The Shifting US Economy: AI and Automation Lead the Way

Economics / AI May 27, 2021 - 12:20 PM GMTBy: Submissions

The Biden administration is 125 days old, and things certainly feel different. What strategies are you employing to take advantage of the shift?

Things often change temporarily before reverting to a mean. Just like market instruments, changing political ideals can, do, and will change, before ultimately reverting back to a mean, or an average state.

Labor force configurations have changed drastically, partially due to the pandemic. What was once everyone’s dream “to work from home”, went from a wish to a potentially harsh reality and has stayed there for many people.

On top of the new remote workforce norm, there has been a shift for many wageworkers, as they are becoming increasingly reliant on government-funded subsidies such as unemployment benefits, food assistance, and others to survive. Many workers needed these benefits to survive during the peak of the pandemic. Many red states have already begun the process of limiting or restructuring unemployment benefits and requirements. However, many blue states have not done so, and perhaps do not intend on doing so.

These collective actions and inactions create a lack of desire for many wageworkers to return to work. And, why would they? If a worker can receive an equal-to, or in many cases, a higher amount of compensation without having to work, there is no financial incentive, albeit some may have a moral incentive. This dynamic creates challenges for small business owners in the US.

Let’s assume that you are a restaurateur. You require a labor force that has a certain skill set and commands a certain compensation. Since the labor market for this type of work does not command a very high rate of pay, the work pool shrinks, and labor is hard to find. So, raise the minimum wage, you say? Then, the small business restaurateur may not be able to survive and continue operations, doling out delicious delicacies to the neighborhood. Who wins in that situation?

Inflation does not help. Is it highly coincidental that inflation metrics have suddenly spiked while a large percentage of certain workforces are not working? What about housing? If you are in the US (depending on your local market), you may be all too familiar with sky-high single-family home prices, and rents are out of control in many markets. Housing seems to be a luxury in many markets and for many people at this time.

How do we try to profit from it? Automation.

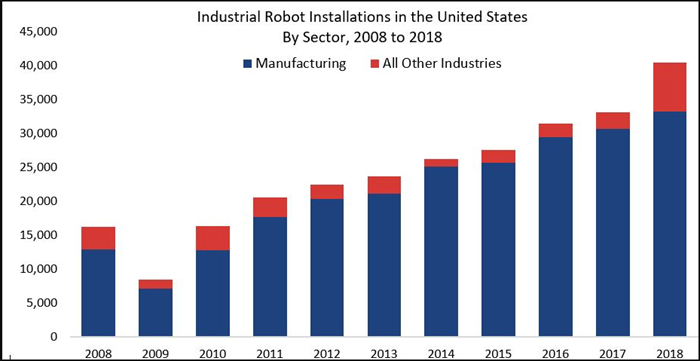

Figure 1 - Industrial Robot Installations in the United States 2008 - 2018. Source International Federation of Robots ifr.org

While the above graphic is a bit dated, it shows an exponential increase in industries other than manufacturing in 2018.

Robots don't need paychecks or lunch breaks. They never call in sick. Bringing a robot into service is a one-time cost and a maintenance cost. If there is no human work pool to fill a demand, robots and automation will likely continue to be the answer, and potentially at a higher rate of increase.

There is no shortage of ETFs for an investor to gain exposure to this trend in automation. After sifting through many of them, I wanted to discuss one that really stood out to me today.

Now, for our premium subscribers, let’s take a look at an instrument that could benefit from increased automation adoption. Not a Premium subscriber yet? Go Premium and receive my Stock Trading Alerts that include the full analysis and key price levels.

Thank you for reading today’s free analysis. I encourage you to sign up for our daily newsletter - it's absolutely free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts.Sign up for the free newsletter today!

Enjoy your day! And remember to be patient with your entries.

Rafael Zorabedian

Contributor

* * * * *

This content is for informational and analytical purposes only. All essays, research, and information found above represent analyses and opinions of Rafael Zorabedian, and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. You should not construe any such information or other material as investment, financial, or other advice. Nothing contained in this article constitutes a recommendation, endorsement to buy or sell any security or futures contract. Any references to any particular securities or futures contracts are for example and informational purposes only. Seek a licensed professional for investment advice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Information is from sources believed to be reliable; but its accuracy, completeness, and interpretation are not guaranteed. Although the information provided above is based on careful research and sources that are believed to be accurate, Rafael Zorabedian, and his associates do not guarantee the accuracy or thoroughness of the data or information reported. Mr. Zorabedian is not a Registered Investment Advisor. By reading Rafael Zorabedian’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Trading, including technical trading, is speculative and high-risk. There is a substantial risk of loss involved in trading, and it is not suitable for everyone. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment when trading futures, foreign currencies, margined securities, shorting securities, and trading options. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Rafael Zorabedian, Sunshine Profits' employees, affiliates, as well as members of their families may have a short or long position in any securities, futures contracts, options or other financial instruments including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. Past performance is not indicative of future results. There is a risk of loss in trading.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.