Markets Deflationary Winds Howling

Stock-Markets / Financial Markets 2021 Sep 25, 2021 - 09:38 PM GMTBy: Monica_Kingsley

Without looking back, S&P 500 rallied in what feels as a short squeeze in ongoing risk-off environment. Daily rise in yields was not only unable to propel the dollar, but resulted in a much higher upswing in tech than value stocks – and that‘s a little fishy, especially when the long upper knot in VTV is considered.

The post-Fed relief simply took the bears for a little ride, and the Evergrande yuan bond repayment calmed the nerves. As if though the real estate sector was universally healthy – I think copper prices and the BHP stock price tell a different story. Things will still get interested in spite of PBOC moving in. The current macroeconomic environment will be very hard (economically and politically) to tighten into – have you noticed that the Turkish central bank unexpectedly cut rates?

As I have written yesterday :

(…) If June FOMC showed us anything, it was the power of (cheap) talk. We‘ve gone a long way since inflation‘s (getting out of hand) existence was acknowledged – yesterday, we were treated to very aggressive $10-15bn a month taper plans, cushioned with the „may be appropriate“ and Nov time designations. Coupled with the few and far away rate hikes on the dot plot, something fishy appears going on.

While the real economy recovery progress has been acknowledged (how does that tie in with GDP downgrades and other macroeconomic realities I raised in yesterday‘s extensive analysis?), I think that the bar is being set a bit too high.

Almost as if to give a (valid) reason for why not to taper right next. And the theater of taper on-off could go on, otherwise called jawboning, as markets reaction to this fragile phase of the economic recovery (marked by increasing deflationary undercurrents as shown by declining Treasury yields and contagion risks – make no mistake, Evergrande is the tip of the iceberg, real estate has been heating up over the last 1+ year around the world, and in the U.S. we have BlackRock mopping up residential real estate supply, underpinning high real estate prices especially when measured against income). Don‘t forget the weak non-farm payrolls either when it comes to the list of excuses to choose from.

At the same time, we have not been entertained by the debt ceiling drama nearly enough yet. Right, the Fed is projecting the aura of independence, which made a Sep decision all the more unlikely. And who says we‘re short of drama these days?

Given the S&P 500 sectoral performance and not exactly stellar market breadth, this is the time to be cautious, if you‘re a bull. Precious metals haven‘t yet caught the safe haven bid, but aren‘t decisively declining either. Dialing back the risk in stocks makes select commodities more vulnerable – copper more so than oil or natural gas, and cryptos are a chapter in its own right.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

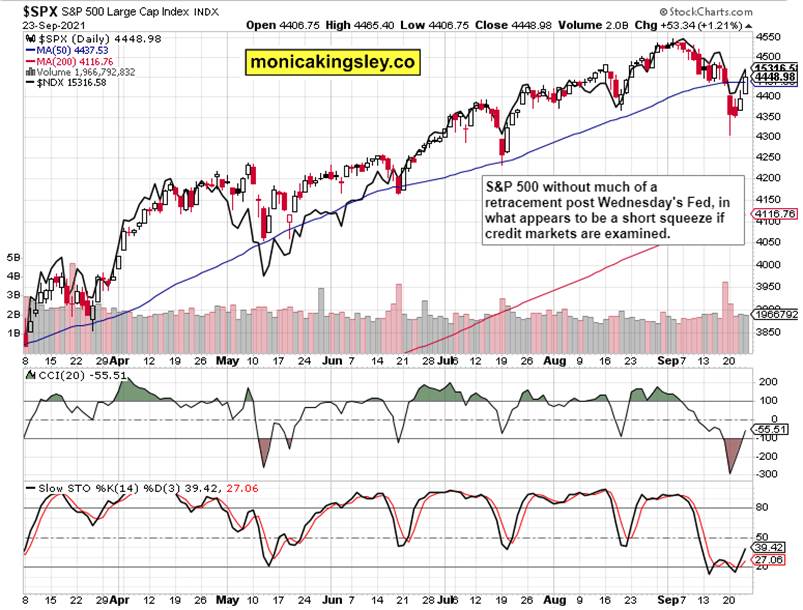

S&P 500 and Nasdaq Outlook

The bulls closed yesterday on a strong note, but the upswing was arguably a bit too steep on a very short-term basis.

Credit Markets

High yield corporate bonds giving up their intraday gains coupled with rising yields in quality debt instruments, that‘s not entirely a picture of strength in the credit markets.

Gold, Silver and Miners

Gold declined on the no Fed taper celebrations, and the sectoral weakness is concentrated in the miners. When it comes to silver, the white metal would be influenced by the copper woes – look for good news on the red metal front before expecting the same for silver, that‘s the short-term assessment.

Crude Oil

Oil stocks performance lends credibility to the oil upswing, and black gold‘s chart is still bullish – energies are likely to do well even if any CRB hiccups occur.

Copper

Copper hesitation is back, and both the bulls and bears are waiting as shown by the low volume. The bears have the advantage here.

Bitcoin and Ethereum

Summary

Yesterday‘s risk-on turn is likely to get questioned, with one day delay – revealing that it‘s not about the Fed setting a tad unrealistic taper pace and conditions. With no fresh stimulus coming, financial assets are facing a fiscal cliff in their own right, that‘s the big picture conclusion, which should temper the bullish appetite across many an asset class.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.