US Fed Interest Rate Actions 1999 to Present – What’s Next?

Interest-Rates / US Interest Rates Dec 15, 2021 - 01:00 PM GMTBy: Chris_Vermeulen

I find it interesting that so much speculation related to the US Federal Reserve drives investor concern and trends. In my opinion, the US Federal Reserve has been much more accommodating for the global economy after the 2008-09 US Housing Market crash. The new US Bank Stress Tests and Capital Requirements have allowed the US to move away from risk factors that may currently plague the global markets. What do I mean by this statement?

US Fed Continues To Maintain Extremely Accommodative Monetary Policy

Over the past 12+ years, after the 2008-09 US Housing Market collapse, the US Federal Reserve has acted to support the US and global economy while the US Congress and US Federal Reserve have acted to build a stronger foundation for US banking and financial institutions. The most important aspect of this is the Capital Requirements that require an operating US bank to hold a minimum amount of reserve capital (Source: Federal Reserve). The US Federal Reserve installed this program to prevent US banks from over-leveraging their liabilities based on the 2008-09 Housing Market Crisis lessons.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

There are still risks associated with a complete global economic collapse – where consumers, banking institutions, and economic activity grinds to a halt because of some external or unknown factor. Yet, the risks of a US-based collapse based on excessive Banking or other financial institution liabilities are somewhat limited in today’s US Economy. Although, globally, the risks have accelerated over the past 12+ years while the US Federal Reserve maintained a very accommodative monetary policy.

Historical US Federal Reserve Actions

Let’s review some of the most significant US Federal Reserve actions over the past 25 years.

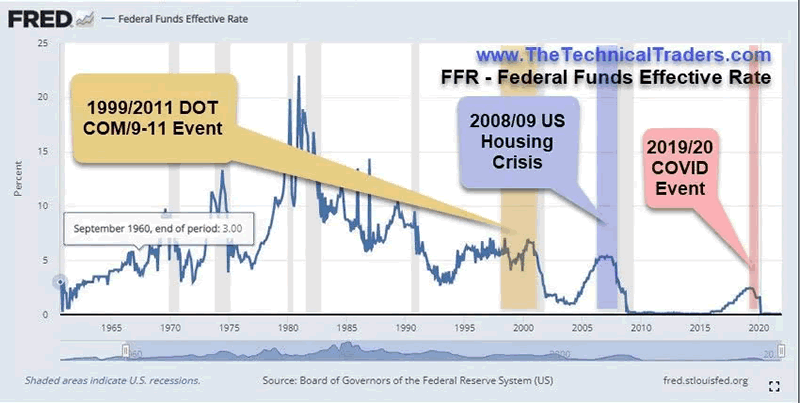

- Early/Mid-1990s: The Fed raised the FFR from 3.0% to 6.5% to 7.0% as the DOT COM Rally continued to build strength.

- 1998/1999: The Fed dropped the FFR to 4.0% as the DOT COM bubble became frothy and started to fracture/burst.

- Early 2000: The Fed raised the FFR from 4.0% to 6.86% over just five months, pushing the cost of borrowing above 7.5%~8.5% in the open market.

- Late 2000/Early 2001: The September 2001 Terrorist Attack on the US pushed the Fed to lower the FFR to 1.0% by December 2002. Before the 9/11 attack, the Fed lowered the FFR after the DOT COM bubble burst rattled the US economy and output.

- 2004/2006: The Fed raised the FFR from 1.0% to 5.5% (more than 550%) while the US Housing Market boom cycle pushed the US economy into overdrive. This was the biggest FFR rate increase since the 1958-1960 rate increase (from 0.25% to 4.0% – more than 1600%) or the 1961-1969 rate increase (from 0.50% to 9.75% – more than 1950%).

- 2007/2008: The Fed decreased the FFR from 5.5% to 0.05 (Dec 2009), effectively setting up a 0% interest rate while the US attempted to recover from the 2008-09 Housing Market Crisis.

- 2015/2020: the Fed attempted to raise the FFR from 0.08% to 2.40% as the US economy transitioned into a strong bullish breakout trend. When the US markets collapsed in early 2020 because of the COVID-19 virus, the Fed moved interest rates back to near 0% and have kept them there ever since.

The deep FFR discounts/rates that started after the 1999/2000 DOT COM/9-11 events pushed foreign markets to borrow cheap US Dollars as a disconnect of capital costs and a growing foreign market economy allowed certain economic functions to continue. Borrowing cheap US Dollars while deploying that capital in foreign economies returning 4x to 10x profits allowed many foreign companies, individuals, and governments to build extremely dangerous debt levels – very quickly.

