Stock Bulls Run – Will Gold Ones Too?

Stock-Markets / Stock Market 2021 Mar 18, 2021 - 04:20 PM GMTBy: Monica_Kingsley

Resting on Friday, surging on Monday. Feeble downswing attempt defeated right after the open, and then just bullish price action. Retail data today, and another FOMC meeting tomorrow – I view the former as not too likely to spoil today‘s market action. About the latter, remembering the latest reactions to Powell pronouncements, I look for the markets to be affected to a much greater degree.

Don‘t look for material surprises, or be spooked by bets on the Fed tightening through dot plot adjustment or other forward guidance tools.I expect no change from what I wrote yesterday:

(…) Who could be surprised, given the modern monetary theory ruling the economic landscape? The Fed amply accomodative, one $1.9T stimulus bill just in, and a $2T infrastructure one in the making. That‘s after the prior Trump stimulus, and who would have forgotten how it all started in April 2020? The old congressional saying „a billion here, a billion there, and pretty soon you‘re talking real money“, needs updating.

Global liquidity isn‘t retreating exactly, emerging markets are building a solid base regardless of the dollar going higher two days in a row, and emerging market bonds are fighting to recover just as much as long-dated Treasuries. Coupled with the sectoral analysis, this is conducive for the unfolding stock market upswing and for commodities as well. We‘re still in a constructive environment for both, and I look within the latter at especially copper, nickel and iron to do well.

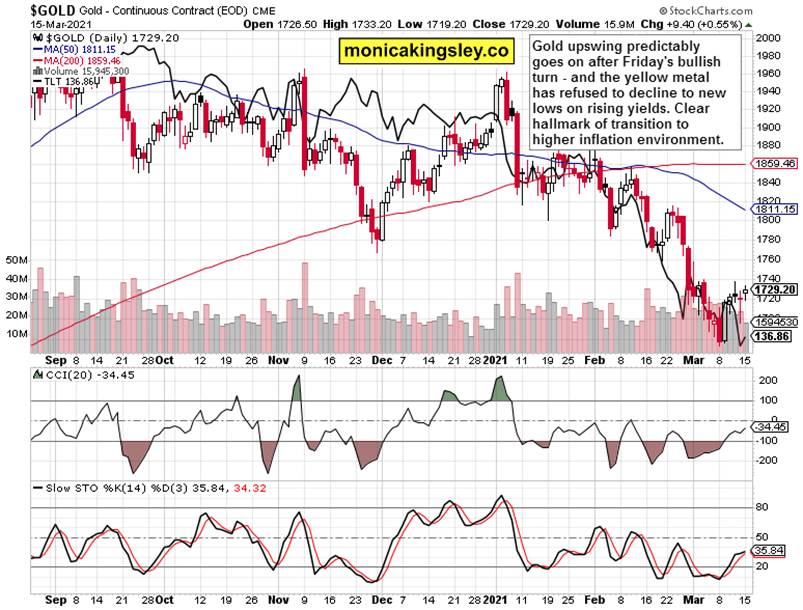

Meanwhile, the precious metals upswing is going fine, and the miners keep outperforming – both gold and silver ones. The time for the bulls isn‘t running out, and the real battles will come once the gold bulls conquer the volume profile thin zone around $1,760. Will the bulls reach it on tomorrow‘s Fed underplaying the threat of inflation and showing tolerance to its overshoot? That‘s certainly one of the possibilities.

The best course of action is to keep a pretty close eye on the metals – no bullish / bearish change from Thursday‘s words:

(…) At the moment, evaluating the strength and internals of precious metals rebound, is the way to go as we might very well have seen the gold bottom, with the timid $1,670 zone test being all the bears could muster. Time and my dutiful reporting will tell.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook

The S&P 500 upswing is ready to proceed further now, and slight volume hint tells me to look for higher prices today.

Credit Markets

High yield corporate bonds (HYG ETF) continue trading in a weak pattern, which however hasn‘t been able to force the stock market down. And not that I looked at it to have a chance to. I continue to view the junk corporate bond market as under pressure in sympathy with investment grade corporate bonds and long-dated Treasuries, which scored modest gains yesterday too. It‘s a euphoric rush into stocks simply.

Volatility

The volatility index shows no signs of panic returning, and the put/call ratio is getting very complacent again. Doesn‘t look like the boat will capsize today really.

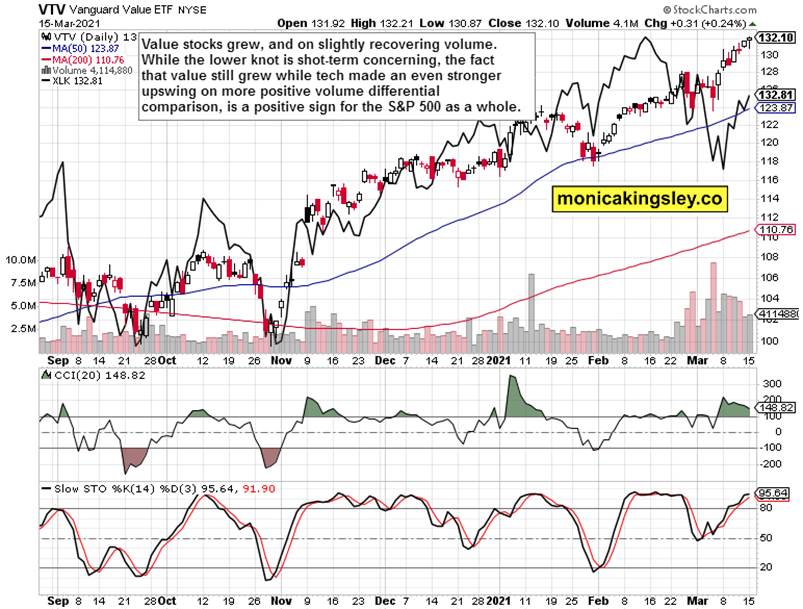

Value Stocks and Tech

Value stocks (VTV ETF) repelled a daily downswing attempt, which is positive considering that technology (XLK ETF) rose more strongly. The leadership in the stock market advance is broadening, and that‘s good news for the bulls.

Gold Upswing Anatomy

Gold added modestly to its recent gains, and would do well to clear the $1,730 area some more really. The low volume is a sign that current prices aren‘t attracting enough interest to step in, and either buy or sell. Given the below chart though, the initiative is still within the bulls.

It‘s that the miners keep outperforming gold without really slowing down, and that‘s still what I like to see well before the upswing makes an intermediate top. The daily indicators remain far from extended. Will the bulls take advantage accordingly?

Silver, Copper and Oil

Silver is consolidating and by no means outperforming, as it so often does at the very late stage of precious metals upswings. The deductive conclusion is that the days of the upswing aren‘t likely over just yet.

Both copper and oil are consolidating within their bullish patterns, and today‘s downswing taking both down around 1.5% from yesterday‘s prices shown above, is taking them nearer to where I would increase weighting. Yes, I‘m bullish stocks and commodities still, and look for precious metals to be gradually joining in some more.

Summary

After the brief consolidation of S&P 500 gains, we‘re again in the full upswing mode, and the credit markets aren‘t a show stopper. The stock market bull is alive and well, and deeper correction has been yet again delegated to the dustbin. The top is very far off as this still nascent recovery gets so much stimulus fuel that overheating becomes a very real possibility this year already.

Gold keeps turning an important corner on, but the bulls could get more comfortable only with an upswing that clears the $1,730 zone now, given the strong performance mining indices are showing. Adding to that even more decreased sensitivity to rising yields would compound the pleasant sight for the bulls. The runup to tomorrow‘s Fed will be telling.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.