Bitcoin: Here's the "$64,000 Question"

Currencies / Bitcoin May 29, 2021 - 05:59 PM GMTBy: EWI

Will the cryptocurrency ever trade at its all-time again?

In the 1950s television game show, "The $64,000 Question," contestants answered general knowledge questions and the money they could earn doubled as questions became more difficult.

The show's title spawned the well-known phrase -- "that's the $64,000 question" -- which, as you probably know, means the crucial question which gets to the heart of a matter.

Well, "the $64,000 question" for bitcoin is: Will the cryptocurrency ever trade at its all-time of $64,899 again (which was reached on April 14 of this year)?

This is a top-of-mind question for many bitcoin investors who've seen the cryptocurrency bounce back from every "correction" since the start of its meteoric rise.

For instance, on Jan. 27, the headline of a major financial magazine asked (Forbes):

Bitcoin Has Crashed. Is This The End?

That was in response to Bitcoin's swift slide from near $42,000 to around $30,000.

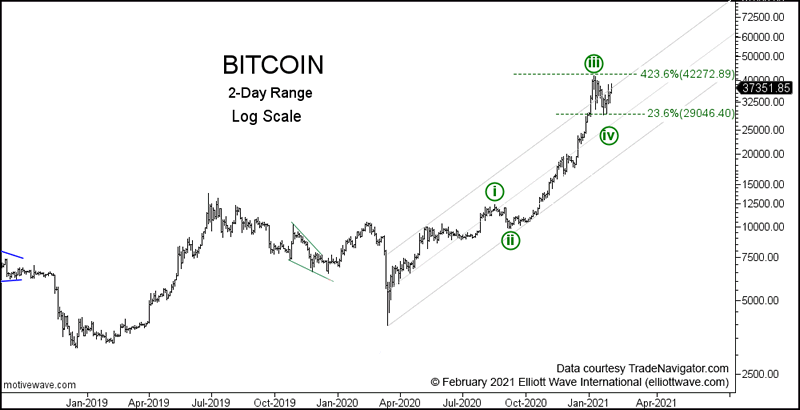

Yet, bitcoin's Elliott wave pattern suggested that the price would rebound. Here's a chart and commentary from the Feb. 5 Global Market Perspective, an Elliott Wave International monthly publication which covers 50+ worldwide markets:

Our preferred [Elliott wave] count is that [Bitcoin] is advancing within the subwaves of a [larger up wave]. ... The wave IV (circle green) correction played out for most of January. Wave evidence suggests that the correction ended on Jan. 22.

As you probably know, the cryptocurrency went on to climb to as high as near $58,000 on Feb. 22. But, then, another heart-pounding drop followed. The price had dropped around $12,000 in just a matter of days.

But, yet again, the digital currency bounced back and eventually hit that April 14 high of more than $64,000.

So, we return to the "$64,000 question": Will bitcoin ever trade at $64,000 again?

The Elliott wave model is once again offering insight -- you'll find it inside Elliott Wave International's Crypto Pro Service right now, as soon as you've subscribed.

Also, tap into the knowledge found inside the special free report:

Crypto Trading Guide:

5 Simple Strategies to Catch the Next Opportunity

Here's a quote from that timely free report:

From its December 2017 peak near $20,000, Bitcoin plummeted more than 80% to below $4000 per coin at its 2018 low.

Yet, as you just saw, in both cases -- before Bitcoin took off and before it crashed -- Elliott wave analysis and sentiment readings were several steps ahead of the markets.

Imagine what you could have done with such advance information.

Elliott wave analysis is uniquely equipped to warn you of changes no one else sees coming.

You can have Crypto Trading Guide: 5 Simple Strategies to Catch the Next Opportunity on your computer screen in just moments. Remember this special report is free.

Just follow this link: Crypto Trading Guide: 5 Simple Strategies to Catch the Next Opportunity

This article was syndicated by Elliott Wave International and was originally published under the headline Bitcoin: Here's the "$64,000 Question". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.