An Eye-Opening Perspective: Emerging Markets and Epidemics

Stock-Markets / Emerging Markets May 21, 2020 - 10:44 AM GMTBy: EWI

People across the entire planet remain very much aware of the COVID-19 health threat.

The global disruption associated with the pandemic far surpasses other major health scares in modern history.

Even so, you may recall 2009 news articles similar to this one from the New York Times (June 11, 2009):

It came as no surprise [on June 11, 2009] when the World Health Organization declares that the swine flu outbreak had become a pandemic.

The disease has reached 74 countries ... .

And, going further back in time, the World Health Organization provided this July 5, 2003 update on the Severe Acute Respiratory Syndrome, known as SARS:

To date, 8439 people have been affected, and 812 have died from SARS.

The reason for briefly reviewing the swine flu and SARS is to point out that, as surprising as it may be, both outbreaks marked not the start, but the end of a downtrend in emerging markets stocks.

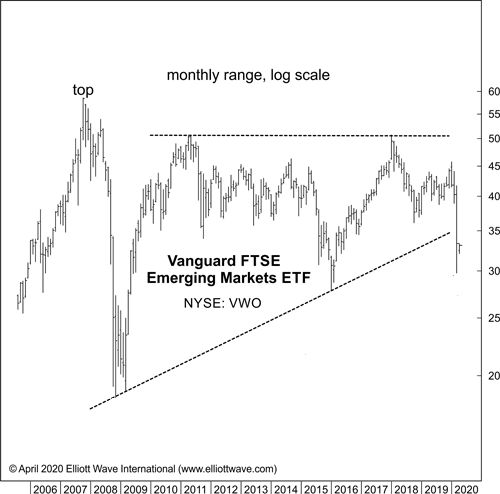

That's a big reason why, amid the COVID-19 scare, Elliott Wave International's April 2020 Global Market Perspective, a monthly publication which covers 40+ worldwide financial markets, showed this chart and said:

The dramatic drop has created an enormous [bullish] opportunity in the form of a completed contracting triangle pattern in emerging markets overall, as shown by the Vanguard FTSE Emerging Markets ETF, which is the largest emerging markets ETF by market capitalization.

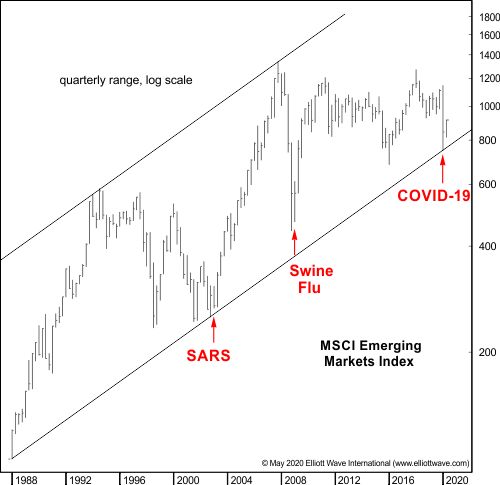

The current, May Global Market Perspective follows up with this chart of the MSCI Emerging Markets Index. The last quarterly bar shows the substantial jump in prices since the March lows. Our global analyst remarked:

That this [price rise] has begun amid the COVID-19 pandemic only adds to the evidence supporting it: Asian-Pacific and emerging markets also began bull markets amid the SARS epidemic of 2003 and the Swine Flu pandemic of 2009, as the chart shows.

Of course, COVID-19 and past outbreaks didn't "cause" stock prices to climb. The point -- as our Global Market Perspective has said -- is that epidemics tend to occur at the end of major sell-offs.

"Tend to" is the key phrase here, of course. There are no guarantees in financial markets. Besides, this outbreak is a full-blown pandemic with social and economic consequences that have already far surpassed anything we saw in 2003 or 2009.

Having said that, emerging markets did rebound, which is something Global Market Perspective subscribers were prepared for, and it's worth noting. What happens next depends on the Elliott wave patterns in market psychology, which our global analysts are tracking in emerging markets (and developed ones) right now.

You can get free access to analysis from our global market experts in "5 Global Insights You Need to Watch," which is a short, 5-video series (plus, two quick reads).

You get our latest forecasts for cryptocurrencies, crude oil, interest rates, deflation and the future of the European Union -- all in just 13 minutes.

The 5 videos and 2 excerpts are straight from the Global Market Perspective -- so yes, this is premium, subscriber-level.

All that's required to access "5 Global Insights You Need to Watch" is a free, Club EWI membership.

This article was syndicated by Elliott Wave International and was originally published under the headline . EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.