FED Balance Sheet Current State

Stock-Markets / Stock Market 2021 Mar 05, 2021 - 04:11 PM GMTBy: Nadeem_Walayat

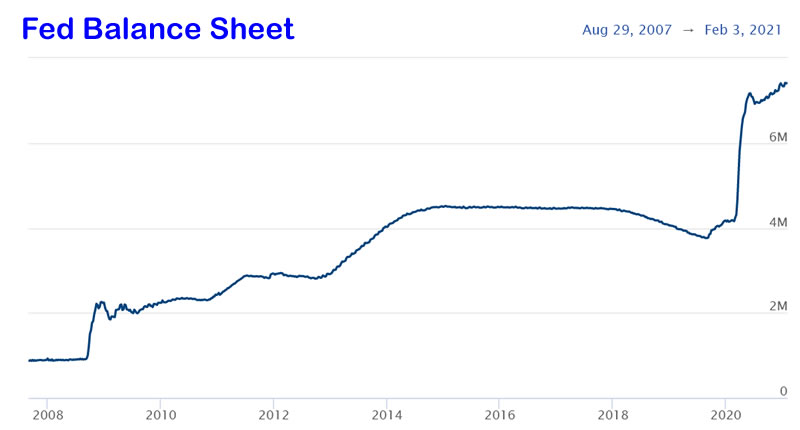

Not to forget the inflation mega-trend courtesy of rampant central bank money printing to monetize government debt coupled with the fake inflation indices. So you really think US inflation is just 1%? it's more like 6%! Anyway the money printing binge now totals $7.4 trillion, up from $4 trillion at the start of 2020.

The bottom line is forget what the bond market is implying because interest rates are manipulated, instead the real impact of money printing 'should' be seen in a falling Dollar, though every central bank is printing money, so it's going to be a bumpy ride. In the meantime if you think there is deflation compare the price of the stuff that you really want against what they were selling for a year ago! That's if you can get what you want because the tech market is OUT OF STOCK of GPU's, CPUs, and MEMORY! A market that is seeing price hikes on a near DAILY basis to near DOUBLE MSRP!

This article is an excerpt form latest extensive analysis that concludes in detailed stock market trend forecast for 2021 that has first been made available to Patrons who support my work.

Dow Stock Market Trend Forecast 2021

- UK Coronavirus Pandemic Current State

- US Coronavirus Pandemic Current State

- Stock Market Forecasts and Analysis Review of 2020

- The Stock Market Big Picture

- Post Covid Economic Boom

- GAMESTOP MANIA BUBBLE BURSTS

- FED Balance Sheet

- Dow Short-term Analysis

- Dow Long-term Trend Analysis

- ELLIOTT WAVES

- SEASONAL ANALYSIS / Presidential Cycle

- Stocks Bear Market / Crash Indicator (CI18)

- Dow Stock Market 2021 Outlook Forecast Conclusion

As a guide here's my forecast conclusion for 2020 -

31st Dec 2019 - Stock Market Trend Forecast Outlook for 2020

Dow Stock Market 2020 Outlook Forecast Conclusion

Therefore my forecast conclusion is for the Dow to target a trend to between 30,750 and 31,000 by the end of 2020. For a likely gain of 8% to 9% for the year (on the last close of 28,642).

My series of 2020 stock market analysis will seek to map out multi-month detailed trend forecasts as was the case for 2019. With the first to be completed during January, going into which my expectations are for a correction early 2020. Which given my bullish outlook implies should prove to be a buying opportunity.

Here is how the Dow trended during 2020 and where it ended the year.

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

My forthcoming schedule for analysis includes:

- AI stocks buying levels update

- UK house prices trend forecast

- How to Get Rich

- Bitcoin price trend forecast

- US Dollar and British Pound analysis

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.