Stocks: Why This "Trend Following" Indicator is Worth Watching

Stock-Markets / Stock Market 2022 Feb 28, 2022 - 11:52 AM GMTBy: EWI

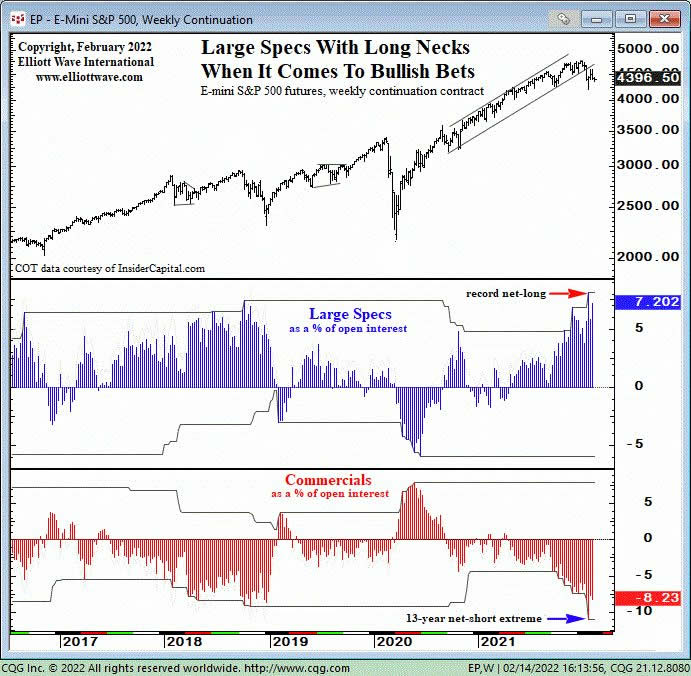

This "is compatible with a stock market that has further to decline"

Large Speculators are a sector of traders monitored by the Commodity Futures Trading Commission and are comprised mainly of hedge fund managers and trend followers.

History shows that this group of traders is usually wrong at key market turns.

The Commercials, which you might call the "smart money," is another sector of traders monitored by the CFTC. They usually take positions opposite that of Large Speculators and are usually right.

This indicator is especially useful when the positions that Large Speculators and Commercials have established reach extremes at the same time a market's Elliott wave pattern suggests a trend turn is nigh.

With that in mind, let's review a chart and commentary from our Feb. 14 U.S. Short Term Update, a thrice weekly Elliott Wave International publication which provides near-term forecasts for key U.S. financial markets:

Friday afternoon's release of the most recent Commitment of Traders Report shows that Large Speculators in E-mini S&P 500 futures are net long 7.20% of total open interest, nearly reaching the record 8.12% registered during the last week of January... The willingness of the trend-following Large Specs to maintain a near-record commitment to bullish bets even though the E-mini S&P is still down nearly 9% from its January high is compatible with a stock market that has further to decline.

As you probably know, the downtrend in the stock market has persisted since this analysis published on Feb. 14.

Indeed, on Feb. 17, the S&P 500 slid 2.1% and the Dow Industrials suffered its then worst single-day 2022 decline, closing more than 600 points lower.

The S&P continued to decline on Feb. 18, with the Dow down by triple digits, making it two weeks in a row that the senior index closed in the red.

And, as of this writing intraday on Feb. 22, the stock market is once again in the red.

Keep in mind that no indicator or service can guarantee that a particular forecast will work out.

In this case, our analyst's confidence level was high as the Elliott wave model also suggested further decline.

Dig into the details of how to use the Wave Principle in your analysis of financial markets by reading the definitive text on the subject: Elliott Wave Principle: Key to Market Behavior, by Frost & Prechter.

Here's a quote from the book:

Although it is the best forecasting tool in existence, the Wave Principle is not primarily a forecasting tool; it is a detailed description of how markets behave. Nevertheless, that description does impart an immense amount of knowledge about the market’s position within the behavioral continuum and therefore about its probable ensuing path. The primary value of the Wave Principle is that it provides a context for market analysis. This context provides both a basis for disciplined thinking and a perspective on the market’s general position and outlook. At times, its accuracy in identifying, and even anticipating, changes in direction is almost unbelievable.

Get more insights into the Wave Principle by reading the entire online version of this Wall Street classic for free.

The only requirement for free access is a Club EWI membership. Club EWI is the world's largest Elliott wave educational community and members enjoy free access to a wealth of Elliott wave resources on investing and trading.

You can join Club EWI for free without any obligations.

Just follow this link: Elliott Wave Principle: Key to Market Behavior -- free and unlimited access.

This article was syndicated by Elliott Wave International and was originally published under the headline Stocks: Why This "Trend Following" Indicator is Worth Watching. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.