UK Coronavirus WARNING - Infections Trend Trajectory Worse than Italy

Politics / Pandemic Mar 24, 2020 - 11:23 AM GMTBy: Nadeem_Walayat

My existing forecasts were concluded at a time when there were literally a handful of cases in the UK and US which gave valuable insight into the relative strength or weaknesses of the US and UK actions towards containing Coronavirus outbreaks, my assumptions at the time were that the UK and US would learn lessons from China and South Korea's and so should ne primed for better outcomes.

However, as you are likely aware by now that both nations have been found greatly lacking as became apparent with each passing day that the governments were basically sleep walking towards a Coronavirus apocalypse of sorts that manifested itself in an ever more severe stocks bear market that materialised long before the number of infections started to run into the thousands as forewarned by the Coronavirus deviation against the trend forecasts.

UK Coronavirus WARNING - Infections Trend Trajectory Worse than Italy

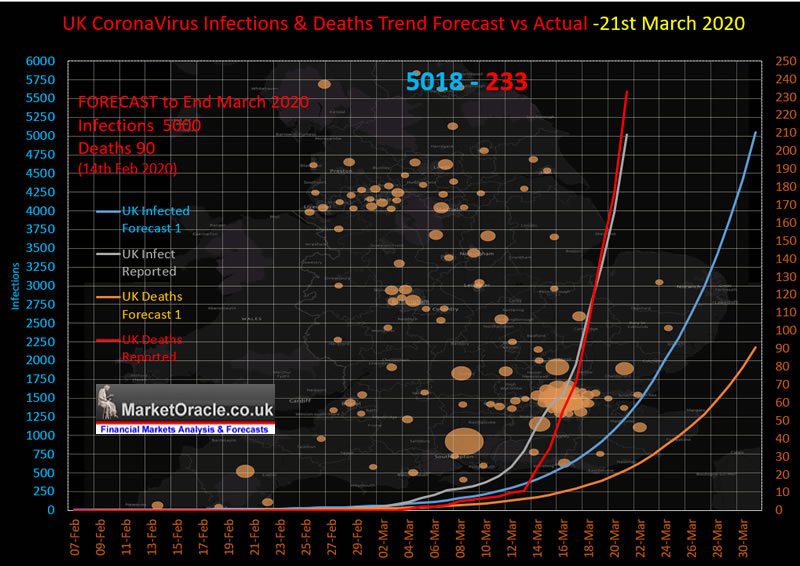

The total number of infections continues to exceed my trend forecast on a parabolic curve, exceeding my forecast by 350%. My original forecast as of 14th Feb 2020 was for the number of infections to target a parabolic trend from 9 at the time to 5000 by the end of March 2020. The actual trend trajectory now suggests that the UK is heading for more than 18,000 officially recorded infected numbers by the end of March.

Whilst the number of deaths at 233 exceeds my forecast by 1000%, which puts Britain on a worse trend trajectory than where Italy was at this stage barely 2 weeks ago! So does not bode well for what is about to transpire that I am sure will spark even more panic amongst the general population than the panic buying we have witnessed this past week as panic buyers have stripped supermarket shelves bare.

The current deaths tally now implies that the UK could be heading for over 1000 deaths by the end of March 2020!

So it looks like "Herd Immunity" is no longer on the menu, though following that plan up until the end of last week means that the damage has already been done. Where I now would not be surprised if Britain's death toll over the next 3 months exceeds 50,000! Never mind the chaos of having upwards of 1 million ill people ill all trying to get access to the NHS which would be in a state of collapse.

ALL of which was avoidable as South Korea illustrates, not only that but Britain had advance warning from China, South Korea and then Italy of what was coming so had plenty of time to prepare for, instead Boris Johnson's government listened to mad scientists with their herd immunity doctrine.

Thus the UK Government has been giving advice to the elderly and weak to self quarantine themselves for the next 3 months, as I suspect the "herd Immunity" protocol has not really gone away, instead just watered down a little so as to make the death toll lower and more palatable to the general population than anything in the region of 400,000 to 1.4 million that the UK was heading towards.

The rest of this extensive analysis that concludes in detailed Coronavirus trend forecasts for the UK and US, folowed by stock market implications of has first been made available to Patrons who support my work - US and UK Coronavirus Pandemic Projections and Trend Forecasts to End April 2020

- Dark Pools of Capital Profiting from the Coronavirus CRASH

- UK Coronavirus Infections Trend Trajectory Worse than Italy

- US Coronavirus Infections and Deaths Going Ballistic

- Herd Immunity and Flattening the Curve

- Italy CFR and Infections Trend Analysis

- US and UK CFR

- UK Coronavirus Trend forecast

- United States Coronavirus Trend forecast

- Vaccines and Treatments

- CoronaVirus Forecast Stock Market Trend Implications

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.