Here’s Why Historic US Housing Market Boom Can Continue

Housing-Market / US Housing Jun 19, 2021 - 11:59 AM GMTBy: Stephen_McBride

Over the past few weeks, I’ve been getting the same question. And it’s an extremely important one.

Over the past few weeks, I’ve been getting the same question. And it’s an extremely important one.

US housing prices are rising at the fastest pace since 2006. Can this possibly continue? I’ll get the short answer out of the way first—YES. In fact, my research says we’re just getting started. And it all has to do with one key metric.

I’ll explain what that is in a moment, as well as the #1 way to take advantage of it. But first, let’s look at where we are today.

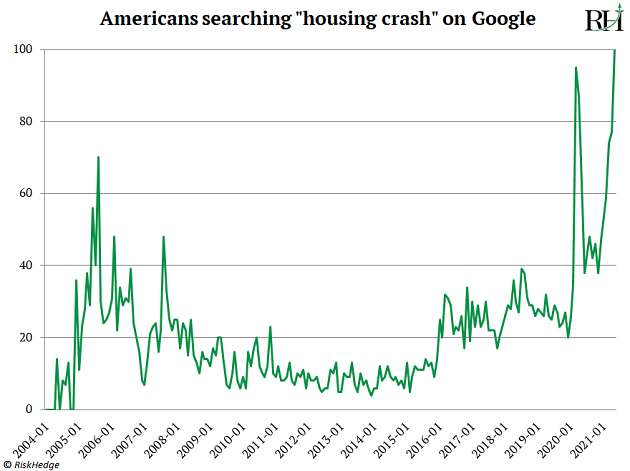

The number of Americans typing “housing crash” into Google hit a record high

Take a look:

Recently, the White House said it was “concerned about rising US home prices.” Look, there’s no denying housing prices have taken off like a rocket in recent months, and I’ve been calling it over the past year.

The number of Americans buying new houses recently spiked to a 15-year high. National Association of Realtors (NAR) data shows house prices are rising at the fastest pace since 2006. The CEO of homebuilder Toll Brothers recently said, “We are currently experiencing the strongest housing market I have seen in my 30 years.”

In short: Housing is as strong as it’s been since the 2008 housing bubble. So it makes sense that many folks are nervous.

The ‘08 housing crash was one of the most financially disruptive events of the century. Housing is what I call a “hot stove” investment. It burned a whole generation of Americans, and they’ll be damned if they ever touch that stove again.

But when you check the housing market’s “pulse,” you’ll see this boom is nothing like the ‘08 bubble. And it has to do with one key metric most folks are ignoring today.

Housing is still very affordable for most Americans

Housing affordability is an important driver of home prices. The National Association of Realtors affordability index takes three key metrics—home prices, mortgage rates, and wages—and boils them down into a single number.

This number tells us if the average Joe can afford a home. When this affordability number drops too low, it means the average American can't afford to buy. That often forewarns a housing bust.

Affordability has dipped from generational highs in the past few years. But it’s still well above the 30-year average. In fact, the index hit 173 last month, which is one of the “most affordable” readings since records began in 1971.

This is key because every housing bust in the past 50 years happened when affordability was below 120. We’re nowhere near that level today, which tells us the risk of a “bust” is much, much lower than the media will have you believe. Put another way: there’s no evidence folks should be worried about a housing blowup.

I recently picked up the phone and called housing expert Barry Habib

If you don’t know Barry, he’s the founder and CEO of leading real estate advisor MBS Highway. He’s an “insider’s, insider.” He spends his days talking to the biggest players in the US housing market. In short, he knows what’s really going on in housing.

I grilled Barry on affordability, and here’s what he told me:

“Stephen, people talk about affordability as being a problem. That’s because they look at the wrong metrics. This is the seventh most affordable market on record.”

Barry said folks are looking at record high median home prices, which is misleading. Regular RiskHedge readers know there’s a massive shortage of homes in America today. In short, there are almost no low-end homes on the market today. So buyers are being forced to bid on bigger homes, which is “skewing the median home price higher.”

And as I mentioned, affordability isn’t just the price you pay for the house. You also have to factor in mortgage rates and wages. Barry emphasized low rates and rising wages have more than offset the bump in real estate prices:

“Stephen, if interest rates stay stable, a 2% rise in income can handle a 10% rise in home prices. And right now, weekly earnings are going up at 7%. So can we handle 10% appreciation? 15%, 20%? Easily.”

With mortgage rates still near record lows, the average American’s monthly payment is less than what it was in 2005, 2006, or 2007!

Buying homebuilder stocks is my #1 way to play the housing boom.

Remember, there’s a massive housing shortage in America right now. And the solution to America’s housing woes is simple: Homebuilders HAVE to build more houses. And after years of sitting on their hands, builders are finally getting back to work.

Last month, new home “starts” shot up to their highest level since June 2006. The number of building permits granted surged to their highest level since March 2007.

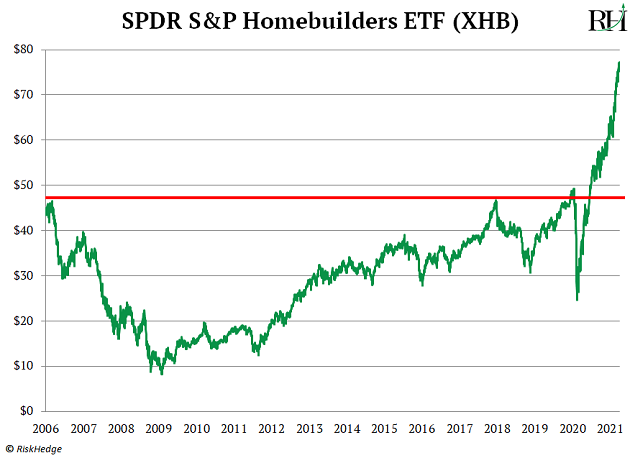

That’s why I’ve been pounding the table on homebuilder stocks. The Homebuilders ETF (XHB) debuted on the stock market in May 2006. It basically nailed the top of the housing market. Homebuilder stocks cratered 80%+ over the next three years as the bubble deflated.

In fact, homebuilders have struggled to get back above their 2006 highs. The $46/share level proved to be a “ceiling” in 2006, 2018, and March 2020. But look what happened in just the past few months:

Homebuilders conclusively broke above that former ceiling after 14 years of being stuck in no man’s land. I believe this marks the start of a new housing boom that will see homebuilders rip higher in the coming years.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2021 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.