Gold Setting Up Major Bottom So Could We See A Breakout Rally Begin Soon?

Commodities / Gold and Silver 2021 Feb 21, 2021 - 04:02 PM GMTBy: Chris_Vermeulen

There has been quite a bit of chatter related to precious metals lately. The rally in Cryptos, particularly Bitcoin, and various other stocks have raised expectations that Gold and Silver have been overlooked as a true hedging instrument. As these rallies continue in various other stocks and sectors, Gold and Silver have continued to trade sideways over the past 6+ months – when and how will it end?

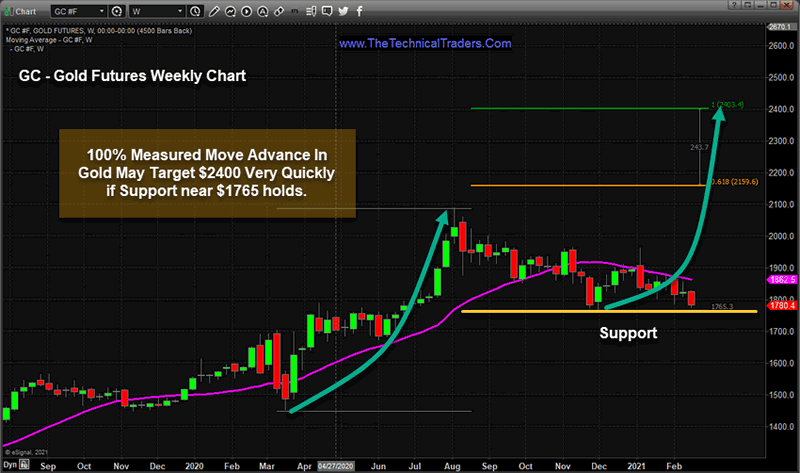

Gold Support Near $1765 May Become A New Launchpad

My research team and I believe the recent downside trend in Gold has reached a support level, near $1765, that will act as a launching pad for a potentially big upside price trend. This support level aligns with previous price highs (May 2020 through June 2020) after the Covid-19 price collapse, which we believe is an indication of a strong support level. As you can see from the Gold Futures Weekly chart below, if Gold price levels hold above $1765 then we feel the next upside rally in metals could prompt a move targeting $2160, then $2400.

The February 2021 Gold contract expires on February 24 – only a few days away. The CME Delivery Report shows an incredible amount of contracts already giving notice of a “Delivery Request”. This suggests that on or near February 25, a supply squeeze for Gold and Silver may become a very real component of price.

For example, there are 32,831 contracts requesting delivery for February 2021 COMEX 100 Gold Futures as of February 16, 2021. That reflects a total delivery obligation of 3,283,100 ounces of Gold. The Silver contract deliveries are similar in size. As of February 16, 2021, here are 1,865 February 2021 COMEX 5000 Silver contracts requesting delivery. That translates into over 9,325,000 ounces of Silver.

Sign up now to receive information on the launch of the Technical Traders’ options trading courses and newsletter!

We still have another five trading days to go before the February contract expires. How many more futures contract holders will pile into the Delivery Que at COMEX and how will this translate into any potential price advance or decline?

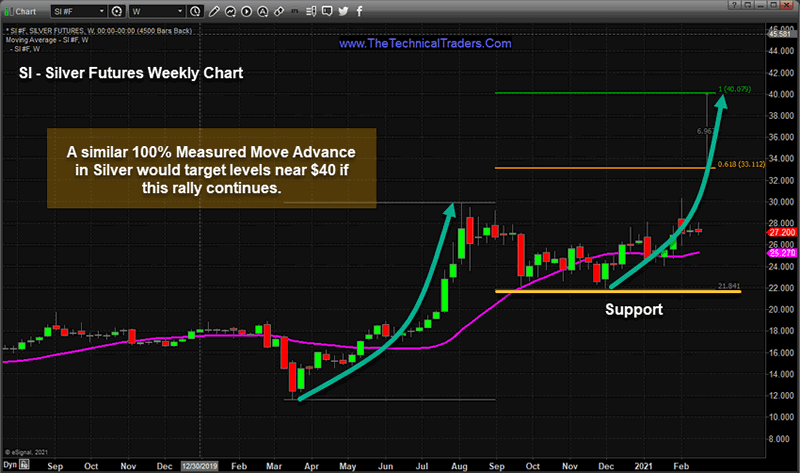

Silver Trends Higher – Already Showing Strong Demand

Silver has already begun to move higher while Gold continues to wallow near recent lows. Our research team believes the next few days of trading in Gold and Silver could become very volatile as global traders suddenly realize the demand for Deliveries may squeeze prices much higher. Traders should stay keenly aware of this dynamic in the Precious Metals markets as we may continue to see futures contract delivery requests out-pace supply as Precious Metals prices continues to move higher.

The 100% Fibonacci measured move technique we are showing on these charts helps us to understand where and how upside price targets become relevant. If support on these charts hold and the February 24, 2021 futures contracts expire with strong demand for physical deliveries, then we believe an upside price squeeze may setup fairly quickly (over the next 5 to 15+ days) in both Gold and Silver.

We need to watch how Gold reacts near this support level and to pay attention to the delivery data from COMEX. If these levels continue to increase over the next few days, before the February 24 expiration date, then we need to consider how and when the price will start to reflect this strong demand. Currently, Gold price activity does not properly reflect what is happening in Silver and Platinum related to the demand for metals. We believe, over the next 30 to 60+ days, this will change as Gold may enter a new bullish price phase – targeting $2400. At this point, we believe the answer to this question will become known by February 25th or so.

Precious Metals, Miners, Rare Earths, and Junior Miners may set up some really interesting opportunities for traders. The entire Metals/Miners sector has been under moderate pressure recently and we believe that trend may be ending soon. 2021 is going to be full of these types of trend rotations and new market setups.

Staying ahead of these sector trends is going to be key to developing continued success in these markets. As some sectors fail, others will begin to trend higher. Learn how BAN strategy can help you spot the best trade setups. You can learn how to find and trade the hottest sectors right now in my FREE one-hour BAN tutorial.

Don’t miss the opportunities in the broad market sectors over the next 6+ months. For those who believe in the power of relative strength, cycles and momentum then the BAN Trader Pro newsletter service does all the work for you in determining what to buy, when to buy it, and how to take profits while minimizing downside risk. In addition, you will be kept fully informed of the market with my short pre-market report delivered to you every morning along with the BAN Hotlist for those looking for more trades.

Happy trading!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.