Ignore the Polls, the Markets Have Already Told You Who Wins in 2020

ElectionOracle / US Presidential Election 2020 Feb 16, 2020 - 06:21 PM GMTBy: Graham_Summers

Ignore the naysayers, the Trump administration has successful engineered an economic boom.

I was recently on Cheddar discussing the markets when the anchor raised the fact that the Trump administration failed to achieve its economic goals.

This is false.

First and foremost, the economic data put out in the U.S. has become EXTREMELY politically biased.

The reason for this is simple, many of the people who compile this information are Democrats who hate the President (the bulk of Government employees live and work in Northern Virginia/ D.C. which went 92% for Hillary Clinton in 2016).

Throughout the Obama years, time and again economic data was massaged to make the so-called “recovery” look better than it was.

The reality is that most of the 2008-2016 period would have qualified as a recession based on objective analysis. Case in point, over 90% of all jobs created by the Obama administration were part-time jobs.

n contrast, we are now seeing the exact opposite occurring with Trump administration: the economic data is being massaged and gimmicked to make the economy look worse.

Real GDP growth is above 3%, and real income growth/ job growth/ etc. are all booming.

If you do not believe me, take a look at the stock market, which is the single greatest discounting mechanism on the planet.

People have political agendas/ biases. The stock market simply discounts reality.

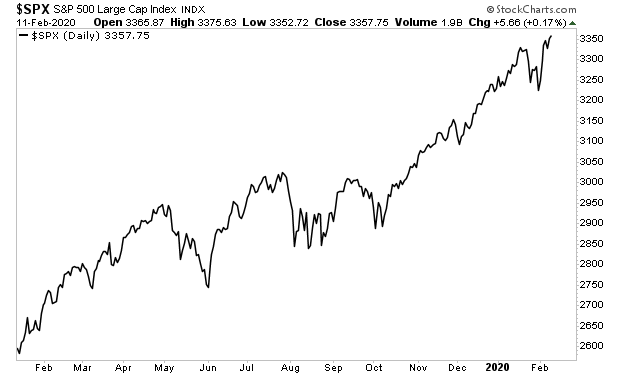

With that in mind, what does the below chart tell you about the state of the U.S. economy? More importantly, what is the stock market is telling us about what’s coming down the pike for the U.S.?

I believe the market is “showing” us that President Trump is going to win the 2020 election in a landslide.

The Trump administration has successfully “branded” the stock market. As such, stocks are closely aligned with the President’s odds of re-election in 2020.

Which is why, this recent breakout to new highs is telling us Trump wins 2020 in a landslide… and that this time there will be few obstacles to his economic agenda.

I want to be clear here…

I DO NOT care about politics. You can hate President Trump or you can love him. That’s 100% up to you.

But the reality is that under the Trump administration the stock market is giving us a once in a lifetime opportunity to GET RICH from our investments.

My clients are already doing this with our new special report titled…

The MAGA Portfolio: Five Investments That Will Make Fortunes During Trump’s Second Term.

In it, I detail five HIGH OCTANE investments that are primed to EXPLODE higher when President Trump wins a second term.

In it, I detail five unique investments that I expect will produce the most extraordinary gains during President Trump’s second term.

Each one of these investments is in a unique position to profit from the combination of Trump economic reforms and Fed monetary easing, combining high growth opportunities with extreme profitability.

We are offering this report exclusively to subscribers of our e-letter Gains Pains & Capital. To pick up your copy please swing by:

https://phoenixcapitalmarketing.com/MAGA.html

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2019 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.