Small Business Owners Are Wasting Billions of Dollars in Interest -- Fintech Can Help

Companies / Debt & Loans Aug 20, 2020 - 03:36 PM GMTBy: Submissions

Andrew Latham writes: It is a challenge for small businesses and entrepreneurs to find lenders willing to provide credit to startups and new companies. Most lenders won’t even consider an application from a business without assets or an established credit history. That is why 10% of small businesses rely on personal loans, according to the latest Federal Reserve’s Latest Small Business Credit Survey. The percentage is much higher for startups.

Using a personal loan to finance your business ideas can be an excellent option. However, many entrepreneurs are overpaying on interest because they think all lenders offer similar rates to borrowers with the same credit score and income. This can be an expensive mistake. Whether you are shopping for a mortgage, an auto loan, or a personal loan, it pays to shop around. Here’s a quick primer on the price dispersion of personal loans and how it is hurting consumers and small business owners.

The price dispersion of personal loans

In 2019, Americans held a balance of $148 billion in personal loans. Even a modest variation in interest rates could have a significant impact on the debt of American consumers. To illustrate, let's assume that $148 billion balance has an average term of 36 months and a 13.5 percent APR. Dropping the average APR by only 3.5 percentage points to 10 percent would save Americans $3 billion a year.

A recent study by SuperMoney, a financial services site, analyzed nearly 160,000 loan offers to over 15,000 borrowers who recently applied for a loan. It found that the average difference between the highest and lowest APR offer (for the same borrower and loan term) was 7.1 percentage points.

The potential savings on even modest loan amounts are huge when the range of rates is so broad. Consider one borrower in the study’s dataset that had a credit score of 720 and applied for a $30,000 loan with a 36-month term. The lowest APR offered was 5.99 percent APR and the highest was 15.87 percent. This price dispersion on a $30,000 loan translates into savings of up to $5,050 — or 17 percent of the loan balance.

It is worth emphasizing again that this price dispersion is for loan offers to the same consumer.

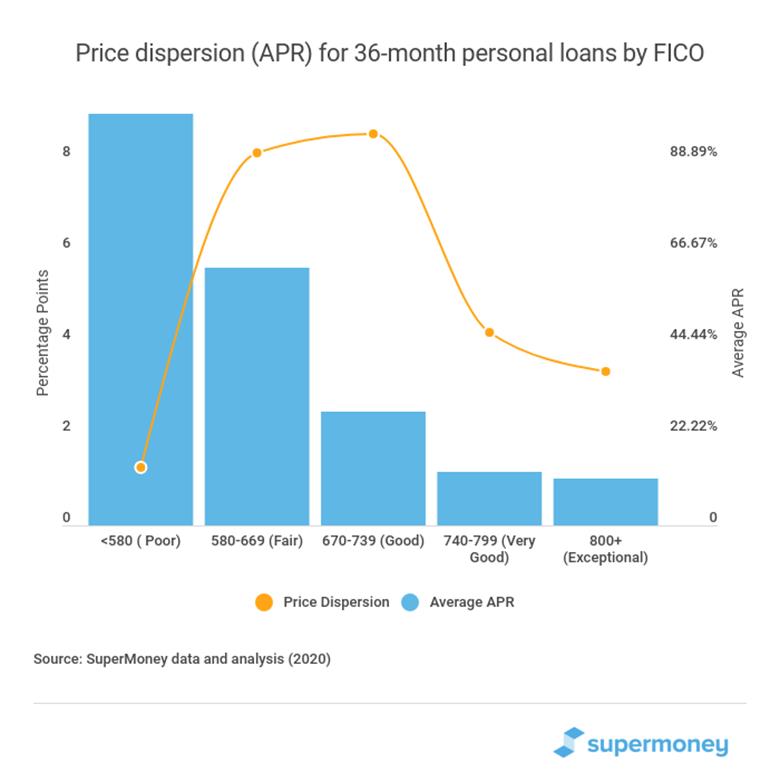

Comparing multiple lenders when shopping for a personal loan is a smart idea no matter what your credit score is. However, the study showed that borrowers with fair (580–669) and good credit (670–739) had the most to gain from comparing multiple lenders. Both credit score brackets had a price dispersion of 8 percentage points.

That does not mean that comparing lenders is not important when you have excellent credit. According to the same SuperMoney study, failing to compare multiple lenders could save borrowers with very good credit more money than increasing their credit score by 100 points.

The problem

Every year, Americans waste billions of dollars on inflated interest rates. Many borrowers only check one or maybe two lenders.

There are several reasons for this. For starters, applying for multiple loan quotes is tedious and time-consuming. Borrowers often think it is a waste of time to compare prices because they assume all lenders have similar rates for people with their credit score.

Some also worry that applying for multiple loans will hurt their credit score. They are not wrong. Every time you get a hard pull on your credit report, your credit score will probably drop by a few points.

The solution

The good news is that many lenders allow you to prequalify and check your rates with a soft credit pull, which will not affect your credit score. There are also fintech companies that are reducing search frictions and price dispersion by making it easier to compare mortgages, auto loans, and unsecured personal loans.

Next time you need a personal loan to finance a business venture do yourself a favor and invest just a few minutes of your time comparing prices. There is no upside to paying more than you have to for a loan. Just spending a few minutes comparing the loans you qualify for could save you thousands of dollars over the life of the loan.

Andrew Latham is the managing editor for SuperMoney and a certified personal finance counselor. He loves to geek out on financial data and translate it into actionable insights everyone can understand. His work is often cited by major publications and institutions, such as Forbes, U.S. News, Fox Business, SFGate, Realtor, Deloitte, and Business Insider.

© 2020 Copyright Andrew Latham - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.