Why a Peak in US Home Prices May Be Approaching

Housing-Market / US Housing Oct 08, 2021 - 10:42 PM GMTBy: EWI

"Is it a good time to sell a house?"

"Is it a good time to sell a house?"

Some people buy a house solely as an investment.

Others want a better place to live -- perhaps more room for a growing family. The investment part is secondary. However, even people in this category would likely hold off on a purchase if they had an indication that lower home prices were just around the corner.

Well, there is such an "indication."

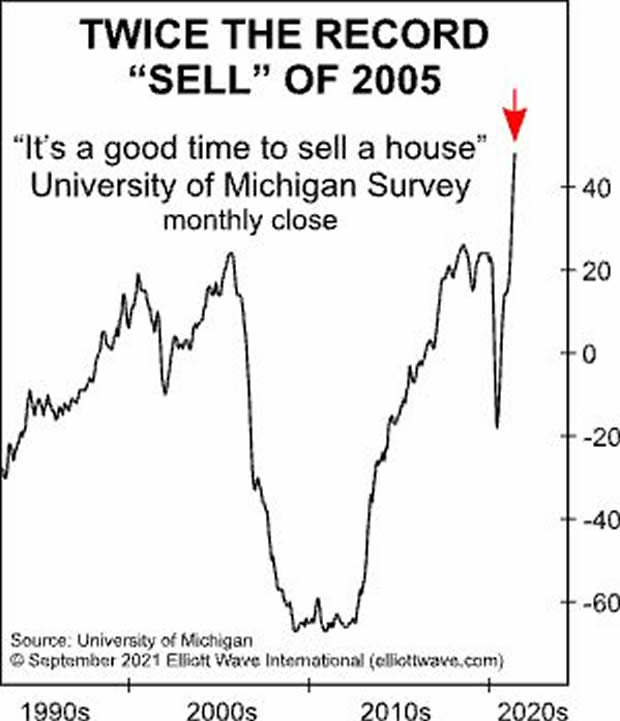

First, a little historical context: In 2005, near the peak of the prior housing bubble, a University of Michigan survey asked participants, "Is it a good time to sell a house?"

In August, September and October of that year, a then-record high percentage of participants said "yes." Eight months later, in June 2006, U.S. home prices topped.

With that in mind, the September Elliott Wave Financial Forecast, a monthly publication which provides analysis of major U.S. financial markets, explains what that same survey recently revealed:

[A] series of questions in the University of Michigan monthly sentiment survey tracks attitudes toward home prices. ... This chart shows affirmative responses to the question "Is it a good time to sell a house?" ... The latest reading of 48 is twice the peak reading at the end of the last housing boom. [This is] a more-than doubling from March to June of this year. [emphasis added]

This sentiment survey may not be a precise timing indicator. Recall the eight-month timespan between the 2005 survey findings and the 2006 peak in home prices. Yet, it is still a "heads up."

Also keep in mind this astounding headline (Marketwatch, Sept. 30):

Home prices have risen 100 times faster than usual during the COVID-19 pandemic [emphasis added]

So, in at least one way, the current housing mania is even more stark than the last one.

Of course, home prices might climb even higher... or not. Is there a way to go beyond guessing, though?

Yes. The stock market and housing prices tend to be correlated. If you know what's likely next for stocks, big-picture, then you also know what's likely next for real estate.

The best way to determine what is next for the stock market is to employ the Elliott wave model.

Here's what Frost & Prechter said in their Wall Street classic, Elliott Wave Principle: Key to Market Behavior:

It is our practice to try to determine in advance where the next move will likely take the market. One advantage of setting a target is that it gives a sort of backdrop against which to monitor the market's actual path. This way, you are alerted quickly when something is wrong and can shift your interpretation to a more appropriate one if the market does not do what you expect. The second advantage of choosing a target well in advance is that it prepares you psychologically for buying when others are selling out in despair, and selling when others are buying confidently in a euphoric environment.

No matter what your convictions, it pays never to take your eyes off what is happening in the wave structure in real time. Ultimately, the market is the message, and a change in behavior can dictate a change in outlook. All one really needs to know at the time is whether to be long, short or out, a decision that can sometimes be made with a swift glance at a chart and other times only after painstaking work.

If you'd like to read the entire online version of the book, you may do so for free when you become a Club EWI member. Club EWI is the world's largest Elliott wave educational community with about 350,000 members.

It costs nothing to join Club EWI and members are under no obligations. At the same time, Club EWI members enjoy free access to a wealth of Elliott wave resources on investing and trading.

Follow the link to have this definitive text on the Wave Principle on your computer screen in just a few minutes: Elliott Wave Principle: Key to Market Behavior (free and unlimited access).

This article was syndicated by Elliott Wave International and was originally published under the headline Why a Peak in Home Prices May Be Approaching. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.