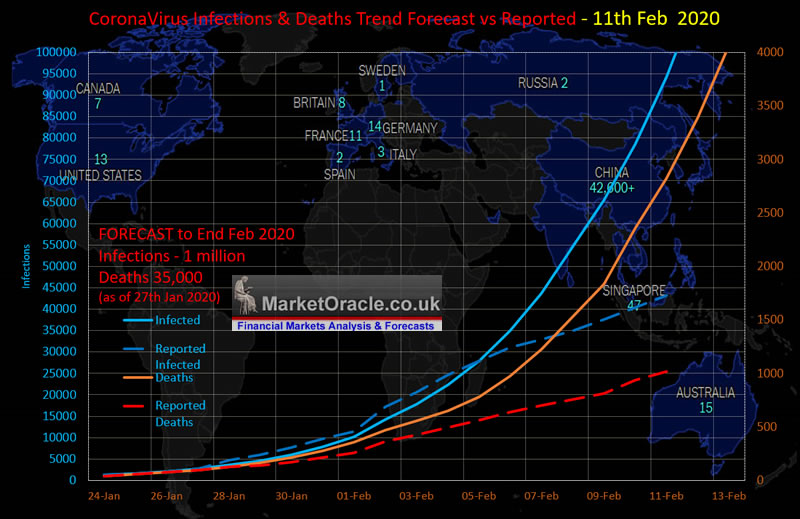

My forecast for the number of infections and deaths by 11th of Feb 2020 vs actual reported:

| Infections | Deaths | |

| Forecast | 129016 | 3612 |

| Actual Reported | 60280 | 1367 |

| % Diff | 47% | 38% |

Were this trend to continue into the end of February 2020 then the number of infected would total 467,000, whilst the number of deaths would total 10,595. So the latest data implies a lower spread but still a relatively high mortality rate of about 2.3%.

In reality the actual number of infections and deaths is likely closer to the forecast than what China's healthcare system hitting capacity constraints implies, as for some weeks all those even suspected of being infected are not being met by medical staff but by a barely protected army of police as the opening minutes of my most recent video illustrates.

The fact that China is grossly under reporting the actual number of cases translates into:

a. The number of infections outside of China will continue to rapidly increase as contact with infected Chinese people acts as sparks for epidemics elsewhere.

b. That the outbreak in China will FAIL to subside, which is what it should do if Chinese statistics were accurate i.e. the pandemic would basically come to an end within a couple of weeks. But instead I expect the number of infections to continue at a high rate for several more months.

So I still expect the actual pool of infected to pass 1 million by the end of February and thus the risks of a global pandemic remain highly probable.

And that there are large susceptible populations with poor healthcare infrastructure such as India that announced it's first infection a week ago where outbreaks could quickly overwhelm heathcare systems. Also that a vaccine is still a good 4 months away so far too late to have any impact on this pandemic.

The bottom line is no one should be fooled by coronavirus statistics out of China, the pandemic is NOT under control and the number of infected has likely already passed 200,000. With like wise the number of deaths exceeding 2,000 or about twice the official number, the evidence of which is being literally cremated.

Therefore given the actual continuing rate of spread of the virus in China then the forecast trend trajectories for the rest of the world is currently one of being in the calm before the storm stage with likely several outbreaks that risk over whelming healthcare systems around the world as has happened in China.

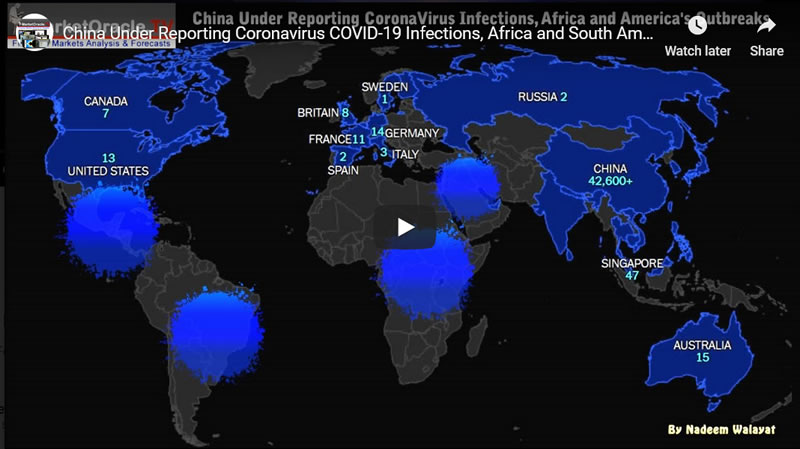

What's more worrying is that when one looks at the world map, apparently there are no cases of the virus in Africa or South and Central America? That is very hard to believe, instead suggests that there are hidden out breaks underway in those regions that will only make the light of day when the body bags start piling up.

Until then don't be fooled into a false sense of security, the pandemic IS coming to your nation, where my next analysis will be a forecast for the expected trend trajectory for the UK into the end of March 2020.

So take this calm before the storm stage to take measures to protect yourselves by both limiting exposure to risk of viral particles and in boosting ones immune systems so as to better cope with an infection, achieved by for instance consuming say 2 or 3 oranges a day for vitamin C, as one example of boosting ones immune system, another example is to ensure you get ample sleep. I will cover how to protect from the coronavirus in more detail in a future article.

Will CoronaVirus Pandemic Trigger a Stocks Bear Market 2020?

My latest in-depth analysis that concludes in a detailed trend forecast for the Dow stocks index has first been made available to Patrons who support my work (Will CoronaVirus Pandemic Trigger a Stocks Bear Market 2020?).

- Stock Market Deviation from Overall Outlook for 2020

- QE4EVER

- As Goes January So Goes the Year

- Short-term Trend Analysis

- Long-term Trend Analysis

- ELLIOTT WAVES

- Formulating a Stock Market Trend Forecast

- Dow Stock Market Forecast Conclusion

- TRADING THE DOW

- Will Trump Win US Presidential Election 2020?

Recent analysis includes :

- Will CoronaVirus Pandemic Trigger a Stocks Bear Market 2020?

- Silver Price Trend Forecast 2020

- Gold Price Trend Forecast 2020

- British Pound GBP Trend Forecast 2020

- AI Stocks 2019 Review and Buying Levels Q1 2020

- Stock Market Trend Forecast Outlook for 2020

Scheduled Analysis Includes:

- UK Housing market series

- Machine Intelligence Investing stocks sub sector analysis

- Bitcoin trend forecast

- Euro Dollar Futures

- EUR/RUB

- US House Prices trend forecast update

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.