Fed Rules Out Yield Curve Control (for now)

Interest-Rates / Inverted Yield Curve Aug 26, 2020 - 03:54 PM GMTBy: Gary_Tanashian

That we are even having this conversation is proof that we are and have been in…Wonderland for years now.

Since at least 2001, actually. Back then Alan the Wizard Greenspan (mixing classic fairy stories, I know) began pulling levers that could never be un-pulled. There were no breadcrumbs with which to find our way back. Off the charts is off the charts. Exponential is exponential. And that’s when funny munny out of thin air entered the realm of normalcy; new normalcy where the financial system is concerned.

I assume that the ‘tool’ known as yield curve control (per this article) is part of MMT (Modern Monetary Theory) TMM (Total Market Manipulation) that the eggheads promote with not an ounce of historical monetary grounding, caution or even human-like soul. They are monetary Humanoids, AKA bureaucrats, AKA economic Ph.Ds with more statistical and theoretical knowledge than common sense. They released the FOMC minutes and policy micro-managers offer their interpretations.

“The lack of a more forward-leaning stance on the review conclusions —along with a sober view on the second half outlook and a firm rejection of yield curve control in current circumstances — is likely responsible for the immediate risk-off / financial conditions tighter response in financial markets,” said Krishna Guha, vice chairman of Evercore ISI. Guha said he was “relaxed and confident” the central bank will embrace a soft average inflation principle at its September meeting.

I know that they’ve employed all sorts of innovative tactics to manipulate the financial system to their will. But still, something about yield curve control is particularly onerous.

“There is nothing wrong with your television set [rational mind]. Do not attempt to adjust the picture [your point of view]. We are controlling transmission [the financial markets]. If we wish to make it louder [more expensive], we will bring up the [funny munny] volume. If we wish to make it softer [cheaper], we will tune it to a whisper [pretend to be hawkish]. We will control the horizontal [rates of interest]. We will control the vertical [price signals]. We can roll the image [roil the markets], make it flutter [you shudder]. We can change the focus to a soft blur [away from that man behind the curtain], or sharpen it to crystal clarity [command your rapt attention to our manipulative goals]. For the next hour [undetermined time period until the macro souffle wheezes, drops and flattens], sit quietly and we will control all that you see and hear. We repeat: There is nothing wrong with your television set [rational mind]. You are about to participate [have been participating] in a great adventure. You are about to experience [have been experiencing for nearly 2 decades now] the awe and mystery which reaches from the inner mind [dark corners of a long-since failed experiment that does not yet know it has failed] to… The Outer Limits.”

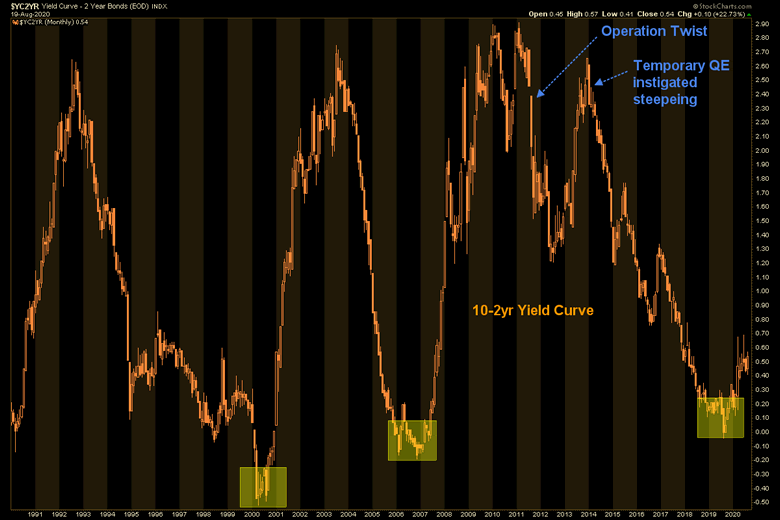

Here’s a chart I made months ago. I have not touched it today. It’s as it was marked up then, complete with the August 2019 projected flattening low. Since then… the steepening has been in play.

That goddamn Operation Twist – the ultimate macro manipulation* – was the crowning achievement of central bankers and their willful control of the financial markets. Again, I tell you that I am not a lunatic blogger with a financial market service that has a funny name (well, maybe); but instead I am someone who remembers clearly the Bernanke Fed’s stated objective with Op/Twist… to “SANITIZE” inflation. Their word, not mine.

That was a master stroke of yield curve control and the resulting – and cooked up – monetary policy instigated boom lasted 8 years. I am not sure what kind of control they’d cook up today. Would they want to keep it steepening in an inflationary signal (a steepening curve can signal either rising inflation or deflation) or tamp down the fledgling steepener?

I’d guess they are fine with steepening for now because in its early stages a steepener may not be lethal (and could be helpful to the Banks and Financial sector, among other reflation targets). People improperly get wigged out by inversion after all, and the tick to inversion was only a year ago. It is the steepener that will eventually become the problem through out of control inflation or destructive deflation. But for now they appear content (if it ain’t broke, don’t fix it).

Trump claims credit for his post-2016 portion of the economy but putting his massive and narcissistic ego aside for a moment, it was all Bernanke and it was created by the yield curve flattening. It is no coincidence whatsoever that the Trump economy has begun (actually had begun prior to COVID-19) to stall with the new steepener. The boom was created in large part by policy, irrespective of Obama this or Trump that.

* With respect to Operation Twist, the Fed stated that it would “sanitize” macro inflation signals by simply buying long-term Treasury bonds and selling short-term Treasury bonds, effectively forcing the yield curve into submission (flattening).

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2020 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.