This Chart Signals When Gold Stocks Will Explode

Commodities / Gold and Silver Stocks 2020 Nov 17, 2020 - 04:55 PM GMTBy: Jordan_Roy_Byrne

Gold Stocks remain in a correction, even if the October 29 lows continue to hold into December.

Corrections are a function of price and time, and often in this sector, a correction can continue in terms of time, well after a low in price is made. But I digress.

The most significant and most consistent moves to the upside usually occur after a crash or after a major breakout.

Gold and silver stocks made tremendous moves after the Covid crash and remain in position for tremendous upside moves over the quarters ahead.

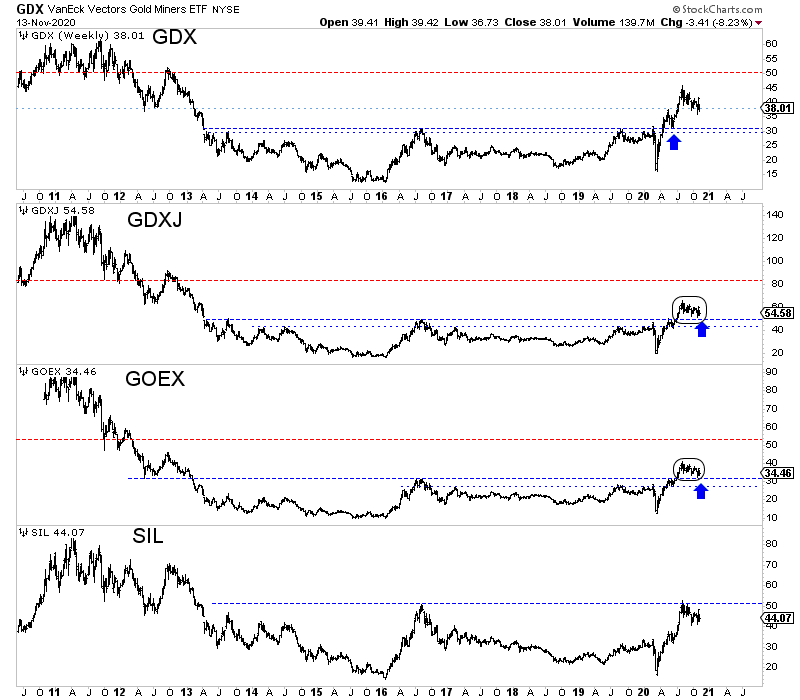

As you can see, the junior gold stocks (GDXJ and GOEX) are simply correcting and retesting their recent multi-year breakouts.

GDX already did so but on a smaller scale. It has less upside potential, while SIL (silver stocks) is consolidating before it attempts a major breakout.

GDX, GDXJ, GOEX, SIL

In short, when this correction is over, junior gold stocks have a good chance to run higher and higher towards the upside targets (red lines). Silver stocks (SIL) could breakout and run with a minimal retest in between.

The above charts are very bullish, but they do not answer my question of when.

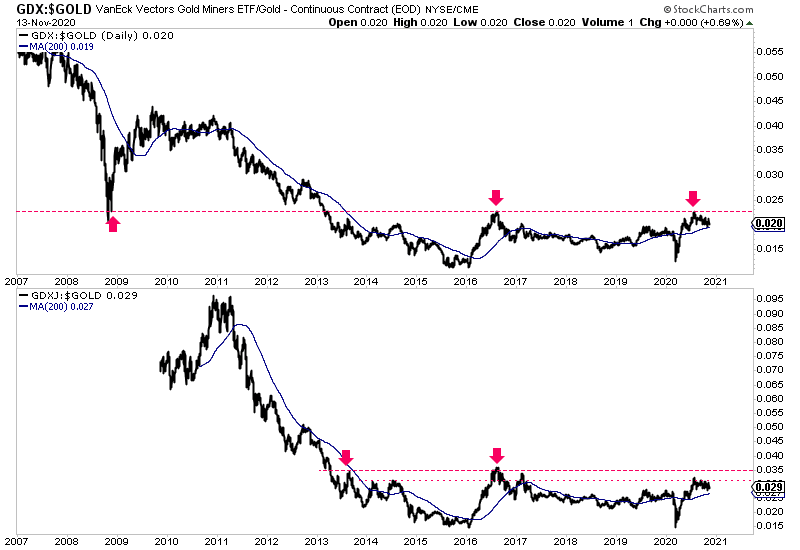

To answer the question, consider the charts of GDX and GDXJ against Gold. These ratios have a great chance to break past the near 8-year resistance.

GDX vs. Gold (top) & GDXJ vs. Gold (bottom)

The GDXJ to Gold ratio, upon a break past its 2013 and 2016 highs, would have a measured upside target of 0.055, which is almost a double in the current ratio.

There will be a one-two punch of Gold breaking past $2,100/oz to new highs coupled with juniors (and all gold-stock indices) dramatically outperforming.

That is when momentum and speculation will explode. GDX will trend towards $100, and GDXJ will trend well past $100.

The good news is that the move of gold stocks breaking out against Gold has not even started.

There’s still time, and there’s plenty of quality juniors trading at reasonable valuations.

I don’t know when that move will start (probably sometime next year), but I do my best to keep subscribers abreast of developments every week.

In our premium service, we continue to focus on identifying and accumulating those stocks with significant upside potential over the next 12 to 24 months.

To learn the stocks we own and intend to buy during the next correction that have 3x to 5x potential, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.