This Boom-Bust Cycle in US Home Ownership Should Give Home Shoppers Pause

Housing-Market / US Housing Sep 09, 2021 - 10:51 AM GMTBy: EWI

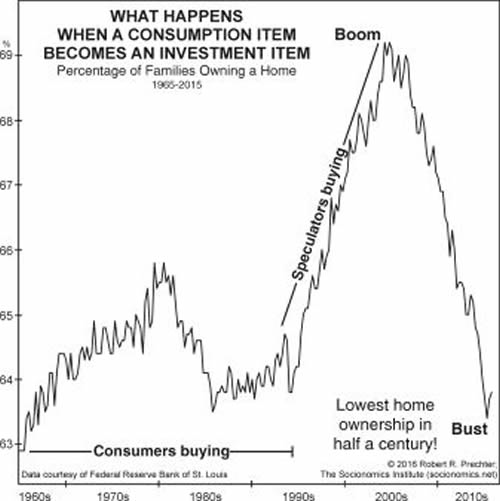

Here's "what happens when a consumption item becomes an investment item"

On a news / talk radio station in my local area, a commercial that frequently runs goes something like this:

"I buy all kinds of houses: big houses and small houses, condemned houses, foreclosed houses, 'my tenant won't pay the rent' houses ..." and on it goes. The speaker says he's a real estate investor and provides his phone number.

Real estate speculation like this helps drive home prices up across the country.

Indeed, on August 27, a financial firm's chief investment officer told CNBC:

"I feel bad for the people who bought homes over the past year because they're the ones that paid the very elevated prices."

The investment officer mentions that if a buyer puts down 5% and home prices correct 10%, the equity is "basically wiped out."

So, what's the likelihood that recent homebuyers will feel financial pain anytime soon?

Well, it's possible that the homeownership boom could continue for a time longer. Then again, if history is a guide, the "bust" part of the equation may be just ahead.

Robert Prechter explains with this chart and commentary from his landmark book, The Socionomic Theory of Finance:

From 1995 to 2006, many speculators built or bought housing and other properties in anticipation of higher prices, thereby treating formerly economic items as financial items. Market participants' shift in mental orientation from a producing or consuming mindset to a speculative mindset changed their behavior, resulting in a classic boom and bust.

So, this might not be the ideal time to buy a house. Even so, sales have ticked up despite skyrocketing prices (Reuters, August 24):

Sales of new U.S. single-family homes increased in July after three straight monthly declines ... .

Of course, everyone needs a place to live, but if current home shoppers can wait, big bargains in real estate may be just around the corner.

Watch the stock market because its trend tends to correlate with housing prices.

The best way to analyze the stock market is by using the Elliott wave model.

Indeed, here's a quote from Frost & Prechter's book, Elliott Wave Principle: Key to Market Behavior:

After you have acquired an Elliott "touch," it will be forever with you, just as a child who learns to ride a bicycle never forgets. Thereafter, catching a turn becomes a fairly common experience and not really too difficult. Furthermore, by giving you a feeling of confidence as to where you are in the progress of the market, a knowledge of Elliott can prepare you psychologically for the fluctuating nature of price movement and free you from sharing the widely practiced analytical error of forever projecting today's trends linearly into the future. Most important, the Wave Principle often indicates in advance the relative magnitude of the next period of market progress or regress. Living in harmony with those trends can make the difference between success and failure in financial affairs.

You can access the online version of this Wall Street classic for free once you become a Club EWI member.

Club EWI is the world's largest Elliott wave educational community and is free to join. Members enjoy free access to a treasure trove of Elliott wave resources on financial markets, investing and trading.

Get started by following this link: Elliott Wave Principle: Key to Market Behavior -- free and unlimited access.

This article was syndicated by Elliott Wave International and was originally published under the headline This Boom-Bust Cycle in Home Ownership Should Give Home Shoppers Pause. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.