Is Wise Really The King of Online Money Transfer Services?

Personal_Finance / Forex Trading Aug 04, 2021 - 06:01 PM GMTBy: Boris_Dzhingarov

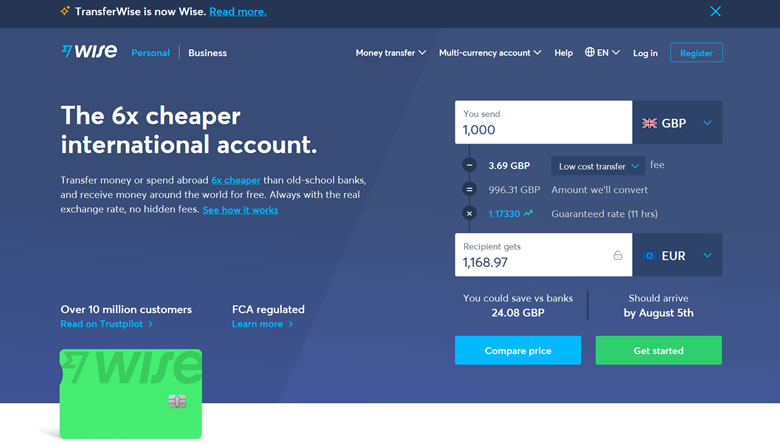

Wise, formerly known as Transferwise, has generated tremendous success and hype over the past 10 years in the online foreign exchange transfer industry. Granted, the company is one of many that offer consumers a nearly identical service of transferring funds from one currency to another.

But what separates Wise from so many UK currency brokers is the fact that its two co-founders scaled a solution to a personal problem to become an industry titan.

Wise Co-Founders Shared An Identical Money Transfer Services Problem

Kristo Kaarmann, a native of Estonia, was working in London for the multinational firm Deloitte and was paid in pounds. But each month he had to transfer money to an account in Estonia to pay for a mortgage in his home country.

Kristo was using his high street bank account to transfer pounds to euros and had no option but to accept the bank’s 5% makeup on the foreign exchange transfer. He said in a 2019 BBC interview he was “incredibly stupid” for assuming his bank would provide the same exchange rate listed on Reuters or Bloomberg.

But at the time there was no option to accept the fees as it was the cost of doing business. That is until he met Taavet Hinrikus, a fellow Estonian ex-pat living in London.

Taavet, Skype’s first-ever employee, was paid in euros as Skype is domiciled in the European Union. This means he needed British pounds to pay for his day-to-day life.

As it turns out the two shared the exact same problem from the opposite side of the transaction. What Kristo had Taavet needed and what Taavet had Kristo needed. If only there was a way for the two to work together and avoid the middleman.

Indeed there was. And it was actually quite simple.

Each month, the two would look up the British pound and euro exchange rate for their own private foreign exchange transfer. Taavet deposited euros into Kristo’s Estonian bank account while Kristo put pounds into Taavet’s bank account using the actual exchange rate.

Since no banks were involved, the two were able to transact with each other at the real foreign exchange rate. And this is how the concept of Wise was born: what if millions of people can transact with each other in a similar way.

The Wise Business Model: How Wise Works

Wise has stayed true to its original purpose of helping two people transact more efficiently with each other. The way it works is quite simple: Wise has company bank accounts located all across the world and each is funded in the local currency.

The technology behind the scenes will complete a transaction in the same way Taavet and Kristo did the very first time.

Suppose you live in the UK and have a friend who is studying a semester abroad in France. If you wanted to transfer them money you would essentially make a deposit into Wise’s UK-based bank account and at the same time, Wise’s France-based account will withdraw euros to the recipient’s account.

Unlike pretty much every other foreign exchange transfer service, Wise money doesn’t technically move money across borders.

By no means was Wise the first to create a system of exchanging one currency for another, that has existed for centuries. But what it did do is challenge the status quo and give consumers a new option where banks can no longer operate under the assumption it can get away with charging consumers whatever they want.

Taking Over The Money Transfer Service Sector By Storm

The vast majority of start-ups can trace their roots to someone’s basement or kitchen. Kristo’s kitchen played double-duty as office space until January 2012, nearly a full year after its first employee was hired.

Within two years Wise was handling more than £1m a day in transactions and the company caught the attention of Sir Richard Branson and Peter Thiel who both became shareholders. By 2017 Wise was able to accomplish a rare feat for startups: turning and sustaining a profit.

By 2020 Wise was valued at £3.58 billion in the private market. Within one year the company doubled in valuation to £7 billion when it became a public company on the London Stock Exchange.

Is this a fair valuation for a company that is still relatively young? By comparison, Paypal Holdings is worth $333.74 billion (£238.5billion) so it is technically a drop in the bucket compared to one of the most recognized leaders in the global money transfer and exchange services business.

As part of the IPO process, Wise said it grew revenue at a 54% compounded annual growth rate from fiscal 2019 to fiscal 2021 while profit before tax more than doubled to £41 million from 2020 to 2021.

Looking forward the company expects revenue growth to moderate to a 20% compounded annual growth rate over the medium-term.

These are impressive numbers for a still-young company so a £7 billion company just getting started on its journey to challenge the status quo seems reasonable. It is unlikely that Wise will command a similar valuation compared to PayPal but even if it achieves 25% over the long-term it will imply a valuation of nearly £60 billion which would imply investors will see a fantastic rate of return.

Bottom Line: Wise Continues To Gain Attention

Wise still competes against big banks in the global money transfer services industry but it is showing no signs of slowing down. The company continues to innovate in the space and is investing heavily in technology, including artificial intelligence and to provide consumers with an even better experience banks can’t match.

By Boris Dzhingarov

© 2021 Copyright Boris Dzhingarov - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.