3 Recession Indicators are Flashing Red… Here’s Why you Shouldn’t Panic

Stock-Markets / Stock Market 2022 Apr 26, 2022 - 07:32 PM GMTBy: Stephen_McBride

The odds of a recession in the US just spiked considerably.

I’m not saying this to scare you…

That’s what three important recession indicators are saying today.

They’re all flashing “red”…

But as I’ll show you today, this isn’t the time to panic. Instead, it’s an opportunity.

I’ll explain in a moment. First, let’s look at each indicator:

- Recession Indicator #1: Gas prices recently hit record highs across America.

I bet you’re spending a lot more at the pump these days.

Gas is a byproduct of oil, and oil prices have spiked 90% since December.

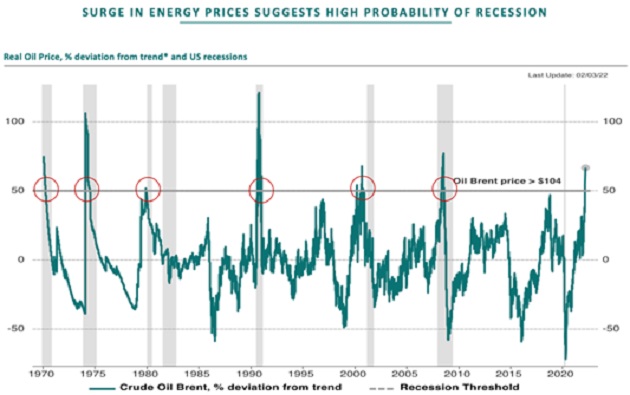

Huge gas price spikes like this are usually a bad omen. Pictet Asset Management looked at every time oil prices jumped sharply in the past 50 years. They found these moves tipped the US economy into a recession each time.

Source: Pictet Asset Management

Keep in mind, the price of gasoline is the most important variable cost to the average suburban American family. When gas prices spike, families feel it in their budgets unlike anything else…

According to Energy.gov, the average American spent $1,550 at the pump in 2019. That was when gas prices were $2.60/gallon. Now a gallon of gas costs four bucks… which means the average gas bill will jump to roughly $2,400.

Think of this like a tax hike, which means folks have less money to spend elsewhere. It also drives up costs for many businesses. I was talking to the owner of my local wine store the other day. The company that delivers ice to the store hit him with a $60 “gas surcharge.”

- Recession Indicator #2: Inflation continues to roar higher…

I buy the same items every week at the grocery store… yet my bill has shot up 50% in the last six months. Home prices are rising at their fastest pace in more than 30 years. Rents in places like Miami and Atlanta have surged 40% over the past year!

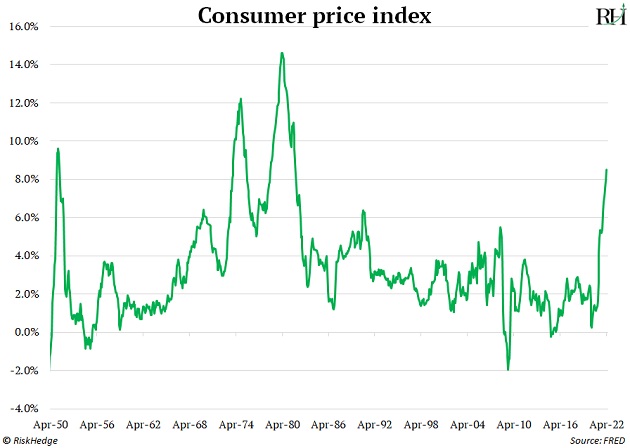

Prices are rising at their fastest pace in 40 years, and that’s not good for the economy.

US inflation jumped above 5% on seven occasions since WWII. Each time a recession occurred within 12 months. Today, US inflation is at a 40-year high of 8.5%.

- Recession Indicator #3: The “inverted yield curve”—the most accurate recession predictor…

If you’ve applied for a mortgage, you know the two most popular options are a 15-year mortgage or a 30-year mortgage. The interest rate you’ll pay on a 15-year mortgage is lower than what you’d pay on a 30-year one.

Makes sense, right? With the 30-year mortgage, you’re borrowing the bank’s money for twice as long, so you must pay a higher rate.

It’s the same with the interest rates the US government pays on its bonds. 99.9% of the time, the longer out a bond goes, the higher rate it pays. A 10-year bond almost always pays higher interest than a 2-year bond.

