Gold Miners Ready to Fall Further

Commodities / Gold and Silver Stocks 2020 Oct 10, 2020 - 05:17 PM GMTBy: P_Radomski_CFA

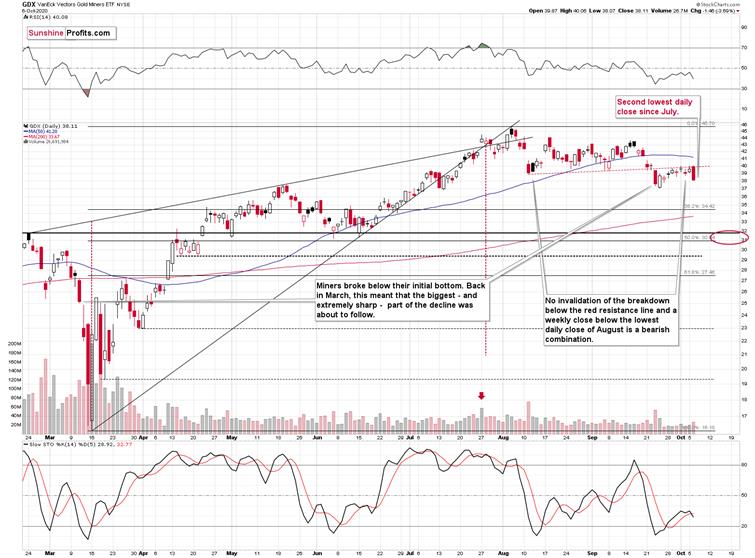

It didn’t take long for the mining stocks to turn south once again. No wonder, given that their breakdown was more than verified.

Additionally, they also got bearish support from gold, the stock market, and the USD Index, which also confirmed their decisive move. For more details, let’s take a closer look at the chart below.

We've witnessed the USD's breakout and breakdowns in the precious metals market, followed by smaller corrections. That’s both: normal and natural.

If the USD Index tendency was really descending, and it was upward in case of PMs:

- The USD Index would have declined to new lows, or at least it would’ve moved below its 50-day moving average.

- Gold would have rallied back above the $2,000 level, or at least it would’ve moved visibly above its August lows in terms of the closing prices.

- Silver would have invalidated its breakdown below the rising support line, instead of verifying it as resistance.

- Gold miners (represented by the HUI Index in the middle of the above chart) would have shown strength relative to gold. For instance, they would not have declined yesterday more than gold or GLD ETF did.

Today, it’s evident that nothing from the above happened. And why is that? Because the medium-term trend changed in August and what we see now is just the early part of the decline. It seems that the noticeable pause after this decline is close to being over. But why? We’ll get to that shortly. In the meantime, let’s take a look at the general stock market performance.

The S&P 500 Index chart is second from the bottom and based on yesterday’s profound reversal. Stocks failed to rally back above the early-2020 highs. This is important evidence in determining the precious metals sector’s performance, particularly in the case of mining stocks and silver.

The correlational values in the rows that show the links between various parts of the precious metals market and the S&P 500 Index indicate that these links are indeed positive. However, it is only in the mining stocks that this link remains strongly positive in every examined period (ranging from 10 to 1500 trading days). As far as medium-term moves are concerned, the S&P 500 and silver connection is stronger than the one between S&P 500 and gold.

Stocks failed to rally back above the early-2020 high, and therefore, in my view, they are quite likely to move lower, which would be in tune with the worsening pandemic situation.

Thus, the implication for the next several weeks remains quite bearish. Let’s get back to the previous question – why do we think that the current pause within the decline is over.

In short, it’s because that’s what the triangle-vertex-based-reversal technique is currently suggesting, and it was able to pinpoint the last three short-term reversals very well. In short, whenever support and resistance lines cross, there’s likely to be some type of reversal. But does it work? Of course, not all the time, but in general - you can bet it does. Please take a look at the chart below for details.

The short-term triangle-vertex-based reversals were quite useful in timing the final moments of the given short-term moves in the past few weeks. Please keep in mind that the early and late September lows developed when the support and resistance lines were crossed.

Now, this technique might not work on a precise basis, but rather on a near-to basis, and given the highly political character of the current month (before the U.S. presidential elections), things might move in a somewhat chaotic manner. In previous months and years, this technique worked multiple times, and it has worked recently as well.

Based on yesterday’s decline, it seems that the early-October reversal point did mark the end of the rally. To be precise, gold did move slightly higher after that time, but the vast majority of the upswing was over at that time, and it was the “pennies to the upside, dollars to the downside” kind of situation.

Since this technique was so useful recently, and since we already saw a sizable downswing yesterday, it seems that the corrective rally is already over.

Other than that, instead of being strong, mining stocks declined profoundly yesterday.

The GDX ETF – the flagship ETF for the precious metals mining stocks – closed at the second-lowest levels since July. That’s now how a medium-term rally looks like. That’s how a post-breakdown decline looks like.

Instead of rallying, miners simply corrected to the previously broken rising red support line, and they verified it as resistance. Since miners have already taken a breather, they appear ready to fall further. Thank you for reading our free analysis today. Please note that the following is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the interim target for gold that could be reached in the next few weeks.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.