Gold Staging New Momentum Base In Preparation For A Big Upside Move

Commodities / Gold and Silver 2021 May 19, 2021 - 02:34 PM GMTBy: Chris_Vermeulen

In the first portion of this research article, I highlighted the correlation between Gold and the US Dollar as well as the correlation between the US Dollar and the EURUSD and JPYUSD. The purpose of this example was to highlight the different phases of US Dollar appreciation vs depreciation compared to the EURUSD/JPYUSD. The EURUSD and JPYUSD are often compared to the US Dollar as major global currencies. Therefore, when the US Dollar moves into a depreciation phase, we expect to see the EURUSD and JPYUSD move into an appreciation phase.

How this correlated to the price of Gold and the phases of advancing vs declining precious metals is simple to understand. Gold will stall, or more broadly downward, while the US Dollar is within an advancing/appreciation phase. Gold will move higher or begin an upward trend bias when the US Dollar begins to generally weaken or moves into a declining/depreciation phase.

Understanding Cycle Phases & Correlative Gold Price Trend Bias

In the first portion of this research article, I highlighted this relationship by detailing the 2007-08 US Dollar depreciation phase that lasted until a major bottom setup in 2014 (almost exactly 7 years). That next US Dollar appreciation phase lasted until a recent major peak in March 2020 (almost exactly 7 years). If the US Dollar continues to decline in value after the COVID-19 virus event and the change in cycle phases, we can expect another 5 to 7+ years of advancing precious metals prices as a result.

The recent bottoming in Gold, just above the $1700 price level, set up a very unique scenario related to potential future advances in price. The current Gold rally from the 2015 lows, near $1045.40, to recent highs near $2089.20 represents almost a 100% price advance. In my opinion, this rally in Gold is similar to the rally that took place between 2000 and 2005 – starting near the end of a US stock market appreciation phase and lasting about 3.5 years into a US stock market depreciation phase. Our researchers believe the US stock market has completed a recent price appreciation phase in 2018~2019 and that we are only about 1~2 years into a new US stock market depreciation phase – which may last until 2027~2029.

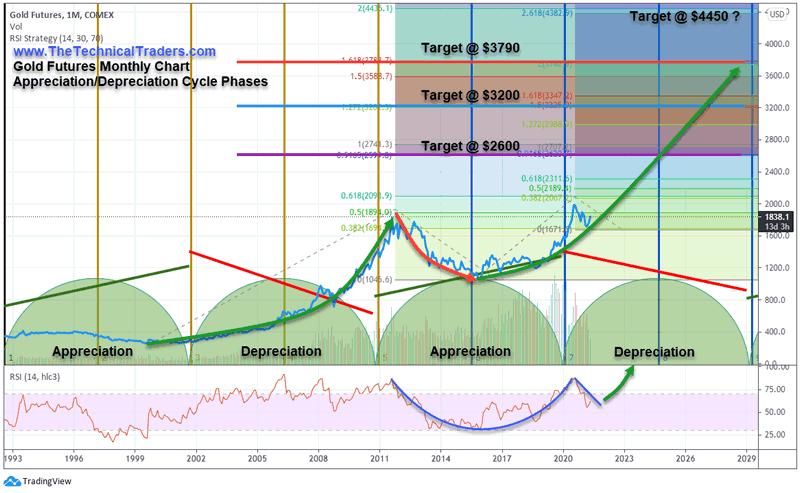

The Monthly Gold Futures chart, below, highlights these Appreciation/Depreciation phases and the advancing/declining price of Gold over the past 25+ years. We want you to pay very close attention to how Gold started to rally in 2000 as the markets peaked because of the DOT COM rally. This rally started in the midst of a US stock market appreciation phase – just like what happened in 2015. Gold prices rallied from the 2000 lows to reach the initial +100% advance by early 2006 (in the midst of a housing market rally and in the midst of a Depreciation US stock market phase). After that, Gold rallied another +265% reaching a peak price level $1923.70 in September 2011.

Currently, Gold has rallied approximately 100% from the 2015 lows – similar to the 2000~2006 rally. The current downside price move in Gold suggests the recent highs, near $2089.20 in August 2020, complete a Cup-n-Handle pattern. Additionally, because we have just entered a US stock market Depreciation phase, we believe the price of Gold will continue to advance to levels highlighted in the chart above. The first target level is $2600, then $3200, then $3790.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

