Coronavirus Infections Outside China Going Parabolic - Trend Forecast 13th March 2020

Politics / Pandemic Mar 13, 2020 - 09:10 AM GMTBy: Nadeem_Walayat

"The Coronavirus is a like a bomb that just keeps exploding" says an Italian Doctor who warns if you don't get a grip early you soon lose control.

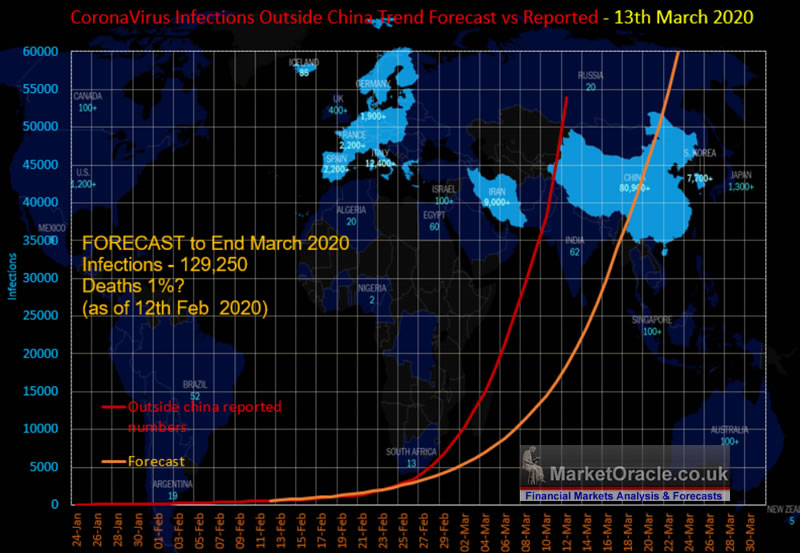

The latest official infections data, which despite a proper record of Africa and the South Central America's numbers has the number of infected literally going parabolic, soaring by 8,400 to 54,00 to well abo ve my trend forecast that projects to an official tally of 129,250 infections outside China by 31st March 2020.

| Infections | |

| Forecast for 12th March | 18474 |

| Actual - 12th March | 53903 |

| % Diff | 291% |

Were this trend to continue into the end of March 2020 then the number of infected outside of China would total 375,000. An explosive rate of growth in numbers that at present is showing little signs of diminishing so does not bode well for what is to come for April 2020. Whilst the number of deaths could be estimated to be at least 2,400 based on a case fatality rate of 0.64% were the infections trend to persist into the end of March and probably closer to 11,000!.

The UK and US continue to scramble to REACT to the unfolding Coronavirus pandemic as governments and health officials have effectively been sat on their asses for the WHOLE of February, DONE NOTHING! LEARNED NOTHING from China, LEARNED NOTHING from South Korea that I held up as a model for what the West should follow so as to prevent a catastrophic case fatality rate of as high as 3.5%! Whilst following South Korea's example offered a case fatality rate of about 0.64%, far less than China's as I covered in the following key articles and subsquent videos:

- How Deadly is the Coronavirus - Case Fatality Rate (CFR) Analysis

- South Korea Coronavirus Warning - Stocks Bear Market Begins, When Will it End?

- Coronavirus Global Calm Before the Viral Storm - China Infection Statistics Probability Analysis

- UK Coronavirus COVID-19 Pandemic Trend Forecast to End March 2020

- Will CoronaVirus Pandemic Trigger a Stocks Bear Market 2020?

This analysis updates the current state of the unfolding pandemic in the UK, US and world outside of China, comparing the actual trend trajectory against my forecasts in advance of my Coronavirus trend forecasts for April 2020 to give advance warning of what to expect in terms of market trends.

Whilst market implications of the unfolding Coronavirus pandemic including trend forecasts were first made available to Patrons who support my works. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat

A month ago I imagined that the likes of America's CDC and Britain's NHS would be better able to respond to the Coronavirus than China's police state, especially given that we had a good 6 weeks head start! Unfortunately with each passing week all I have seen is INACTION!

