To Be or Not to Be: How the Evergrande Crisis Can Affect Gold Price

Commodities / Gold and Silver 2021 Oct 24, 2021 - 10:52 PM GMTBy: Arkadiusz_Sieron

Evergrande is on the brink of bankruptcy. Will gold prices collapse together with the real estate developer or benefit from its default?

Evergrande is on the brink of bankruptcy. Will gold prices collapse together with the real estate developer or benefit from its default?

Generals are always prepared to fight the last war, while economists are always prepared to fight the last recession. But what if the next economic crisis doesn’t start in the US financial sector, but in China’s real estate?

Naturally, I refer to Evergrande, a Chinese developer with total liabilities of more than $300 billion — around 2% of China’s GDP! A default of one of China’s largest and most indebted companies could entail significant repercussions for the global economy.

Although the Evergrande crisis won’t necessarily be China’s Lehman Brothers moment (I will elaborate on this in the upcoming edition of the Gold Market Overview), it will certainly curb China’s economic growth. Actually, the slowdown has already begun, as the country’s GDP grew just 4.9% in the third quarter of 2021, much less than the 7.9% seen in Q2. It was the slowest pace recorded in a year.

The slowdown is not surprising. After all, China faces a massive energy crunch, shipping disruptions, and a burst of the property bubble. Until recently, the bubble was tolerated or even actively boosted as it drove income and growth, benefiting everyone: developers, authorities, and also ordinary citizens who placed most of their savings in real estate. The property sector has grown so much that it accounts for about 30% of China’s GDP! So, given the size of China’s economy, it has become one of the most important sectors in the world.

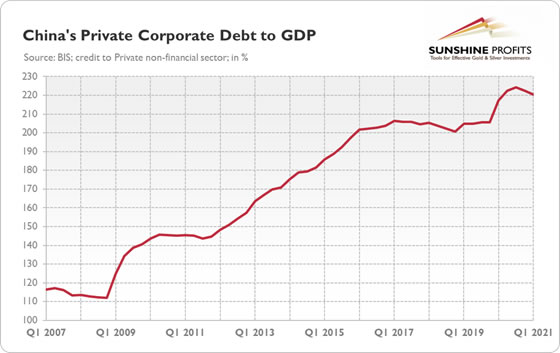

However, China’s government decided to curb excessive borrowing and deflate the bubble. Perhaps the irrational exuberance became too irrational – just think about all these ghost towns with millions of empty apartments, not to mention the surge in corporate debt from 112% of GDP in 2008 to 222% in 2020 (see the chart below). So, last year, China’s government introduced the policy of “three red lines” which made it much more difficult for large developers such as Evergrande to issue more debt. This tightening caused a liquidity crisis, as well as a drop in property investment by 4% in September.

Here is the problem: the government wants to move away from a growth model based on investment and debt, but the country hasn’t transitioned to a consumption-led model yet. Thus, given the size of China’s property sector and a lack of new growth engines, we should expect a further slowdown in China’s (and global) economic growth.

Implications for Gold

What do China’s economic problems imply for the gold market? Well, the price of gold hasn’t been affected by the Evergrande crisis so far, remaining stuck below $1,800. Although, please remember that gold is most sensitive to the US economy, and we haven’t seen any signs of contagion spilling over the Chinese borders yet. However, the slowdown in global economic growth caused by the burst of China’s real estate bubble should bring us closer to the stagflationatory scenario, which should be positive for gold prices. The deceleration in China’s economic growth could abruptly change the narrative about a solid recovery from the pandemic, making investors worry more about inflation. A slowdown in economic growth could also lower bond yields, which should be supportive for the yellow metal.

Furthermore, even though most of the pundits downplay the risk of financial contagion stemming from the collapse of Evergrande (or other Chinese real estate developers), such a risk exists. If it materializes, gold should shine as a safe-haven asset.

Another possible implication is that China might devalue the yuan again. As investments are weakening and consumption hasn’t become a sufficient driver of the economy, the government could bet on exports to support the GDP growth. This could trigger some safe-haven inflows into gold, but there are also some risks here. As I wrote in 2017, “in the summer of 2015, China devalued the yuan, which pushed global equities lower. Hence, a devaluation of the renminbi would imply an appreciation of the U.S. dollar, which does not sound good for the gold market.”

Thank you for reading today’s free analysis. We hope you enjoyed it. If so, we would like to invite you to sign up for our free gold newsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all our premium gold services, including our Gold & Silver Trading Alerts. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.