Fed 'Narrative Nonsense' Rattles Precious Metals Investors

Commodities / Gold and Silver 2021 Jun 25, 2021 - 06:35 PM GMTBy: The_Gold_Report

Sector expert Michael Ballanger explains how recent statements by the Federal Reserve could prove hazardous to one's wealth. In the past week, precious metals investors, speculators and traders have been forced to apply all kinds of salves, balms and ointments to jangled nerves, rattled resolve and battered net worth statements, all directly the result of an unexpected shift in the official narrative on interest rate policy released during Wednesday's Federal Open Market Committee (FOMC) statement.

Arriving like a thief in the night, the Fed's intentions were obvious and came on the heels of same fairly harsh anti-commodity-speculation rhetoric from the halls of the CCP (Chinese Communist Party) and its attack dog central bank. The Chinese are the commodity vacuum hose in a world already starved for new supplies, but we all know that if they are jawboning against rising raw material prices, you just know it is because they are buyers. It is like reading a Goldman Sachs "Buy" recommendation on anything; once you realize that their prop-desk is always long anything they advise their clients to buy (and at prices demonstrably lower than current ones), you are considerably ahead of the game.

Similarly, the Federal Reserve Board, led by former Goldman stock peddler Jerome Powell, are masters at talking out of one side of their mouths while saying (and doing) something completely different on the other side. Years ago, only after being forced to eat out of dog food cans and after becoming expert in patching up pockets hanging pitifully out of pants, I became convinced that the Fed never says or does anything that its member banks aren't positioned for. Call me a cynic and I will buy you a beer, because it became the only way I could afford to do so—and to coin a well-learned phrase, "naivete breeds poverty," especially when dealing with the Fed.

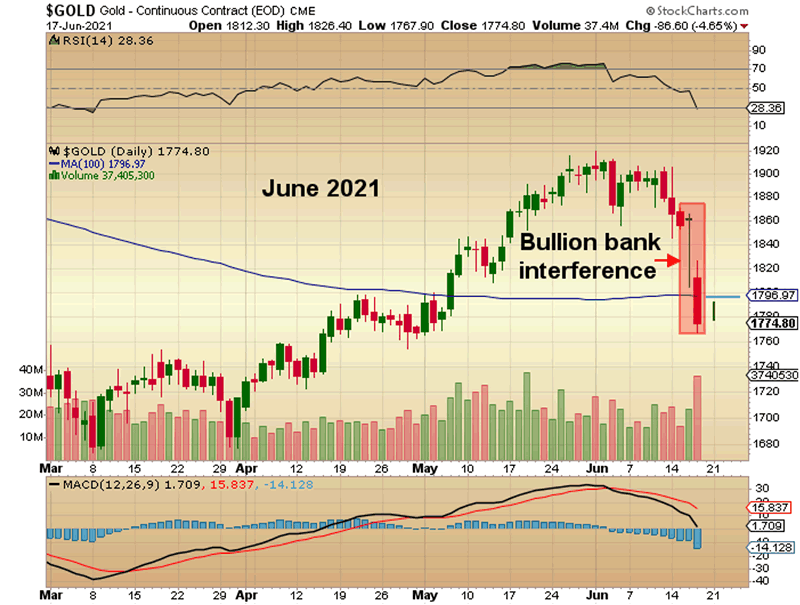

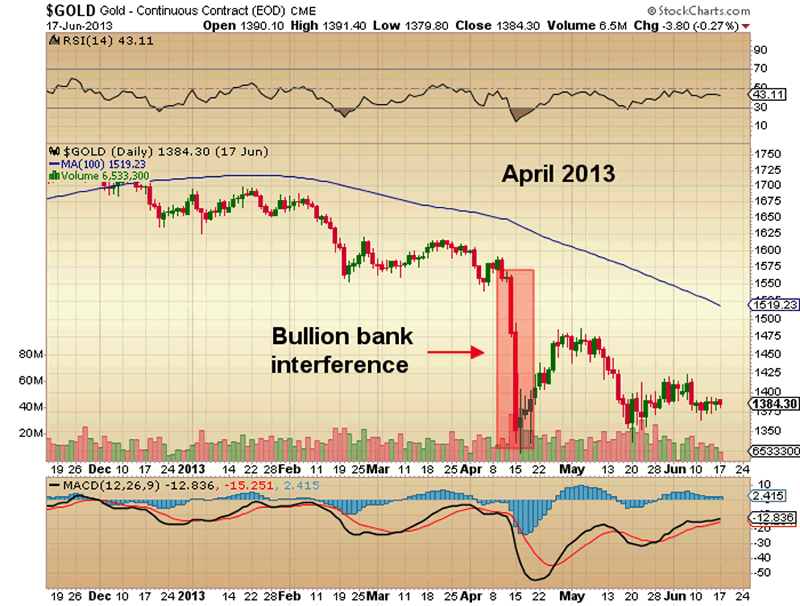

As gold and silver went "downside vertical" this past week, the only noises louder than the screams of protest from gold bug newsletter community were the noises of the gold and silver permabulls tweeting out with terminal ferocity that "they can't raise rates or they will implode the system!" To this, I would only reply in Santayana-type logic that those who would fail to remember errors from the past (as in April 2013) are condemned to repeat them, followed by "Why can't the Fed implode the system?" If the member banks to whom they are blood-bound and fused are "short the system," they will crash markets in a flash.

