How My Friend Made $128,000 Investing in Stocks Without Knowing It

Companies / Investing 2020 Nov 16, 2020 - 12:52 PM GMTBy: Stephen_McBride

If it weren’t for my wife, I still wouldn’t know about that pile of money.

My friend John recently told me a crazy story over coffee. One that’s 100X more powerful than any “hot stock tip.”

“It was 1996,” he said. “I was managing apartment buildings and shopping at Home Depot 2–3 days a week. Every time I walked in there, the place was PACKED. I was just getting started investing… but I knew I needed a piece of this business.”

John enrolled in their direct stock purchase plan (DSPP), which automatically buys a fixed dollar amount of shares on a regular basis. “I put an initial $2,500 in, and set it up to buy $75 more every month.”

For the first couple months, John carefully watched his account grow. Then the newness wore off, and he forgot about it. John moved to Costa Rica and turned his attention to real estate. After a successful career there, he and his family moved to Delray Beach, Florida, in 2015.

“Here we were 20 years later, going over our finances. That’s when my wife looked up and asked: Honey, what ever happened to those Home Depot shares?”

John didn’t even know his password to log into his account. But when he finally figured it out, he was stunned at the number. “It was $128,000.”

This Is The #1 Trait of Successful Investors

A few years ago, brokerage firm Fidelity conducted a study. The results were hilarious. They found that investors who performed the best had one thing in common: They forgot they had an account! These investors weren’t trading in and out of positions. They weren’t trying to catch the next “high-flying” stock. They weren’t trying to “time” the market.

They weren’t doing anything! Yet their portfolios were blowing everyone else’s out of the water. This, and John’s story, reveals a very important investing truth. Owning world-class businesses—and holding them for the long haul—is one of the most reliable ways to build lasting wealth.

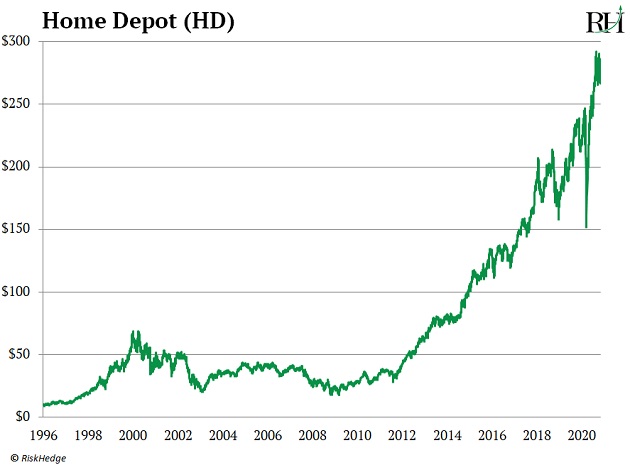

Now, John’s $128,000 nest egg didn’t appear overnight. In fact, it took 20 years. But it was the least stressful $100K he ever made. And the stock’s still booming today:

The thing with world-class businesses is you don’t need to log into your account every day and monitor them. They’re simple. They solve problems. And you never have to worry about them “going out of style.”

Right now, people are buying and renovating homes in droves now. And people will continue to buy homes—and renovate them—for the next hundred years. Remember, John didn’t overthink his decision to jump on Home Depot (HD). He saw everything he needed the minute he set foot in that store 20 years ago.

When It Comes to These Businesses, the Best Time to Sell Is “Never”

The #1 mistake investors make when trying to invest this way is dumping world-class businesses the minute they sell off. We’re not talking about penny stocks here. We’re talking about owning the most dominant businesses on the planet. You’re not going to get wealthy trying to “time” your entry and exit points perfectly.

Of course, the challenge is figuring out which dominators will remain dominant, and which ones are sitting ducks to be disrupted. For every Home Depot there’s an ExxonMobil (XOM).

Exxon reigned as one of the world’s most dominant companies for 40 years. From 1974 to 2014, anyone who invested a big part of their life savings in Exxon stock looked like a genius. But then everything changed. Oil as our primary source of fuel is on its way out. Exxon stock has been a total disaster, torching investors’ money to the tune of -67% over the past 6 years.

Disruption comes at you fast. So how do you tell the difference between a true dominator and a sitting duck? I focus on the world dominators doing the disrupting, not the ones getting disrupted.

Two of my favorites right now are at the heart of one of the most unstoppable trends on earth: the end of the traditional banks. And the rise of “new money” disruptors. Specifically, I’m betting on Mastercard (MA) and Visa (V).

These guys don’t get nearly as much attention as hot stocks like Tesla or Netflix. But Visa and Mastercard have handed investors big gains over the past decade. I expect that to continue for the next decade and beyond.

If you’re like the average American, you carry four credit cards in your wallet. While all the cards are from different banks—and they all have their own special privileges, prestigious names, and color schemes—most have one thing in common: “Visa” or “Mastercard” stamped on the bottom right.

It hardly matters what bank you use. Your card likely uses one of these payment networks to function. In fact, there are 3.4 billion Visa and 2.6 billion Mastercard cards in circulation!

These are two of the most consistently impressive businesses I’ve ever analyzed. They absolutely dominate the market for moving money around, and will continue to for a long time.

Visa and Mastercard’s position at the core of the global payments system makes them one of the safest bets for the long haul. Unlike Exxon, they’re what I call “undisruptible.” And the best part? You can buy them, forget about them, and get on with your life. (And if your spouse asks about them years from now, you may be surprised at the number in your account, too.)

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2020 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.