(Source: ST Louis FED)

Now, let’s get down to the core differences between pre-1990 and post-1990 US Fed actions and global economy functions.

US Fed Added Rocket Fuel To An Already Accelerating Global Economy

Before 1985, foreign markets were struggling to gain their footing in the global economy. Larger global economies, like the US, Japan, Europe, and Canada, could outsource manufacturing, supplies, and labor into foreign nations that provided a strategic cost advantage.

After 1994 or so, after the Asian Currency Crisis settled, the growth of manufacturing and labor in China/Asia started booming at an exponential rate. This prompted a 2x to 5x growth factor in many Asian nations over 10+ years. The 9-11 terrorist attacks briefly disrupted this trend, but it restarted quickly after 1994~1995.

This high-speed growth phase in China/Asia after 1999 created a massive demand for credit and expansion as Asian consumers and economies grew at exponential rates from 1997 to now. The US Fed inadvertently promoted a global growth phase that resulted in the fastest global economic increase in history. Multiple foreign nations were able to take advantage of cheap US Dollars. At the same time, the US Fed acted to support the recovery of the US economy after 9-11 and the 2008-09 Housing/Credit crisis. Those cheap US Dollars continued after the COVID-19 turmoil in early 2020 and likely pushed already at-risk debtors over the edge as bond rates have started to price extensive risk factors.

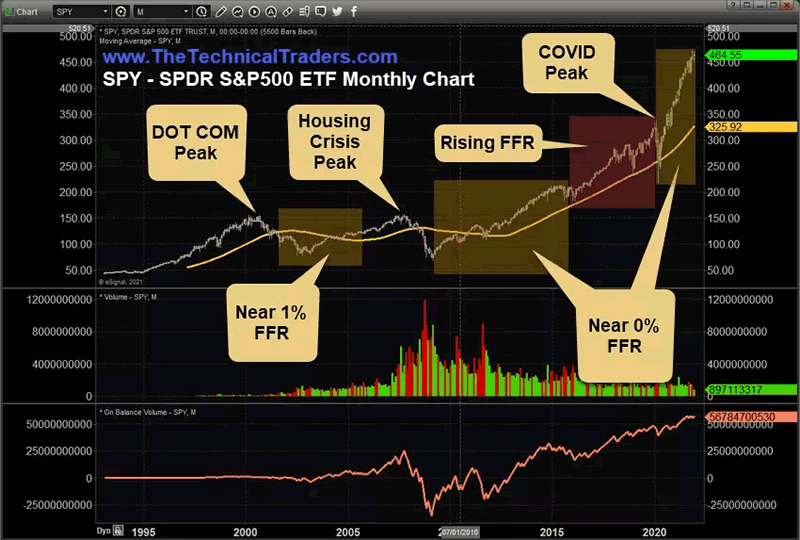

The result of these crisis events and the US Federal Reserve’s continued easy monetary policy has been the fastest growth of assets the planet has seen in over 80 years. Not only have global economies grown in a parabolic phase, but the US stock market has also moved higher and higher after the 2010 bottom and the 2015-2016 shift towards higher US corporation earnings/revenues.

Once the COVID-19 virus event hit in early 2020, the US Fed moved rates back to near 0% – supplying a nearly unlimited amount of rocket fuel for the global markets (again).

The problem this time was the global COVID shutdowns essentially took the spark away from the fuel (capital).

Now, we are waiting for the US Fed statements to close out 2021. I’ll offer this simple hint to help you prepare for what’s next – more volatility, more big trends, and more deleveraging throughout the global markets. In Part II of this research article, I’ll share my thoughts on what I expect from the US Fed and what I hope for in 2022 and beyond.

Want to learn more about what affects the markets?

Learn how I use specific tools to help me understand price cycles, set-ups, and price target levels. Over the next 12 to 24+ months, I expect very large price swings in the US stock market and other asset classes across the globe. I believe the markets are starting to transition away from the continued central bank support rally phase and may start a revaluation phase as global traders attempt to identify the next big trends. Precious Metals will likely start to act as a proper hedge as caution and concern start to drive traders/investors into Metals.

If you need technically proven trading and investing strategies using ETFs to profit during market rallies and to avoid/profit from market declines, be sure to join me at TEP – Total ETF Portfolio.

Have a great day!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.