The Bitcoin Crime Wave Hits

Currencies / Bitcoin Jun 14, 2021 - 04:20 PM GMTBy: EWI

The conviction gripping bitcoin's ascendancy is so deep that children are now being indoctrinated into the bullish fold. We talked about this phenomenon with respect to the stock market last month. This Bloomberg column from May 16 signals its arrival in the cryptocurrency world: "Why I Pay My Seventh Grader in Bitcoin." The columnist claims he wants his "kids to be able to think independently about money" and "feel the full spectrum of feelings that money induces." Sure, why not feel the burn of the real world? Besides, the big kids are doing it, too. According to MarketWatch, "As Bitcoin and Dogecoin Plummet, College Students" are "Going Long on Crypto." According to a survey by College Finance, "more than 60% of college students and recent graduates see crypto as a long-term investment."

In April, EWFF showed two magazine covers' positive portrayal of bitcoin and other cryptocurrencies. We labeled it bearish for bitcoin's immediate prospects. Last month, we added that bitcoin's "Great Arrival" into the "mainstream" of finance confirmed this forecast. One of the signals of cryptocurrencies' acceptance into the financial establishment was Coinbase Global Inc.'s emergence as a publicly traded company. On May 19, with bitcoin down more than 53% from its high, Bloomberg observed the following about the premier cryptocurrency trading platform:

The siren song reached a peak with Coinbase Global Inc.'s market debut on April 14. The direct listing of the largest U.S. crypto exchange supercharged theories that crypto had made it to the investing mainstream, that Wall Street's embrace lent legitimacy to the asset class and the sky was the limit. Retail investors flooded in.

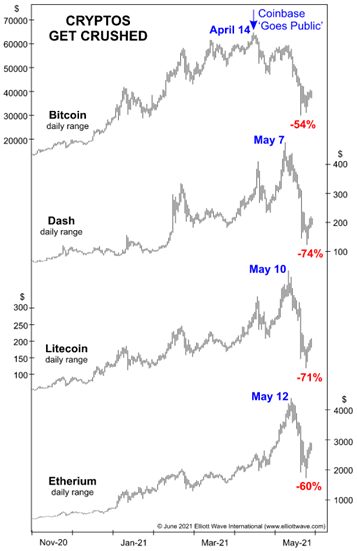

The chart at right shows the relationship between bitcoin's top and Coinbase's public offering, which occurred the same day. The chart also shows that the rise in crypto optimism pressed on as so-called altcoins, dash, litecoin and ethereum, rallied until May 7, May 10 and May 12, respectively. Then they crashed. Various other indicators also pressed on. According to a Bank of America monthly survey, fund managers were never as enamored with bitcoin as they were in the first few days of May. The result of its poll of 194 managers showed that bitcoin was the "most crowded trade," with 43% saying they were long bitcoin. The total was the highest for the cryptocurrency in the history of the survey, which dates from December 2013. In January, bitcoin was also the leading fund manager asset with 40% holding the crypto back then. The only other months in which bitcoin was the leading asset were September and December 2017, when about 30% of fund managers said they held the crypto. Bitcoin topped that very month and plunged 84% over the next 12 months. The same set-up is already well on the way to producing a similar result.

The chart at right shows the relationship between bitcoin's top and Coinbase's public offering, which occurred the same day. The chart also shows that the rise in crypto optimism pressed on as so-called altcoins, dash, litecoin and ethereum, rallied until May 7, May 10 and May 12, respectively. Then they crashed. Various other indicators also pressed on. According to a Bank of America monthly survey, fund managers were never as enamored with bitcoin as they were in the first few days of May. The result of its poll of 194 managers showed that bitcoin was the "most crowded trade," with 43% saying they were long bitcoin. The total was the highest for the cryptocurrency in the history of the survey, which dates from December 2013. In January, bitcoin was also the leading fund manager asset with 40% holding the crypto back then. The only other months in which bitcoin was the leading asset were September and December 2017, when about 30% of fund managers said they held the crypto. Bitcoin topped that very month and plunged 84% over the next 12 months. The same set-up is already well on the way to producing a similar result.