I found it so completely laughable watching all of the posts and tweets and podcasts crying "Foul!" as one seemingly innocent remark about "rate hikes in 2023" sent everything except (of course) the tech stocks (which are undoubtedly owned by the Wall Street banks) crashing. Not that six months of raging inflationary pressures and commodity price escalation was ever going to be allowed to continue, but the reaction of the investment community is so typical of the recency bias that haunts most investors. "They" (the Wall Street Masters of Finance) cannot raise interest rates, so what they project is a feint, a carefully worded fakeout followed by an outright intervention in the futures markets designed to send a forceful message to those that would nurture "inflationary expectations."

What happened this week was a very familiar chapter out of the Fed's well-used and tattered playbook and I might add, a playbook far less covert than in past times. This was a blatant act by a desperate Fed to ensure that the Powell use of the adjective "transitory" would carry into the future an insulated legacy.

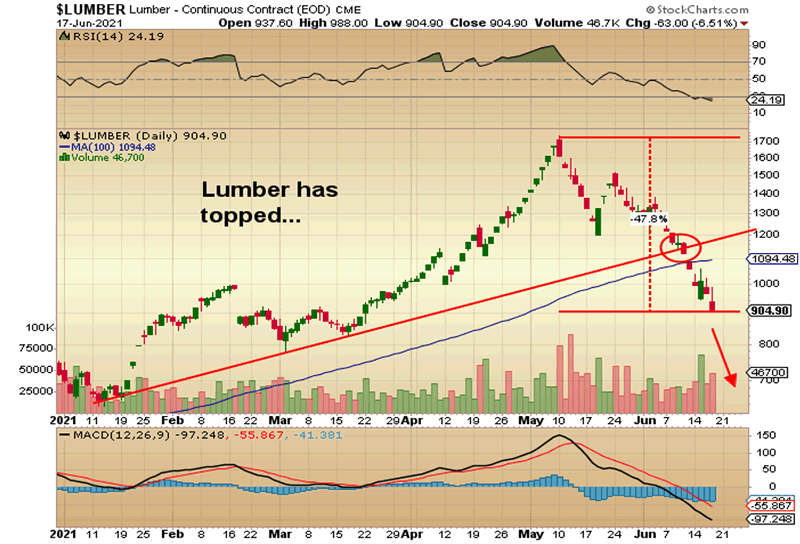

Another sign of the Fed "getting their way" can be seen in the chart of lumber, currently trading down 47.8% from the May peak. This would also imply the massively overvalued housing market is ripe for a—let's call it a "slowdown," rather than a crash or bloodbath. (Have you seen the prices being paid for two-bedroom townhouses these days?)

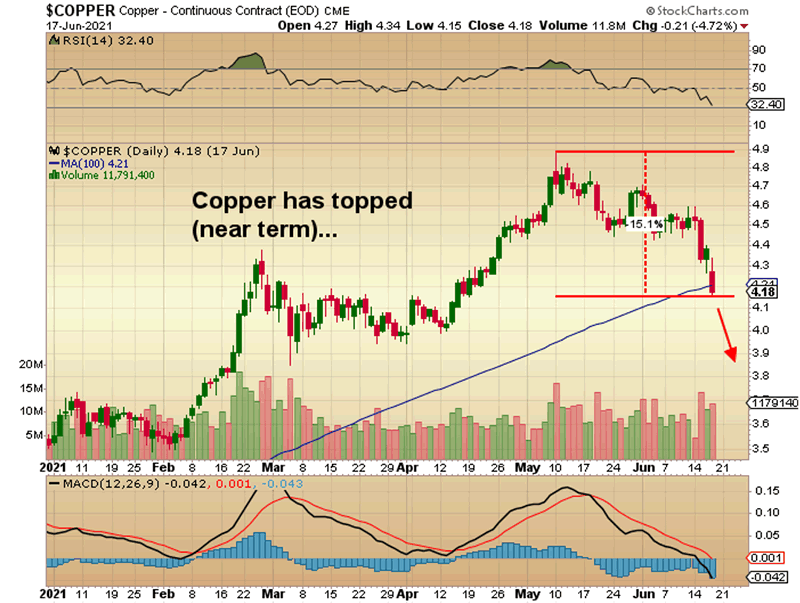

Also reeling back on its heels is the price of copper, one commodity whose fundamentals are going to be driven by shrinking mine supply and accelerating electrification demand. As I have written since copper was in the mid-$3 range, it is a compelling story and one that I still maintain will play out favorably for the bulls. However, if China, the Fed and the member banks all want copper under $3.00, then that is precisely where it is going.

