How to profit off the Acquisition spree in Fintech Stocks

Companies / Fin Tech Oct 01, 2021 - 10:12 PM GMTBy: Stephen_McBride

By Justin Spittler: A buying frenzy is underway on a stock not many investors have heard about…

Even fewer have positioned themselves to cash in on it.

But RiskHedge subscribers have been making a killing off this buying frenzy.

I’m talking about returns of 47% and 35% in a single day.

In a minute, I’ll share the name of the stock that’s delivering these fat returns. And how you should play it to take advantage.

But let’s start by looking at what’s unfolding…

- Two weeks ago, mobile payments giant Square (SQ) acquired Afterpay (AFTPY) for $28 billion…

Afterpay is a leader in the booming “buy now, pay later” (BNPL) space.

BNPL lets consumers break up their purchases into installment payments without racking up interest or fees.

News of the buyout caused shares of Afterpay to surge 44% in just four days.

And that’s hardly the only huge news to come out of the BNPL space lately.

Two weeks ago, PayPal (PYPL) announced it’s going to acquire Japanese BNPL firm Paidy for $2.7 billion.

- You’re probably wondering why these fintech giants are investing billions into BNPL…

It’s quite simple.

BNPL’s popularity is skyrocketing.

Last year, US BNPL payments hit $19 billion. That’s twice as big as the market was in 2019.

Consumers are embracing BNPL for a couple of reasons.

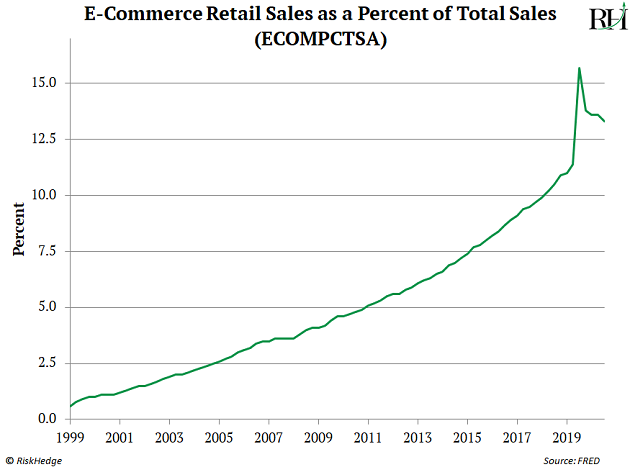

For starters, online shopping grew like crazy last year thanks to COVID-19. See for yourself. Online shopping now accounts for more than 13% of all sales. That’s up from just from 4.7% a decade ago!

This is important because BNPL is mostly used for online shopping. So, the spike in online shopping has led to a big spike in folks seeing and choosing BNPL as an option.

And BNPL is often cheaper than putting large purchases on a credit card. Most credit card companies charge outrageous interest rates of 20%+. Most BNPL options, on the other hand, don’t charge any interest as long as you adhere to the payment schedule.

And many folks using BNPL to buy stuff online because it allows them to shop without racking up huge amounts of credit card debt or paying steep interest rates.

And there’s no reason to think this won’t continue.

In 2019, US consumers paid $121 billion in credit card interest. That’s in addition to $3 billion in late fees and $11 billion in overdraft fees.

It’s no wonder that young consumers are using BNPL to buy computers, designer clothes, and other high-ticket items.

- I believe pretty soon, every major online retailer will offer BNPL as a payment method to its customers. …

And I don’t just say this because Square and PayPal are now offering BNPL solutions.

A flurry of BNPL companies have inked partnerships with giant retailers in the past year.

You can now use BNPL to buy stuff off Amazon (AMZN) or through Shopify (SHOP). In Canada, you can use it to buy iPhones, iPads, and other Apple (AAPL) products.

Over the next two years, the BNPL segment share is projected to triple in size to 3% of total e-commerce payments.

In other words, there’s still time to make a killing off BNPL.

- Subscribers of my IPO Insider advisory are already profiting off this megatrend…

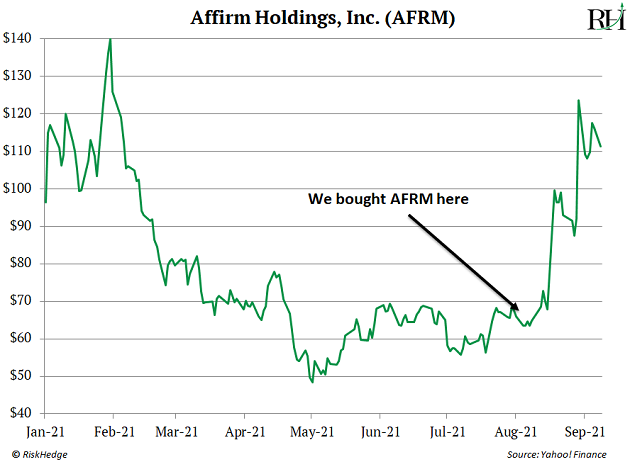

On August 9, I recommended Affirm (AFRM)—an undisputed leader in the BNPL space—to my readers.

Affirm is one of the most promising “fintech” companies to IPO all year. Its platform lets customers defer payments for goods and services without racking up interest, late fees, or penalties.

The company has more than 6.2 million customers. Collectively, those customers have made more than 17 million transactions on Affirm’s platform!

Affirm has partnered with 6,500 merchants in the US, including retail giant Walmart (WMT), interactive fitness pioneer Peloton (PTON), Shopify, Apple…

And even Amazon.

This was big news.

It’s Amazon’s first partnership with a “buy now, pay later” (BNPL) player.

Affirm’s partnership with Amazon will allow customers to split purchases of $50 or more into smaller installments.

News of this blockbuster deal caused Affirm to skyrocket 47% in a single day!

Less than two weeks later, Affirm’s shares soared by 34% after the company reported incredible quarterly results.

Affirm’s sales last quarter rose by 71%. The company also saw a 412% spike in the number of merchants using its platform, thanks to its partnership with Spotify.

To top it all off, Affirm’s total active users jumped by 97%. There are now more than seven million people using its platform.

IPO Insider subscribers are sitting on an 88% gain in only a month.

And I believe Affirm could easily grow into a $200 stock within the next 12 months.

But the stock has been on an absolute tear lately, so it’s currently a “hold” in the IPO Insider portfolio.

I wouldn’t chase it at these levels. I’d wait for it to consolidate or pull back before taking a new position.

- So you might be wondering…

How did I know Affirm was getting highly likely to explode?

It wasn’t because I had advance knowledge of the Amazon deal.

And I didn’t know Affirm would release blowout quarterly results.

Instead, its stock was displaying one key trait that, sooner or later, usually leads to a spiking stock price.

In next September 28’s RiskHedge Report, I’ll show you exactly how I knew Affirm was a screaming buy for IPO Insider subscribers.

It’s a strategy that my subscribers and I have repeatedly used to collect big, quick gains. It’s how we’re sitting on a 58% gain on ZoomInfo Technologies (ZI) in just 10 months… and a 44% gain in Axonics Modulation Technologies (AXNX) in only 11 months.

I’ll tell you all about this strategy next week…

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get our latest report where we reveal our three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

© 2021 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.