How to Cash in on the “Big Supply Shortage”

Companies / Investing 2022 Mar 21, 2022 - 06:03 PM GMTBy: Submissions

By Justin Spittler Have you been to the grocery store lately?

By Justin Spittler Have you been to the grocery store lately?

If you have, you’ve probably noticed many of the shelves are half-stocked, or empty.

In recent weeks, members of our team have had trouble getting everyday items like nursery water and pet food. According to the Consumer Brands Association, grocery stores usually have around 7–10% of items out of stock. But now it’s about 12% for all products. And 15% when it comes to food and drinks.

Online shopping hasn’t been a much better experience. These days, it can take weeks for a pair of sunglasses or shoes to show up at my doorstep.

But it’s not all bad news. In a minute, I’ll explain why the “Big Shortage” is sending a specific group of stocks higher—and how you can capitalize.

Let’s first look at what’s driving this.

- When COVID-19 first hit, the world practically shut down…

Schools closed their doors. People stopped going into the office.

Many factories shut down entirely.

As a result, fewer goods were produced. Delays became the norm.

At the same time, people dramatically changed their spending habits during COVID.

They spent less money going to bars, restaurants, and other “experiences”… and more on goods.

First-time remote workers bought laptops, printers, and monitors. Many upgraded their homes with new furniture and TVs. Many people also bought workout equipment like Peloton bikes to stay fit with gyms closed.

This one-two punch of soaring demand and tight supply led to massive supply chain bottlenecks.

Even though the world has opened up again, we’re still experiencing these bottlenecks. And they won’t go away overnight…

Many top executives believe the global supply chain problems won’t be sorted out until 2023.

That means we can expect more shortages, and higher prices.

But it’s also an opportunity for savvy investors…

- Shipping companies are at the front and center of the Big Shortage…

Shipping companies own and operate huge shipping vessels that transport products. It’s an indispensable industry. There are over 226 million containers shipped every year.

According to Drewry Supply Chain Advisors, the cost of shipping containers has jumped from $1,540 per container to $9,379 per container since the beginning of the pandemic. That’s a 500% increase in just two years.

The Russia and Ukraine war will only make these surcharged rates even worse. Experts expect the conflict could triple the cost of shipping containers to $30,000.

And in addition to paying extra just to get a shipping container, companies are scrambling to make sure their goods arrive on time.

That’s because the demand for on-time shipping has never been higher. And it’s increasing the cost of shipping across the board, making all types of companies suffer the extra charges.

Apple (AAPL) CEO Tim Cook recently said, “We’re paying more for freight than I would like.”

Some companies are resorting to more extreme measures to cut costs and ensure their goods arrive on time. Costco has started to charter its own ships to deliver several thousands of shipping containers.

Walmart, Home Depot, Party City, and Dollar Tree are all following suit.

- Moving shipping containers is only one part of the problem…

The other part is getting those shipping containers off the boat.

Demand is so high for this that we’re seeing unprecedented congestion at many of the world’s biggest ports. Just look at this recent photo taken of the Los Angeles port.

Source: CBSLA

Those are all ships waiting for their chance to dock and be offloaded.

The Port of Los Angeles delivered a record-setting 10.7 million 20-foot shipping containers last year. That was 13% more than the previous record it set in 2018, well before the pandemic.

The executive director of the Port, Gene Seroka, expects that the pace will continue.

- Investors can turn this supply chain holdup into big profits by investing in shipping stocks.

Shipping stocks have been top performers the past two years.

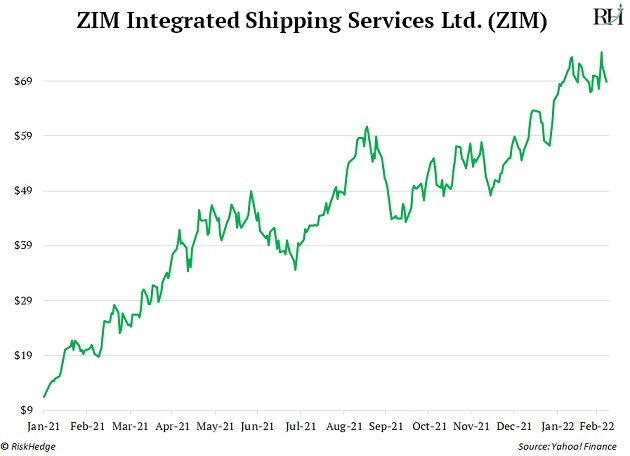

Just look at this chart of ZIM Integrated Shipping Services (ZIM). It’s rocketed 616% since going public in January 2021. That’s more than 44X the return of the S&P 500 over the same period.

Matson, Inc. (MATX) is up 330% from its COVID lows. And Star Bulk Carriers Corp. (SBLK) has surged 570% during the same period.

These are tremendous gains. But shipping stocks could run much higher in the coming months.

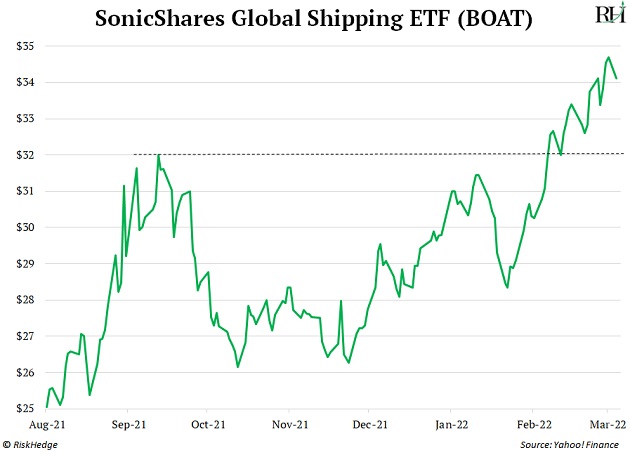

To understand why, check out this chart. It shows the performance of the SonicShares Global Shipping ETF (BOAT), which invests in a basket of global shipping stocks.

You can see that it’s rallied 39% over the past year.

In other words, shipping stocks are crushing the market. But I see them heading higher in the coming months.

As you can see above, BOAT recently reclaimed and retested a key $32 level. This is bullish for BOAT, and shipping stocks as a whole. It suggests they’ll likely deliver even bigger gains in the coming months.

So, consider investing in shipping stocks today as a way to profit from the shortage issues plaguing the world.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Justin Spittler

© 2022 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.