If there is one thing bitcoin enthusiasts cannot accommodate, it is criticism. In early May, after Berkshire Hathaway vice chairman Charlie Munger called the cryptocurrency "contrary to the interest of civilization," "crypto enthusiasts mocked his investment performance, compared him to an elderly Muppet and said he was too old to understand the technology." A well-known crypto investor/CEO added, "Do you go to your great-grandfather for investment advice on new technologies?" And then of course, there is dogecoin, the joke-coin-turned-crypto-blue-chip, which recently showed up for its curtain call. As discussed last month, the crypto took its star turn on Saturday Night Live on May 8, where guest host Elon Musk mentioned the joke currency. As he did, dogecoin's price fell 30%. From its peak of 74 cents, dogecoin declined 70% to May 19.

Here's what EWFF said to look for in the culture with the onset of a new trend: "When a bear market begins, the focus will shift from crypto speculation to crypto crime and scandal." It didn't take long. On May 12, two days after the Dow's recent intraday high, Bloomberg Businessweek columnist Joe Light reported that "a criminal gang" responsible for the cyberterrorism attack that shut down 45% of the East Coast's fuel supply, demanded to be paid "a ransom in bitcoin, or another cryptocurrency. How's that for "contrary to the interest of civilization.'" He went on to list various ways in which regulators are moving in on the crypto sphere. As bitcoin declined over 30% on May 19, the attacks against the legitimacy of cryptocurrencies spread. "China banned the use of cryptocurrencies for financial institutions," reported Barron's. "Other countries might be considering tighter regulation, particularly as cryptos become the currency of choice for ransomware hackers. Tesla stopped accepting bitcoin as payment for vehicles." On May 21, Bloomberg ran an editorial stating that bitcoin's "price is completely disconnected from any practical use. It's useless as a means of payment and store of value (unless you're a criminal). Your crypto is worth only what the next buyer will pay--and that could be an awful lot less than you hope." In investment markets, it was ever thus. As bitcoin started its post-December 2017 crash, EWFF observed:

Bear markets are always more volatile than bull markets. Yet-higher volatility will further damage bitcoin's role as a medium of exchange, which will destroy its role as a store of value. The currency has always been vulnerable to this vicious cycle.

The attacks in more public forums are occurring because the vicious part of the cycle is underway once more. But this is not to say the optimism is in any way extinguished. Bitcoin hedge funds are reportedly treating the decline "as nothing more than a sale." Here's a quote from a Singapore-based hedge fund operator on May 21: "Every time we see massive liquidation is a chance to buy. I wouldn't be surprised if bitcoin and ethereum retrace the entire drop in a week." On May 19, Bloomberg reports that a well-known investment manager is "keeping the faith." "We go through soul searching in times like this," she says. "Our conviction is just as high." Bloomberg's headline says she's still a "Bitcoin Believer, Sees It Going To $500,000." Our guess is that it will not be the last wild bitcoin prediction.

FREE REPORT: "Crypto Trading Guide"

For Crypto Traders and Just "Crypto-Curious"...

When it debuted in 2009, one Bitcoin was worth ~0.5 a cent. By 2011, it suffered one blow after another, from hacking and theft, and remained currency-non-grata to most of the world.

But the contrarians at Elliott Wave International saw Bitcoin's potential as early as 2012; quote:

"Presuming Bitcoin succeeds as the world's best currency -- and I believe it will -- it should rise many more multiples in value over the years."

Result: What happened next... well, you already know.

The question is, how do you ride Bitcoin's upcoming twists and turns? (And there will be many!)

EWI's free crypto report gives you 5 clear Bitcoin strategies.

Read EWI's "Crypto Trading Guide: 5 Simple Strategies to Catch the Next Opportunity" now.

This article was syndicated by Elliott Wave International and was originally published under the headline The Bitcoin Crime Wave Hits. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.