Stock Market 2021 Predictions for Another ‘Year Like No Other’

Stock-Markets / Stock Market 2021 Jan 01, 2021 - 05:46 PM GMTBy: John_Mauldin

By Robert Ross : Investors might have thought they'd seen it all in 2020. But the stock market action was merely a preview of what's to come in 2021.

Just to take a quick look back, the market gave everyone a scare in 2020 when it bottomed in March. But then the S&P 500 surged 67% between March 23 and year-end.

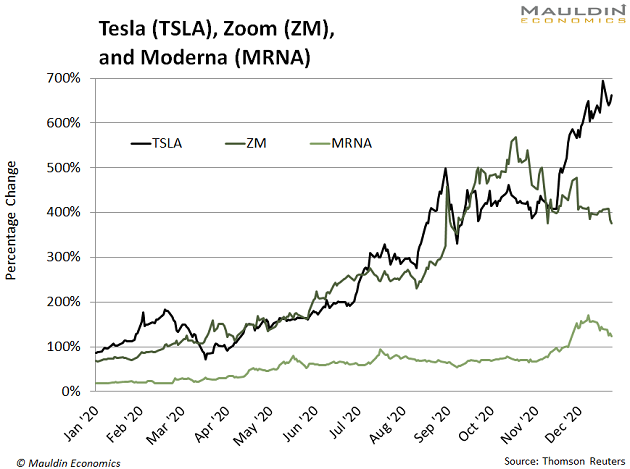

Certain stocks like Tesla (TSLA), Zoom (ZM) and Moderna (MRNA) performed even better, soaring by triple-digits.

And now, we are going from one "year like no other" to another.

Here's what I expect the new year will bring for investors…

Prediction No. 1:

The Bull Will Still Run in 2021

As 2020 has shown us, things outside your control—like a global pandemic—can render any prediction worthless.

But I have a lot of confidence in—and a lot of money riding on—this idea.

Why? Three reasons…

- We have every reason to expect the Federal Reserve will keep money flowing into stocks.

Their easy money policies help push people out of “safe” investments (i.e., money market funds and bonds) and into riskier assets (i.e., stocks). With the Fed pledging to keep interest rates low until 2023, bulls can look forward to a multiyear boost.

Here's something else investors can look forward to…

- Congressional gridlock isn't going anywhere.

With political leadership split nearly down the middle in Washington, D.C., we are in for at least two years of political gridlock. Gridlock is historically great for stocks… especially Walmart (WMT), Hewlett-Packard (HPE), and IBM (IBM).

As is this…

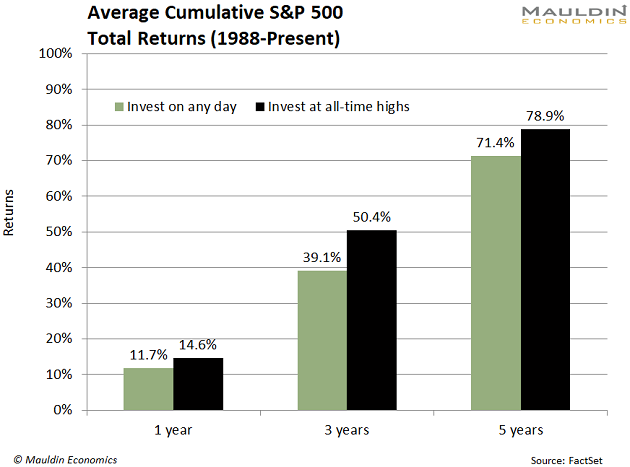

- Markets are at all-time highs… which typically lead to more all-time highs!

Since 1988, the S&P 500 returns were significantly higher on one-, three-, and five-year time horizons when the index was at all-time highs:

But while I expect the bulls to keep charging, some sectors are looking even better than others.

Prediction No. 2:

Tech Will Be 2021's Top-Performing Sector

Technology stocks have been on an incredible run over the last five years. In fact, it has been the best-performing sector in three of the last four years.

Forget those nattering nabobs of negativity who say the tech run is just about done. Get ready to see more outperformance in 2021.

