What The 1987 Crash Reveals About Silver Today

Commodities / Gold & Silver 2020 Aug 27, 2020 - 10:57 AM GMTBy: Hubert_Moolman

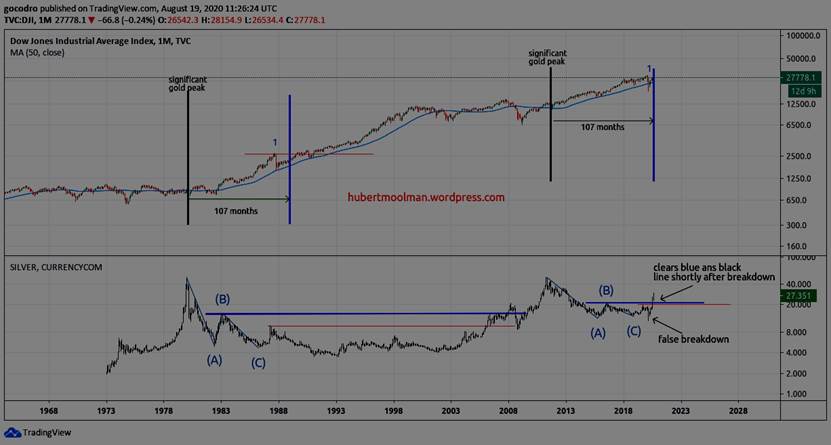

The 1987 stock market crash occurred after a period with a similar build up to the 2020 crash. After being stuck in a range for a number of years in the 1970s and the 2000s, the Dow managed to break higher after a significant gold peak in 1980 as well as 2011 respectively. See the chart below:

In both cases, prices more than doubled over a period of at least 90 months from the level it was at the gold peak. Point 1 on the chart (for 1987 and 2020) marks the top of the rallies.

When the Dow reached the top (point 1) in August 1987, silver was already in decline. It was in it’s third wave down since its peak in 1980. That third wave down started at the peak after point C (from where it touched the red line).

In a similar manner, silver was already in decline when the Dow reached its peak in February 2020. Silver’s third wave down started at the peak after point C (from where it touched the red line).

It took silver almost a decade to surpass the high at the red line, after touching it in 1987. However, in the current pattern, it has already cleared the high at the red line (only months after touching it). This is a massive divergence.

It is a signal that silver will likely continue much higher in a multi-year bull market as suppose to a multi-year bear market (which was the case in the 80s and 90s). This is especially true since it has also cleared the high at the blue line as well.

Together with the recent new all-time high for gold, it is also a signal that you will have to wait long for a new bull market for the Dow. This is how gold and silver make up for the under performance, relative to the Dow, that is created as a result of central bank credit extension (as previously discussed).

After all, not all assets are equally affected during massive credit extension, in a debt-based monetary system. While the stock market had its time to shine over the last decade, it is now time for silver to outperform.

The roles are now reversed. It is now silver that is in a similar space to where the Dow was in 1987. The Dow went from around 2700 at the peak in 1987 (point 1) to a top of more than 29000 in 2020. Silver will do even better.

Here is one way of looking at it (note that the breakout is already successful):

For more on this, and similar analysis you are welcome to subscribe to my premium service. I have also recently completed a Silver Fractal Analysis Report as well as a Gold Fractal Analysis Report.

Warm regards,

Hubert

“And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved”

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2020 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.