These markets have nothing to do with fundamentals; they are completely driven, managed and controlled by the "narrative." While it remains total nonsense, failure to heed the desired narrative has been proven to be seriously hazardous to one's wealth.

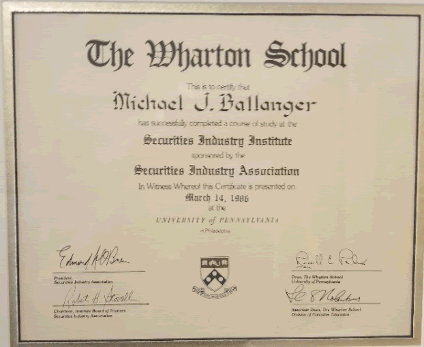

In the early 1980s, I attended the Securities Industry Association's three-year course (lasting for one week each year) at Philadelphia's esteemed Wharton School of Finance, located at the University of Pennsylvania. During the second year, I listened to a lecture from a hedge fund manager named Robert Gordon, who was a disciple of the late Ivan Boesky, jailed in the '80s for insider trading, during which Gordon made a statement that has stayed with me for over forty years. "If you listen to the Fed," he said, "they always say exactly what they are going to do." But then he added, "It's just that sometimes it is in a different language."

No truer words were ever spoken with regard to the Fed, and no greater relevance has ever existed than in its significance to the world in which we currently live. The current narrative being promoted by the Fed is that "inflation is transitory," and yet the smugness with which the gold bug community sluffs it off is shockingly naïve. As we now know, one utterance of the word "taper" (as in "rate hikes") sends the prices for all things "non-paper" crashing through the floorboards. In other words, if Jerome Powell wishes inflation to be "transitory," then it bloody well will be transitory—period. Such is the state of the capital markets under the iron-fisted rule of the omnipotent Fed.

By the way, the best part of the Wharton School course was listening to former Wall Street Week guest Julius Westheimer (the only retail salesman ever invited to the show) explain why he never carried business cards. "If I give you my card, it is your choice as to whether you contact me," he said with a mischievously wry smile. "But, if I have yourcard, it is my choice as to whether I contact you, which I will, within hours!" Then they handed me a shingle with "The Wharton School" plastered at the top, giving the impression that I graduated "cumma sum laude" from the MBA program, when in fact I spend the last three days of Year Three raising hell in Atlantic City.

Last week ended with precious metals attempting a rebound, but I still think that a better entry will occur later this week. It is obvious to anyone with a pulse that the metals have suffered a mortal wound technically, and despite the relative strength index (RSI) numbers moving into oversold status under 30, it is important to remember that at the lows in March 2020 (when subscribers were handed the "Generation Buying Opportunity" for the GDX and GDXJ; "shameless plug"), RSI plunged to well below 20, as gold miners went essentially "no-bid" at the tail end of the COVID crash.

It may be too late to sell with markets so oversold, but I thought the same thing in April 2011, with gold down from $1,908 to $1,525, but once the interventions were completed, gold simply continued down to the 2015 lows of $1,045, not because fundamentals warranted it, but more because the Wall Street Masters ordered it.

Finally, if I hear or read one more time that I "don't get it," I will be forced to remind everyone that if you carry into the locker room the battle scars that I have on arms, legs and back, you are forced by the cruelty of mirrors to recall the financial agony incurred in past campaigns. I am not a gold bug; I am a gold advocate. I am not a #silversqueeze disciple; I am a silver acquirer. Finally, I am not a precious metals devotee; I am a precious metals, slash-and-burn trader, and my wide-eyed allegiances were jettisoned along with marriages, friendships and lost cottages a great many years ago.

As to the junior developers, I am of the belief that having one's fortunes tied to execution and events is far superior to being slave to "macro" conditions. One of the greatest passes I ever made was in the middle of the 1981–1982 bear market in stocks (and during the long bear market in gold), with the Hemlo gold discovery of 1981. The developer names I hold are all fully funded and actively engaged in the process of either defining or expanding their resources, which means that exploration or corporate finance surprises can often outweigh any suppressive macro environment. Of course, it is an easier task when the macro tailwinds are there, but we cannot rely on that after the Fed's warning shot this week.

My final parting comment on the week ended June 18 is this: Never, ever trust anything that you hear or read when it comes to the financial media. They are totally and completely compromised and controlled by the Wall Street and Washington spin machines. "Buy" means "Sell," and "technical breakouts" should be sold and "technical breakdowns" bought. These architects of illusion make their living off the carefully crafted narrative that sounds so convincing that you keep piling on right up to the point where you realize that you are in a Ponzi-ficated poker game, and it is you that is the patsy.

Follow Michael Ballanger on Twitter @MiningJunkie. He is the Editor and Publisher of The GGM Advisory Service and can be contacted at miningjunkie216@outlook.com for subscription information.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. 2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.