For instance in the UK the Cheltenham Horse Racing Festival that will likely be attended by 250,000 people has not been cancelled! This just shows how negligent the response of our governments has been! So despite Wednesdays UK Budget announcement of pumping an extra £30 billion into the economy to help mitigate the Coronavirus economic shock, coupled with Bank of England slashing interest rates from 0.75% to 0.25%, plus £250 billion being made available to the banking crime syndicate so as to prevent a financial crisis. All of this amounts to just half measures if events such as the Cheltenham festival continue to take place! That WILL be a BREEDING ground for the virus! hundreds, maybe thousands will become infected at this one festival who will go on and infect many thousands more, which suggests to expect explosive growth in the number of UK infected a week or so from now when people start showing symptoms.

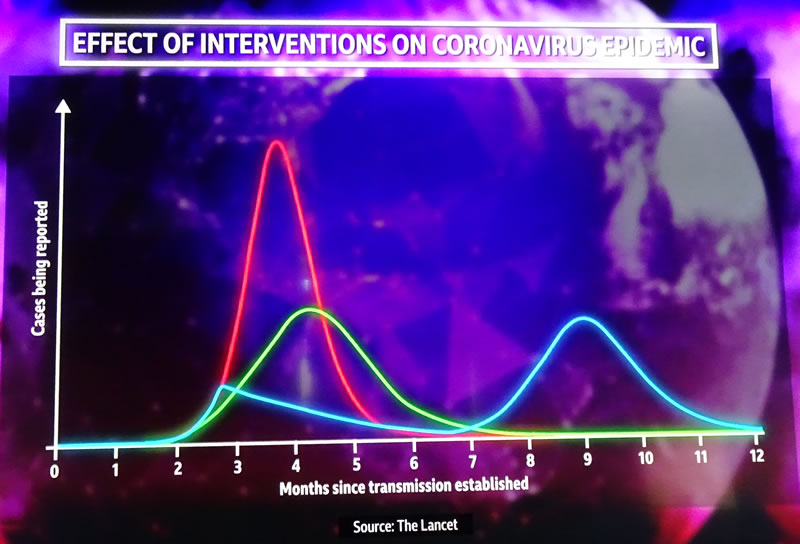

The infections trend curves for the West were expected to be shallower and longer (green line) thus allowing for healthcare systems to be better able to cope with the seriously ill.

Unfortunately, as we are likely to find out that NO Coronavirus lessons have been learned, it's as though those in charge were completely oblivious to the Pandemic until this week. Thus the US and UK to a lesser extent look set to experience the red trend line, whilst all those singing China's praises at the moment fail to realise that China's pandemic will resume when they start to lift restrictions though with a less sharp peak (blue line). Which is why to expect a global recession for 2020, because the worst of the Coronavirus pain is yet to come i.e. we in the West are at the 2 month mark and following the red line trend trajectory so you can imagine how bad things are going to quickly get.

Whilst the the fools at the WHO have now finally declared what has been blindingly obvious for some time that a global pandemic is underway!

The bottom line is that the actions being announced this week in the UK and US are too late to prevent a much worse pandemic than what should otherwise have been the case. So it is time to batten down the hatches and protect ourselves in which respect VITAMIN D can help lessen reparatory tract infections as I covered one of my recent videos.

So perhaps the number 1 thing you could do right now to prepare yourselves to the coming Coronavirus storm is to bolster your immune systems by getting yourselves some Vitamin D3 from 25mcg (1000iu) strength upto 100mcg (4000iu). Also make sure you are buying D3 and not the less effective D2. Do that before entertaining other supplements and devices such as virus and bacteria killing UV-C lamps.

CoronaVirus Stocks Bear Market Trend Forecast Implications

This rest of this analysis has first been made available to Patrons who support my work. UK and US Entering Coronavirus Pandemic Storm Stage Triggering Market Panic Drops

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Recent updates include:

- How Deadly is the Coronavirus - Case Fatality Rate (CFR) Analysis

- Coronavirus Parabolic Pandemic, Bitcoin Price Trend Forecast

- The Coronavirus Stocks Bear Market Begins, When Will it End?

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.