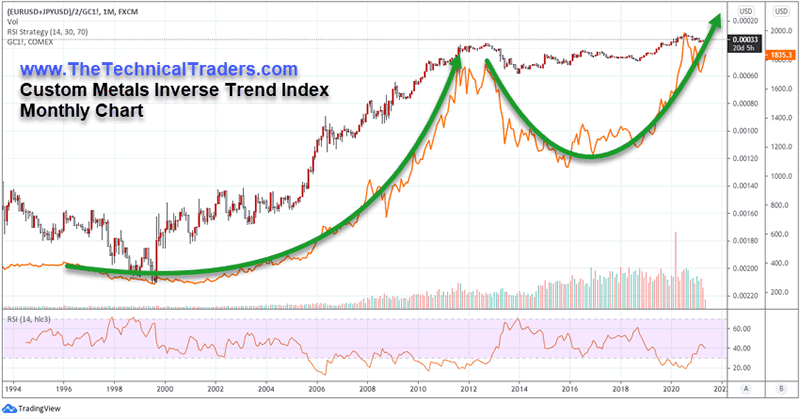

Our Currency Correlation Inverse Trend Index also aligns with the Appreciation/Depreciation cycle phases. If the US Dollar continues to decline in value over the next 2 to 5+ years, attempting to consolidate below $84 as it has done in the past, then we believe the EURUSD/JPYUSD currency values may advance above the threshold (near 0.65) to prompt a stronger rally in precious metals over the next 4+ years.

US Dollar & Currency Correlations Suggest Big Advance In Metals Is Pending

The primary driver of this move is the declining US Dollar – not the move higher in the EURUSD or JPYUSD. These other currencies are simply barometers of the global perception of the strength of the US Dollar. A weakening US Dollar will usually be prompt a moderate advance in Gold prices. We believe the correlation between the US Dollar value (above or below the 85~86 level), as well as the correlation of the strength of the EURUSD and JPYUSD in comparison to the US Dollar, may prompt a change in how Gold reacts to moderate trend bias as well as how Gold reacts to changes in the US Dollar trends. The bias trend of Gold within this extended market cycle phase tends to mitigate Gold price volatility as the US Dollar temporarily bottoms/bases and starts to rise. This suggests a broader rally in Gold throughout this new market cycle phase may extend much higher than many people expect.

The following Monthly Custom Metals Inverse Trend chart, below, highlights the bottoming/basing formation in the currency correlation compared to Gold. You can see the moderately deep bottom that set up in Gold between the peak in 2011 and the bottom in 2015, as well as the recent rally in gold to the new highs. The recent moderate selloff in Gold correlated to a very minor decline in the Inverse Currency Index – suggesting that a bigger rally is setting up as currencies rotate into the new cycle phase.

Our Custom Metals Index Weekly chart, below, highlights the recent upward price rotation in the precious metals/miners sectors. Pay very close attention to the RED price channels on this chart and the LIGHT BLUE arching GANN Fan resistance levels near the recent tops in price. We believe any upside price advance above these current GANN arcs will prompt a rally that may push metals prices back into the RED price channels – advancing possibly +10% to +30% higher before the end of 2021. This advance may prompt Gold to rally to levels near our $2600 price target before the end of 2021. Silver may advance to levels above $39~$44, more than 30% to 40% from current price levels if Gold continues to advance as we expect.

US Dollar Flirting With Massive Price Decline Once $89.00 Is Breached

One key factor that is likely to drive this new advance in Gold and Silver – the US Dollar trends. I am watching two critical support levels in the US Dollar right now; $89.70 and $89.20. If the US Dollar falls below either of these support levels, Gold will likely advance higher as the currency depreciation cycle phase appears to be continuing to engage as we expect. Remember, the key level for the US Dollar is that 85~86 level. The closer we get to those levels, the more conviction traders and investors will have regarding the advancing precious metals prices. The 89 price level for the US Dollar is likely the breaking point for this cycle phase to really break loose so watch that level very closely.

As the US stock market attempts to shrug off inflationary concerns and worries that the US Fed may be forced to raise rates to curb inflationary trends, Traders and Investors should start to pay attention to precious metals and the currency correlations related to these broader market cycle phases. My research team and I have published a number of articles related to these Appreciation/Depreciation cycle phases and attempted to warn of potential market volatility events over the past 8+ months, including: How To Spot The End of an Excess Phase (November 27, 2020); Are We Days Away From Potential GANN/Fibonacci Price Peak? (March 17, 2021); Adapting Dynamic Learning Shows Possible Upside Price Rally In Gold & Silver (November 22, 2020).

What is important to understand about this potential cycle phase shift and new precious metals trend bias is that it may take many weeks or months to complete before the bigger rally really starts to build momentum. Yet, the evidence is starting to build that a decreasing US Dollar trend may prompt this new cycle phase shift in the currency correlation and that may prompt a big shift in how precious metals and miners start to rally higher. Right now, we are seeing Gold and Silver start to shift into a new bullish trend bias – therefore, we may be starting to see a shifting in expectations; which is very similar to what we saw in 2000~2005 – just before Gold exploded higher.

Make sure you stay on top of the prices of precious metals if you want to be able to take advantage of the expected rally. Every morning I share my market analysis and review the price action of precious metals with my premium subscribers of BAN Trader Pro. Join now to get my pre-market video analysis deilvered to your inbox every morning, and get ready for a great ride in Gold and Silver over the coming months and years!!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.