Try The “Compounding Capital Gains” Strategy Today

InvestorEducation / Learning to Invest Oct 26, 2020 - 02:23 PM GMTBy: John_Mauldin

By Justin Spittler : Super-genius Albert Einstein called it “the eighth wonder of the world.” Legendary investor Warren Buffett attributes his $81 billion fortune to this force. And it’s how investors from all over the world have turned small stakes into millions of dollars.

I’m talking about “compounding.” But not in the way you’re probably thinking. Most of us learn about the power of “compound interest” in school. Back in the “good old days” when banks actually paid interest, you could put your money in a savings account.

Slowly but surely, it would grow. $10,000 compounded at 5% per year grows to $16,289 in 10 years, $26,533 in 20 years, $43,219 in 30 years.

Compounding works in dividend-paying stocks, too. You buy shares in a rock-solid company like Apple (AAPL) and consistently reinvest the dividends to buy more stock. In 30–40 years, you’ll have a lot more money than you started with.

But what if you don’t have 30 years to wait around? What if you could speed up compounding? In this essay, I’ll show you exactly how to do it.

I Call It “Compounding Capital Gains”

Before I continue, fair warning: This is an unconventional approach. Most folks don’t know about it. But even if they fully understood how lucrative it can be, the vast majority still couldn’t follow it. That’s because it’s human nature to want to spend your trading profits.

I’m suggesting you do it differently than most folks. I’m suggesting you save and reinvest some or all of your winnings from one trade into the next trade, in order to snowball your account quickly.

Do this well, and you’ll enjoy “compound interest on steroids.” I’m talking 200%–300% returns in months—the kind of gains that normally take years or decades to realize. I know you might be thinking: To bag those kinds of big, quick gains, don’t you need to take on huge risks?

Not at all. In fact, if you follow my golden rule of trading, this is one of the safest strategies out there. Let me show you. For the sake of example, the average gain across all our IPO Insider trades in the last year (counting winning trades and losing trades) is 72.6%.

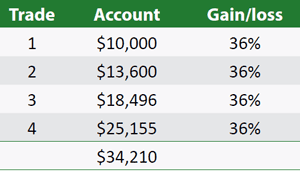

To be conservative, let’s take half that: 36%. Now imagine you strung together a couple of 36% winning trades in a row. But instead of spending the profits, you rolled them all into the next trade.

How many trades do you think you’d have to string together to triple your account? You may find the answer surprising. Just four trades is all it would take to triple your trading account from $10K to $34K:

Of Course, There Are Some Problems With This Oversimplification

- Gains are never this smooth.

- You wouldn’t necessarily roll all your profits into the next trade.

- You’ll certainly incur losses along the way.

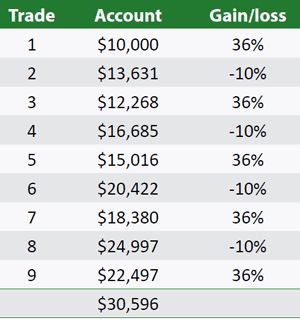

So let’s assume you did not string together a bunch of winners. Let’s assume you incurred some losses, but followed my golden rule of trading: Cut your losing trades early. In this scenario, you got a 36% win, followed by a 10% loss, and that pattern repeated. After nine trades—even though nearly half your trades were “duds”—your $10K turned into $30K:

Nine trades and you’ve tripled your account. Unlike the old way of compounding interest or dividends slowly, my “capital gain compounding” works best with fast-moving stocks.

In particular, it works best on the new class of “hypergrowth” stocks that are, quite simply, the fastest-moving stocks in America.

You see, unlike slow-moving “hold forever” stocks, you only want to hold hypergrowth stocks when momentum is on their side. In other words, when they’re rising fast.

And if a stock loses steam, that’s okay. You simply take your gains and reinvest them into the next hyper-growing opportunity. Your goal is to achieve a “snowball effect” where your growing account balance can compound faster and faster.

With the explosion in new hypergrowth stocks on the market, many more opportunities like this come along than you may think. In fact, a whopping 223 US stocks have soared more than 30% over the past month, while 81 have rallied 50%! If you haven’t yet, consider using my “ compounding capital gains” strategy.

Get our report "The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money". These stocks will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Justin Spittler

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.