INFLATION IS KILLING SILVER

Commodities / Gold and Silver 2022 May 11, 2022 - 04:19 PM GMTBy: Kelsey_Williams

More than just a few people are buying silver because “it protects them from inflation” – or something to that effect. Ever wonder if that argument holds up? The chart (source) below indicates otherwise…

Silver Prices (inflation-adjusted) – 50 Year Historical Chart (1)

According to the chart, it appears that silver continues to be pressured downwards as inflation gets worse. Where is the fundamental or technical appeal in that kind of price action?

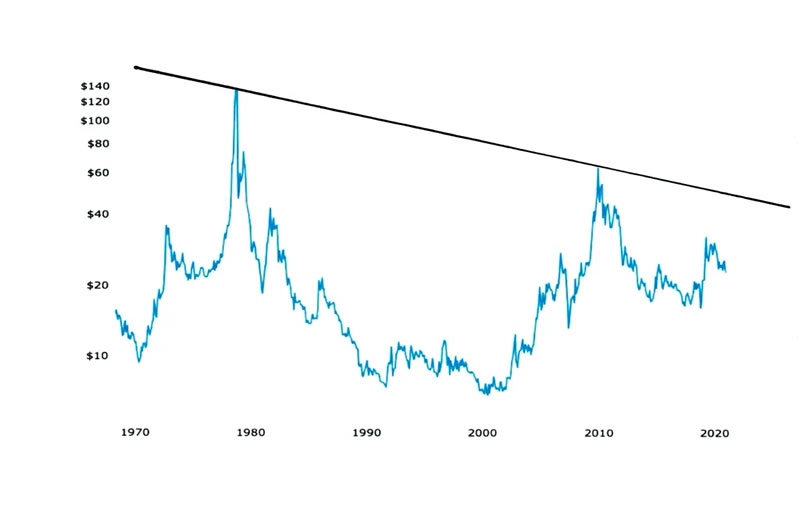

Here is the same chart with the addition of a downward sloping line connecting the major silver price peaks dating back to 1980…

Silver Prices (inflation-adjusted) – 50 Year Historical Chart (2)

Most investors don’t consider inflation-adjusted pricing in their expectations or calculations for silver. The argument given is that silver prices will go a lot higher as inflation gets worse, but there is no historical indication of that.

Price-conscious investors are usually looking at other charts, such as the one below…

Silver Prices – 50 Year Historical Chart (3)

The chart immediately above shows the long-term uptrend in silver prices since May 1970 from $1.61 oz to $22.31 oz currently. It is possible to be swayed by the numbers, but the numbers aren’t that good anyway.

On an inflation-adjusted basis the numbers are worse. Allowing for the effects of inflation, the increase isn’t even 2-to-1 ($22.31 divided by $11.96 = 1.86).

How excited can anyone be to own an investment that has almost doubled over the past fifty-two years (a 1.2% annual rate of return)?

The effects of inflation have recently done considerable damage to longer-term holders of silver.

For example, the average monthly closing price for silver in August 2011 was $41.76. The current, comparable inflation-adjusted price is $52.99 oz.

That means that the current silver price is forty-seven percent lower than it was in August 2011; and in inflation-adjusted terms it is fifty-eight percent lower.

SILVER PRICE UPTREND

In chart number (3) above, there is a definite uptrend in nominal silver prices (prices not adjusted for inflation). Here is the chart with the addition of that uptrend line…

Silver Prices – 50 Year Historical Chart (4)

The uptrend line is clearly defined; even so, a drop in silver prices could go as low as $8.00 oz. without breaking it.

That ($8.00 oz) may seem far-fetched, but it is no more unrealistic than silver price projections of $100.00 oz. or more.

SILVER – UP OR DOWN?

Whether the silver price is headed higher or lower from here is hard to say. It could go either way in the short term. In the long term, though, silver has lots of room on the downside.

Since its peak in 1980 silver has not matched the effects of inflation, let alone produced any real profits. Silver price history doesn’t support current expectations for higher prices, but there are some painful examples of horrendous drops in price.

WHAT COULD CAUSE SILVER TO DROP?

Silver has a history of lower prices regardless of economic conditions.

During The Great Depression (1930s) silver reached a low of $.28 oz.

Then, several decades later, in the middle of the greatest period of economic growth in US history (1980-2000), silver fell from nearly $50.00 oz. to under $3.00 oz. That is a drop of ninety-four percent without factoring in the effects of inflation.

Currently, the arguments in favor of higher silver prices are not consistent with the tale of history.

Any sustained movement in the direction of more moderate effects from inflation, or the occurrence of deflation, could take the silver price much lower.

If the US economic activity improves to any measurable degree, it would not provide any impetus for a higher silver price.

All factors considered, there isn’t a strong argument for higher silver prices. And, yet, inflation continues to erode real value from silver as its inflation-adjusted price continues to weaken over time (see chart number (2) above).

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2022 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.