Gold And US Treasuries – Punctures In The Everything-Bubble

Commodities / Gold and Silver 2021 Mar 10, 2021 - 05:47 PM GMTBy: Kelsey_Williams

Meanwhile, eyes are fixed on interest rates for US Treasury bonds. During the same six-month period (August 2020 – February 2021) during which the price of gold fell by seventeen percent, the price of the 20-year US Treasury bond fell by twenty percent. That IS a huge deal, as it corresponds to sharply higher interest rates from less than 1% last August to as high as 2.26% just the other day.

The rush to proclaim correlation between interest rates and gold has resumed. Also, warnings and predictions of much higher inflation from around the globe are increasing.

As we have said on several occasions, there is no correlation between gold and interest rates (see Gold And Interest Rates – There Is No Correlation).

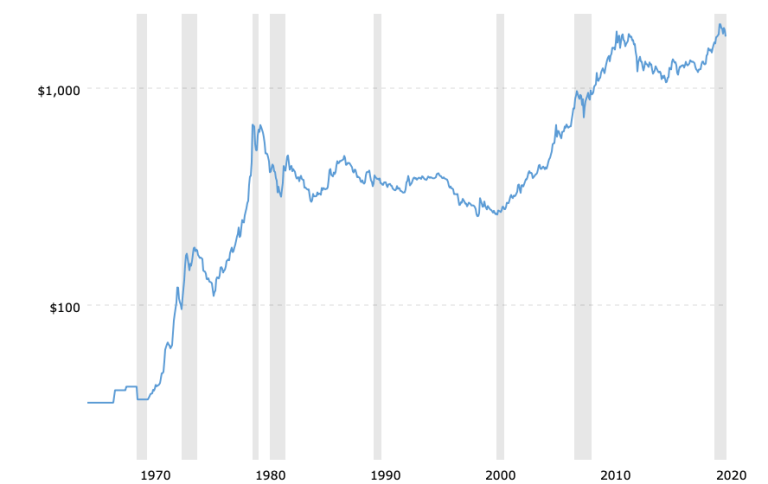

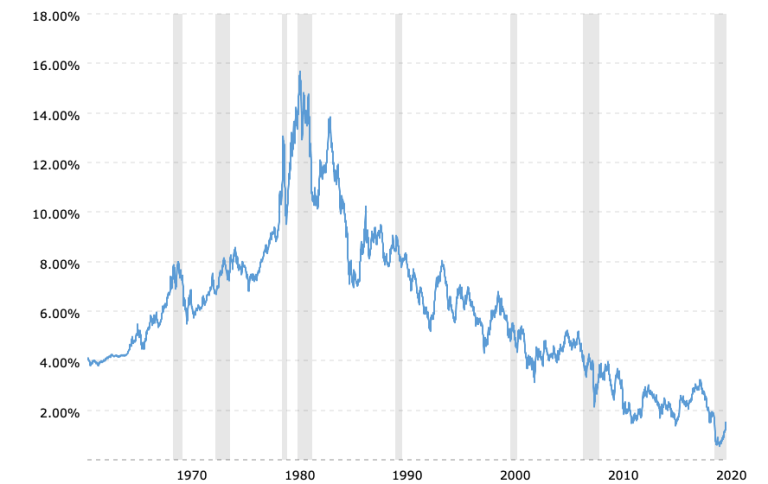

This can be seen on the charts below. The first chart (source) is a history of gold prices over the past fifty-six years and the second chart (source) is a history of interest rates over the same time period…

GOLD PRICES 1965-2021

10 YEAR US TREASURY RATE 1965-2021

During the 1970s, the price of gold rose from $40 per ounce to an intraday peak of $850. All throughout that time, the interest rate on the 10-year US Treasury bond rose higher and higher; from approximately 4% to 12.5%.

However, during the years 2000-2011, while the price of gold rose from $250 to $1900, interest rates on the 10-year US Treasury bond dropped from 6% to 2%.

The two decade-long periods provide contradictory results for the argument that lower interest rates are correlated to higher gold prices.

And for those who argue that the higher rates we are currently seeing are an indication of significantly higher inflation, then why is the gold price declining?

The higher interest rates are possibly a market reaction to the brutal effects of infinite credit creation and interest rate manipulation by the Federal Reserve.

The entire world economy is funded with cheap credit and most economic activity is dependent on it. The prices for all financial assets misrepresent and grossly exaggerate any underlying fundamental value.

Higher rates might trigger a credit collapse so severe that any asset could decline in price by fifty percent or more.

As for gold, it would also decline – to a level commensurate with whatever strength the US dollar attains.

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2021 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.