Source: Novel Investor

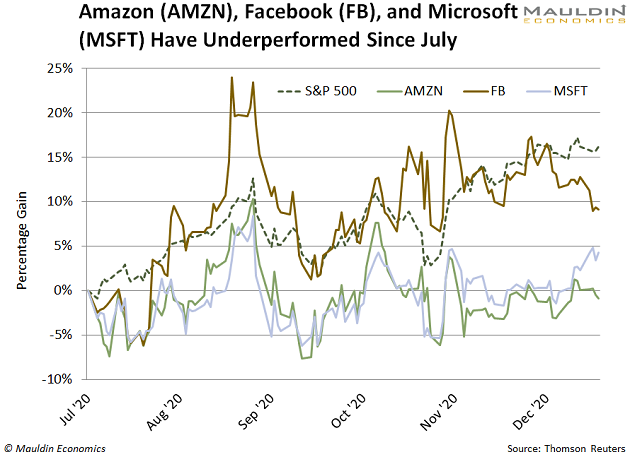

For one, while some tech names have had an incredible run in 2020, others have struggled... particularly in the second half of the year.

Household names like Amazon (AMZN), Facebook (FB), and Microsoft (MSFT) have well underperformed both the S&P 500 and Nasdaq since July. And smart investors will see this opportunity to buy great companies at a discount to their peers.

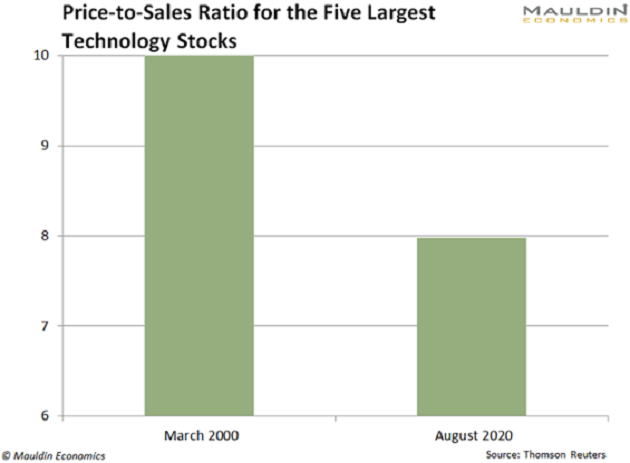

The other kicker is technology stocks are not expensive.

Compared to the dot-com bubble (when interest rates were 5X higher) the five largest US technology companies are relatively cheap:

Technology companies allowed many of us to keep working from home, and biotechnology companies will help us return to normal.

That means we'll see another big year from the companies that made—and will continue to make—this possible.

The worst of the COVID-19 pandemic will soon be behind us. The coronavirus vaccine will take effect, both physically and psychologically, and the global economy will find its footing again.

Some companies are already taking that side of the bet...

Prediction No. 3:

2021 Will Be the Best Year in a Decade for Dividend Hikes

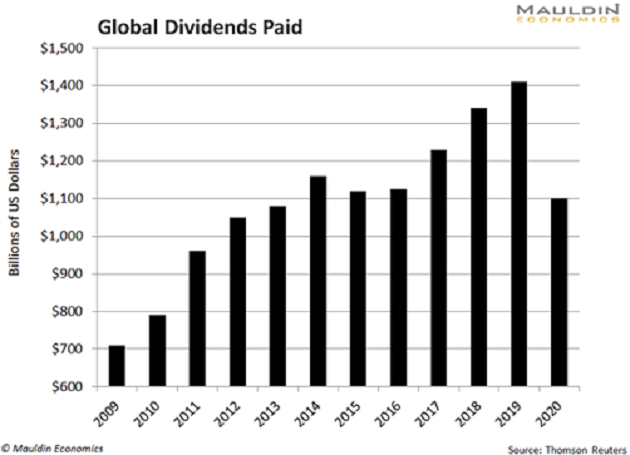

2020 was the worst year in a decade for dividend investors. In total, global companies cut their dividends by 22%.

That means 27% of all publicly traded companies slashed their dividends this year.

We stayed on top of these dividend cuts throughout the crisis. From cruise ships to casinos, we steered away from companies whose payouts my Dividend Sustainability Index (DSI) identified as being in danger.

But what goes down… must come up. At least when it comes to dividends.

We have already seen a few dividends return from the dead. Kohl's (KSS), TJX Companies (TJX), Marathon Oil (MRO), and Darden Restaurants (DRI) are among the first to reopen their purse strings.

Look for more where that came from… even among those that maintained and/or raised their payouts in 2020.

Why? We can use history as our guide.

In the two years after the 2008 financial crisis, we saw global dividend payouts increase 39%.

With the Fed keeping the easy money flowing… techs and biotechs getting ready for another unbelievable year… and dividend income ready to be unleashed, there's never been a better time to be an investor.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.