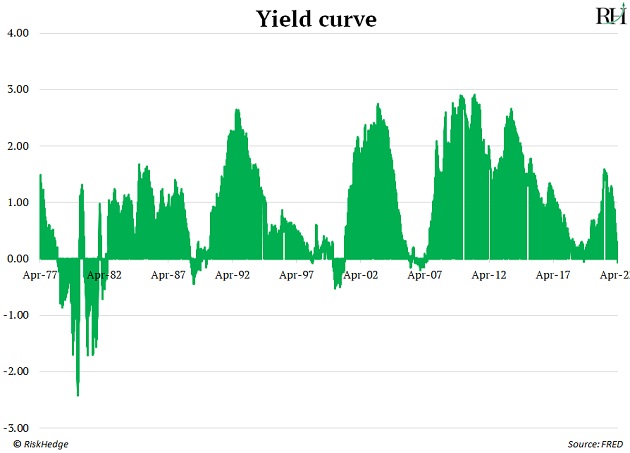

But occasionally, the interest rate on the 10-year US bond sinks below the two-year bond. This “upside-down” situation is what investors call an inverted yield curve. And it signals something is “off” with the US economy...

The yield curve has inverted eight times since 1969.

As I mentioned in this recent RiskHedge Report, the inverted yield curve typically warns of a recession over a year in advance. From the time the yield curve first inverts, a recession hits about 18 months later, on average.

In early April, the yield curve inverted for the first time since 2019:

Using the past 50 years of US economic history as a guide, this tells us we should prepare for a recession sometime in the next year or two.

You could dismiss any one of these warning signals on their own. But we can’t ignore all three.

Together, they tell us the likelihood of a recession is much higher than it was at the start of the year.

If we are headed for a recession, what does it mean for your money?

- A recession could be coming: But you shouldn’t panic…

Here’s something I bet you didn’t know about recessions.

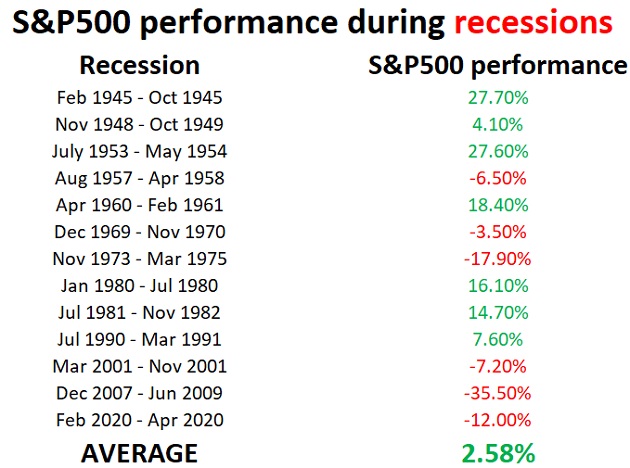

Stocks typically eke out a small gain during recessions. The S&P 500 rose in seven of the past 13 recessions, as you can see:

We all know recessions are bad for stocks. So how the heck did they go up in most recessions?

Ever hear of the National Bureau of Economic Research (NBER)? It’s the official scorekeeper of recessions. Problem is… it moves as slow as a snail.

Remember the Great Recession that began in December 2007? The NBER didn’t officially “call it” until December 2008.

The previous recession started in March 2001, yet the NBER didn’t officially declare it until November of that year.

The shortest recession in US history—the “COVID recession”—lasted two months, from February to April 2020.

When did we know it officially happened? August 2021.

- The stock market sniffs out trouble long before economists do.

The S&P 500 typically provides a seven-month “heads up” that a recession is coming. It’s peaked ahead of every recession except one since the 1970s.

The S&P 500 also front-runs the recovery. On average, stocks bottom five months before the end of a recession.

I’m not saying stocks don’t fall during a recession. During the eight recessionary bear markets since WWII, the average peak-to-trough S&P 500 decline was 36%.

But the pain usually happens before the recession. By the time we’re officially in a recession, it’s time to buy.

What should we make of this? If we get a recession, there’s likely more downside for stocks. The S&P 500 is only about 6% off its highs from January.

But as I told my Disruption Investor subscribers, we can turn this potential danger into a golden opportunity.

We’re not sitting back and waiting for a recession. Instead, we’re getting ahead of the opportunity by buying world-class disruptors on sale.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2022 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.