AI Stocks Strength vs Weakness - Why Selling Google or Facebook is a Big Mistake!

Companies / AI Jun 14, 2021 - 04:27 PM GMTBy: Nadeem_Walayat

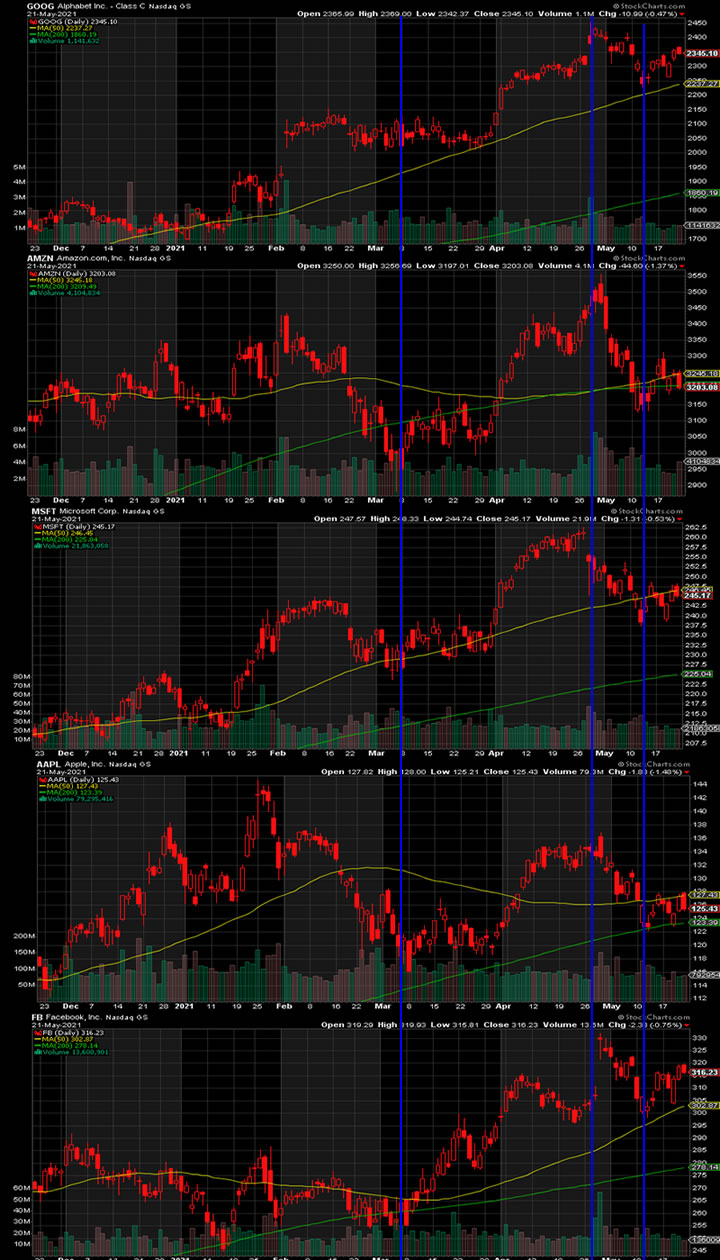

Stock market corrections are useful in gauging what is going on under the hood of corporations long before any information makes it into the public arena. For instance looking at the relative strength of the top 5 AI stocks shows Google and Facebook showing relative strength, whilst Apple and Amazon are showing relative weakness with Microsoft in the middle. What this is saying is that one should definitely NOT make the mistake of Selling Google or Facebook! Whilst as expected in my last AI stocks update Apple and Amazon are looking tired and so are unlikely to start galloping higher any time soon and thus set to under perform for some time. whilst Microsoft is doing its own thing somewhere in the middle.

In fact the EC ratio continues to prove to be a useful indicator as it flagged what to expect in terms of relative strength going into the correction i.e. that Google and Facebook would remain strong in relative terms whilst Apple would likely be the weakest of the 5, leaving Microsoft and Amazon to play piggy in the middle, I also note insiders have sold about $7 billion of shares in Amazon over the past 30 days. Which is why I suggested those who WERE looking to cash in profits could look to sell the more expensive stocks on my list such as Amazon, Apple, Microsoft and Nvidia.

I will be looking into further refining the EC indicator in my next update so as to enhance the deviation between stocks in terms of valuations.

In the meantime I will definitely be looking for an opportunity to buy more Google and Facebook stock over the coming weeks and maybe Amazon and Microsoft in line with my last analysis. Whilst Apple would need to fall quite some way to under $110 before I would contemplate adding as Apple remains over valued.

The rest of this extensive analysis that concludes in my latest biotech stocks with the potential to X10 over the coming years Five More Small Cap Bio and Tech Stocks to Invest for 2021 and Beyond! has first been made available to Patrons who support my work.

Topics Include:

- Invest and Forget

- Stock Market Early Summer Correction Review

- AI Stocks Strength vs Weakness

- RAMPANT MONEY PRINTING INFLATION BIG PICTURE!

- HIGH RISK STOCK BUYING LEVELS

- RISK RATINGS

- WESTERN DIGITAL - WDC $71 - CHIA! - Risk 1

- Life Sciences Biotech Smaller Cap High Risk Stocks Investing Binge

- Biotech stock 1 - Cheap Low Risk Pharma - Risk 1

- Biotech stock 2 - HIGH RISK GENE EDITING - Risk 9

- Biotech stock 3 - Low Risk 2

- Biotech stock 4 - X10 for Max Risk 10

- High Risk Stocks Portfolio Buying Levels

- Covid India Black Mold Epidemic

- Bitcoin and Raven Coin Buying Levels

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- Bitcoin Trend Forecast - 80% done

- More X10 Biotech Tech Stocks - 50% done

- UK House Prices Trend Analysis - 10% done

- How to Get Rich! - 70% done

- US Dollar and British Pound analysis

- Gold and SIlver Price Analysis

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst investing in biotech stocks.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.